Massachusetts Letter of Notice to Borrower of Assignment of Mortgage

Description

How to fill out Letter Of Notice To Borrower Of Assignment Of Mortgage?

If you need to full, obtain, or print out authorized document web templates, use US Legal Forms, the largest assortment of authorized kinds, that can be found online. Use the site`s basic and hassle-free lookup to discover the papers you will need. A variety of web templates for organization and individual uses are categorized by groups and suggests, or search phrases. Use US Legal Forms to discover the Massachusetts Letter of Notice to Borrower of Assignment of Mortgage with a number of clicks.

Should you be already a US Legal Forms consumer, log in for your bank account and then click the Down load key to have the Massachusetts Letter of Notice to Borrower of Assignment of Mortgage. You can even access kinds you earlier downloaded within the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for the correct metropolis/nation.

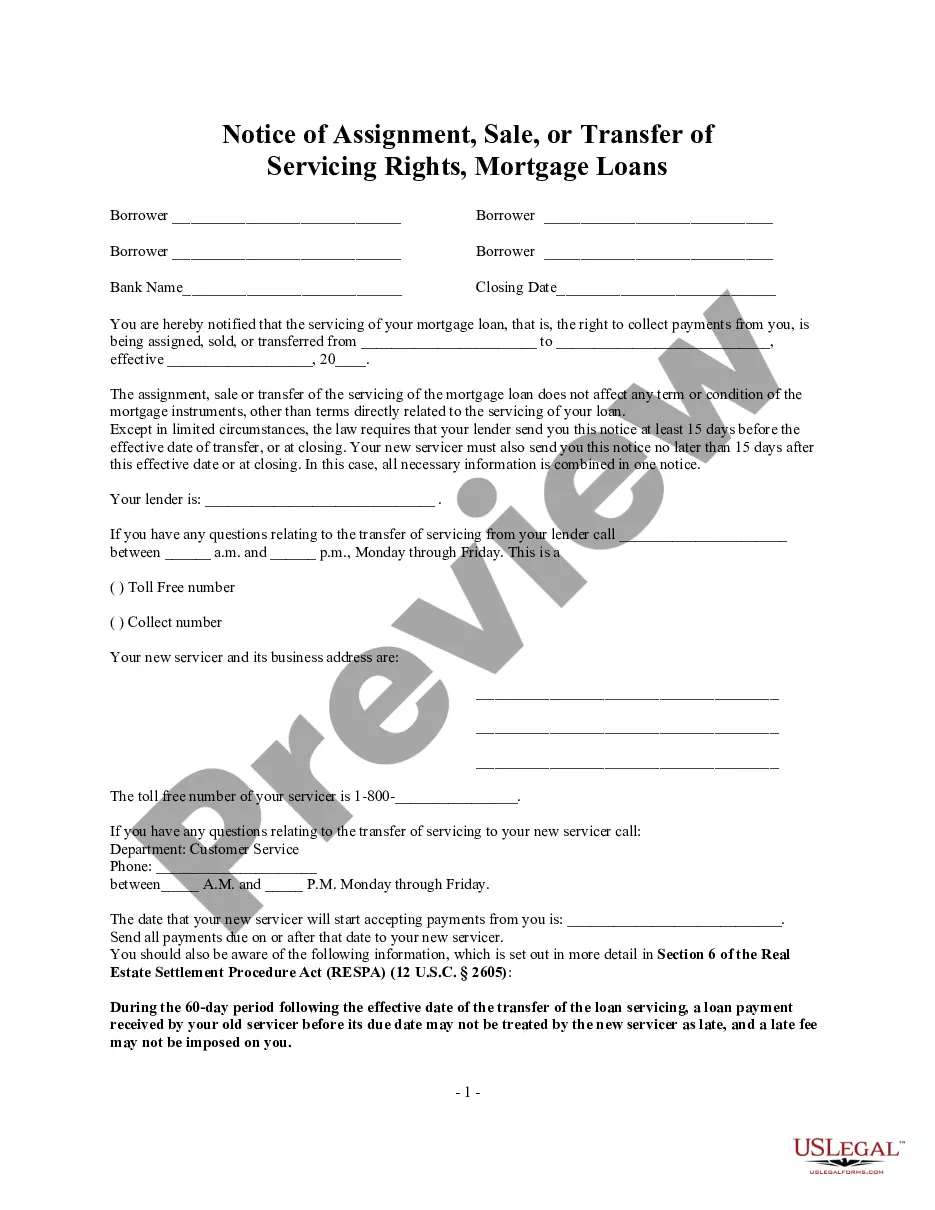

- Step 2. Use the Review method to look over the form`s articles. Do not overlook to see the outline.

- Step 3. Should you be not satisfied with the form, make use of the Lookup area near the top of the display screen to find other variations from the authorized form web template.

- Step 4. Once you have found the shape you will need, go through the Get now key. Opt for the prices strategy you prefer and put your references to register on an bank account.

- Step 5. Approach the financial transaction. You should use your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Choose the structure from the authorized form and obtain it on your product.

- Step 7. Full, revise and print out or indication the Massachusetts Letter of Notice to Borrower of Assignment of Mortgage.

Each authorized document web template you get is yours for a long time. You possess acces to each and every form you downloaded with your acccount. Click the My Forms portion and select a form to print out or obtain yet again.

Remain competitive and obtain, and print out the Massachusetts Letter of Notice to Borrower of Assignment of Mortgage with US Legal Forms. There are millions of expert and condition-specific kinds you can utilize for your personal organization or individual requires.

Form popularity

FAQ

Dear [recipient's name], I write to you today in response to a letter I received from you, dated [insert date], about [insert number] of late payments on my loan from [insert date to date]. I am writing this letter today to explain to you the reasons for my delay.

Notice of Transfer of Mortgage Loan Ownership If the holder of your mortgage loan sells the debt to a different entity, federal law requires the new owner or assignee to notify you about the change of ownership no later than 30 days after the sale, transfer, or assignment.

Format it as you would a business letter, address it to your lender and plug in the address of the property it's regarding in the subject line. Keep it brief, providing only what the lender requests. It needs to be no more than a single paragraph describing that you'll use the property as your primary home.

Format it as you would a business letter, address it to your lender and plug in the address of the property it's regarding in the subject line. Keep it brief, providing only what the lender requests. It needs to be no more than a single paragraph describing that you'll use the property as your primary home.

It's best when writing a letter of explanation to make it short and to the point. You'll want it to provide the recipient with the information they need, however. Be clear and offer as much relevant detail as possible since the person reading the letter will need to understand your situation.

5 tips for a good letter of explanation Keep it short and to the point. The mortgage underwriter is looking for clarification on a specific issue, so stick to that topic. ... Emphasize the circumstances that led to the issue. ... Explain how your finances have improved. ... Proofread your letter. ... Be nice.

The transferor and transferee servicers may provide a single notice, in which case the notice shall be provided not less than 15 days before the effective date of the transfer of the servicing of the mortgage loan.

How to explain large cash deposits during the mortgage process The cancelled check that was deposited. A letter from the person who gave you the money explaining why, especially if it's a down payment gift. A third-party estimate of the item's value, such as the Kelly Blue Book value for a vehicle.