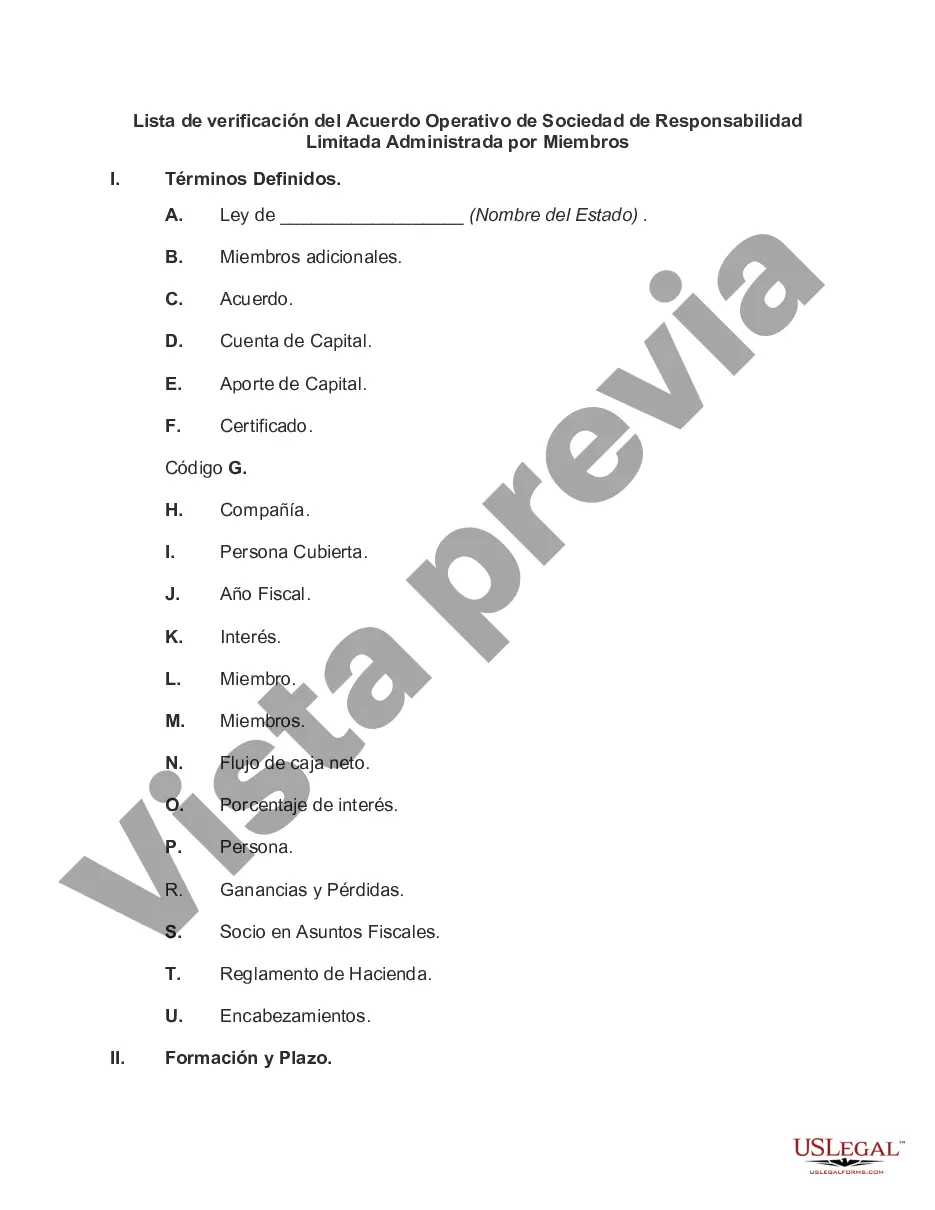

The Massachusetts Checklist of Member Managed Limited Liability Company Operating Agreement is a comprehensive document that outlines the essential provisions and guidelines for the operation and management of a member-managed limited liability company (LLC) in the state of Massachusetts. This agreement serves as a crucial legal framework for LCS, ensuring smooth and efficient functioning while protecting the interests and rights of the company members. The checklist covers various key aspects that should be addressed in the operating agreement. These include but are not limited to: 1. Formation and Name: The agreement specifies the name of the LLC and outlines the necessary steps to be taken for its formation, such as filing the necessary documents with the Massachusetts Secretary of State's office. 2. Purpose and Business Activities: It defines the purpose for which the LLC is established and details the nature of its business activities, ensuring clarity and alignment among the members. 3. Capital Contributions: The operating agreement outlines the capital contributions required from each member, specifying the respective ownership percentages and rights associated with each member's contributions. 4. Management: It establishes the member-managed structure and describes how the LLC will be managed, granting decision-making authority to the members collectively or designating specific managers for day-to-day operations. 5. Voting and Decision-Making: The agreement outlines the rules for voting on important matters, including procedures for member meetings, quorum requirements, and voting thresholds for specific actions. 6. Profit and Loss Allocation: It defines how profits and losses will be allocated among the members, considering their respective ownership interests and any agreed-upon profit-sharing arrangements. 7. Distributions: The operating agreement sets forth the rules and procedures for distributing profits to the members, including frequency, timing, and priority of distributions. 8. Transfer of Membership Interests: It outlines the procedures and restrictions applicable to the transfer of membership interests, ensuring that member transfers comply with the legal requirements and protect the LLC's stability and continuity. 9. Dissolution and Liquidation: The agreement includes provisions for the dissolution and liquidation of the LLC in various scenarios, such as member withdrawal, bankruptcy, or unanimous member agreement. It is important to note that there are different types of operating agreements based on the management structure chosen by the LLC members. Besides the member-managed agreement described above, the Massachusetts Checklist also covers the Manager-Managed Limited Liability Company Operating Agreement. This agreement is specifically designed for LCS that opt for a manager-managed structure, where one or more managers are designated to oversee the company's operations while the members have limited involvement in day-to-day decision-making. In conclusion, the Massachusetts Checklist of