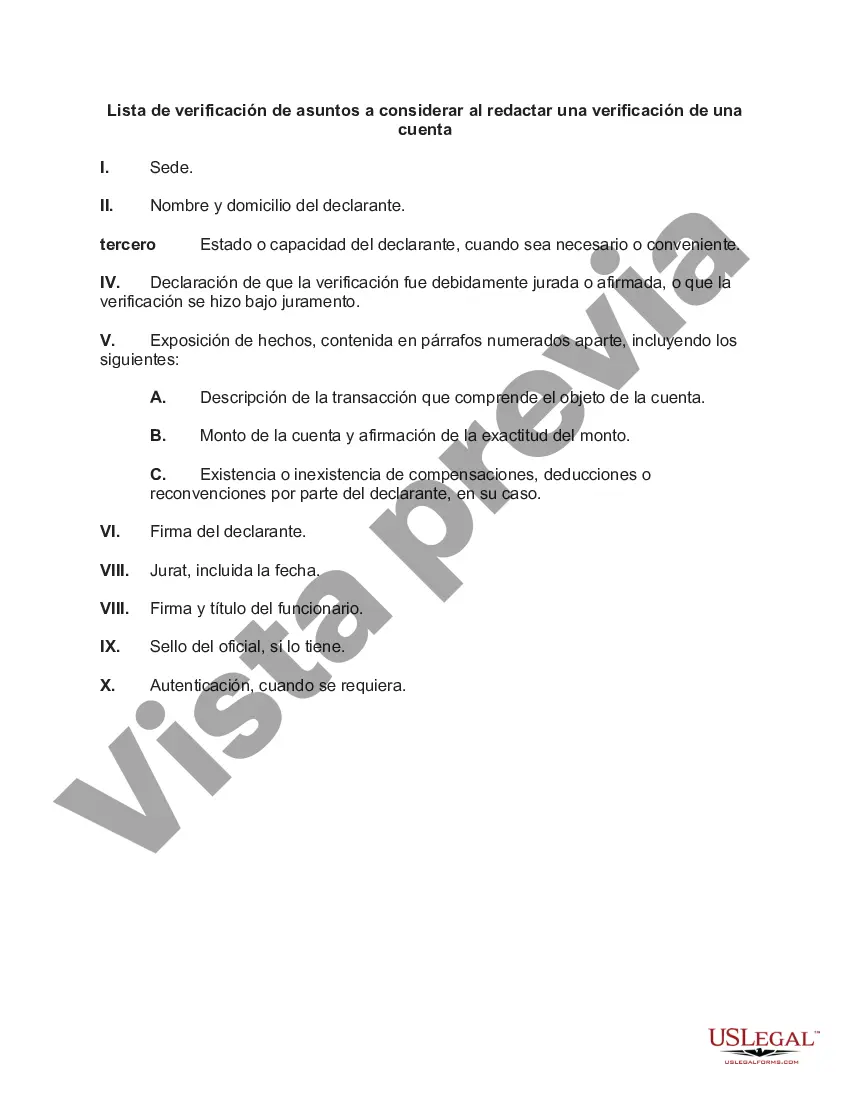

The Massachusetts Checklist of Matters to be Considered in Drafting a Verification of an Account is an essential tool used in legal processes related to account verification. It provides a comprehensive list of crucial points and considerations that should be addressed when drafting such a verification document in the state of Massachusetts. This checklist aims to ensure that all necessary information is included and that the verification is accurate, complete, and compliant with relevant laws and regulations. By adhering to this checklist, individuals and organizations can minimize errors, improve document quality, and maintain the integrity of the verification process. Some key matters to be considered in drafting a verification of an account in Massachusetts include: 1. Identification of Parties: The verification should clearly state the names, addresses, and contact information of all parties involved or affected by the account, including the account holder, the account custodian, and any legal representatives. 2. Account Details: This section should outline specific details about the account, such as the type (bank account, investment account, etc.), account number, and any relevant financial institutions involved. 3. Verification Statements: Clear and concise statements verifying the accuracy and authenticity of the account information need to be included. These statements must be made under oath or penalty of perjury. 4. Supporting Documentation: All relevant documents that support the account's validity or any claim being made should be attached. This may include bank statements, transaction records, legal notices, or any other relevant paperwork. 5. Compliance with Legal Requirements: The verification must adhere to all applicable Massachusetts laws, regulations, and court rules regarding account verification. This includes ensuring that the document meets the requirements of the specific court or jurisdiction where it will be filed. 6. Signature and Notarization: The verification should be signed by the account holder or an authorized representative and notarized to authenticate its execution. The notary public must certify the signer's identity and affirm that they signed voluntarily. 7. Date and Jurisdiction: The verification should indicate the date it was executed and include a statement confirming that it is being executed within the applicable jurisdiction. It is important to note that there may be variations or specific requirements within different types of accounts in Massachusetts, such as bank accounts, investment accounts, or estate accounts. However, the main principles and considerations mentioned above generally apply to all types of account verifications. By following the Massachusetts Checklist of Matters to be Considered in Drafting a Verification of an Account, individuals and organizations can ensure that their account verification documents are comprehensive, accurate, and legally compliant.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Massachusetts Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

Are you currently within a position that you require documents for both organization or specific functions virtually every working day? There are tons of legitimate document themes available on the net, but getting kinds you can depend on is not easy. US Legal Forms offers 1000s of kind themes, just like the Massachusetts Checklist of Matters to be Considered in Drafting a Verification of an Account, which can be written to satisfy state and federal needs.

When you are presently knowledgeable about US Legal Forms website and get an account, just log in. Next, you may down load the Massachusetts Checklist of Matters to be Considered in Drafting a Verification of an Account design.

Unless you come with an account and want to begin using US Legal Forms, abide by these steps:

- Discover the kind you want and ensure it is to the right metropolis/region.

- Utilize the Preview button to examine the shape.

- Browse the explanation to actually have selected the appropriate kind.

- In the event the kind is not what you are looking for, use the Lookup area to get the kind that fits your needs and needs.

- If you obtain the right kind, just click Purchase now.

- Pick the costs plan you would like, fill in the necessary information to generate your bank account, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Pick a convenient file formatting and down load your copy.

Get all of the document themes you have bought in the My Forms food list. You can get a extra copy of Massachusetts Checklist of Matters to be Considered in Drafting a Verification of an Account any time, if needed. Just go through the required kind to down load or print out the document design.

Use US Legal Forms, by far the most substantial selection of legitimate varieties, to save lots of time as well as prevent errors. The services offers expertly made legitimate document themes which you can use for an array of functions. Produce an account on US Legal Forms and commence generating your life easier.