Member Managed Limited Liability Company Operating Agreement is a crucial legal document that provides guidance and structure for member-managed LCS in Massachusetts. By carefully addressing the above-mentioned key elements, this agreement ensures transparency, fairness, and effective governance among members while protecting the company's interests and promoting its success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Lista de verificación del Acuerdo Operativo de Sociedad de Responsabilidad Limitada Administrada por Miembros - Checklist of Member Managed Limited Liability Company Operating Agreement

Description

How to fill out Massachusetts Lista De Verificación Del Acuerdo Operativo De Sociedad De Responsabilidad Limitada Administrada Por Miembros?

US Legal Forms - one of the most significant libraries of authorized types in the States - delivers an array of authorized document layouts it is possible to obtain or print. Making use of the web site, you can find a huge number of types for organization and personal reasons, categorized by classes, suggests, or keywords.You will discover the newest variations of types like the Massachusetts Checklist of Member Managed Limited Liability Company Operating Agreement in seconds.

If you have a registration, log in and obtain Massachusetts Checklist of Member Managed Limited Liability Company Operating Agreement through the US Legal Forms library. The Down load key will appear on every kind you look at. You gain access to all in the past delivered electronically types inside the My Forms tab of your respective account.

In order to use US Legal Forms the very first time, allow me to share basic instructions to help you get began:

- Be sure you have selected the proper kind for your city/state. Select the Preview key to review the form`s content material. Look at the kind information to ensure that you have chosen the proper kind.

- When the kind doesn`t fit your demands, utilize the Lookup area on top of the monitor to discover the one that does.

- If you are happy with the shape, verify your option by clicking the Buy now key. Then, opt for the rates plan you prefer and offer your references to register to have an account.

- Process the deal. Use your charge card or PayPal account to complete the deal.

- Find the format and obtain the shape on your device.

- Make alterations. Fill out, revise and print and indicator the delivered electronically Massachusetts Checklist of Member Managed Limited Liability Company Operating Agreement.

Each template you added to your money does not have an expiry date and is also the one you have permanently. So, if you want to obtain or print another copy, just check out the My Forms section and then click around the kind you will need.

Gain access to the Massachusetts Checklist of Member Managed Limited Liability Company Operating Agreement with US Legal Forms, probably the most extensive library of authorized document layouts. Use a huge number of professional and express-particular layouts that meet up with your small business or personal requirements and demands.