Massachusetts Credit Information Request is a formal process initiated by individuals or organizations to obtain access to their credit-related information. Credit information refers to any records or data pertaining to an individual's borrowing history, including credit scores, repayment behavior, outstanding debts, and credit limits. It plays a crucial role in determining an individual's financial health and creditworthiness. In Massachusetts, there are primarily two types of Credit Information Requests: 1. Free Annual Credit Report Request: This type of Credit Information Request allows Massachusetts residents to obtain a free copy of their credit report from each of the nationwide consumer reporting agencies, namely Equifax, Experian, and TransUnion. The Fair Credit Reporting Act (FCRA) mandates that these agencies provide individuals with one free credit report every 12 months upon request. It is important to regularly review these reports to identify errors, fraudulent activities, or any issues that may affect creditworthiness. 2. Credit Report Dispute Request: Massachusetts residents can file a Credit Report Dispute Request if they believe there are inaccuracies or fraudulent entries on their credit reports. The FCRA grants consumers the right to dispute any information they deem incorrect or incomplete. To initiate this request, individuals must notify the credit reporting agencies in writing, providing detailed explanations and supporting documentation. The agencies are then required to investigate the disputed items within a specified timeframe, usually 30 days, and inform the individual of the results. Massachusetts Credit Information Requests are essential in maintaining a healthy credit profile and protecting oneself from identity theft or credit fraud. They enable individuals to stay informed about their creditworthiness, identify any problematic areas, and take appropriate actions to rectify errors or discrepancies. Regularly monitoring credit reports, disputing inaccurate information, and striving for good credit management are all vital for securing favorable borrowing terms, applying for loans, or making significant financial decisions in Massachusetts.

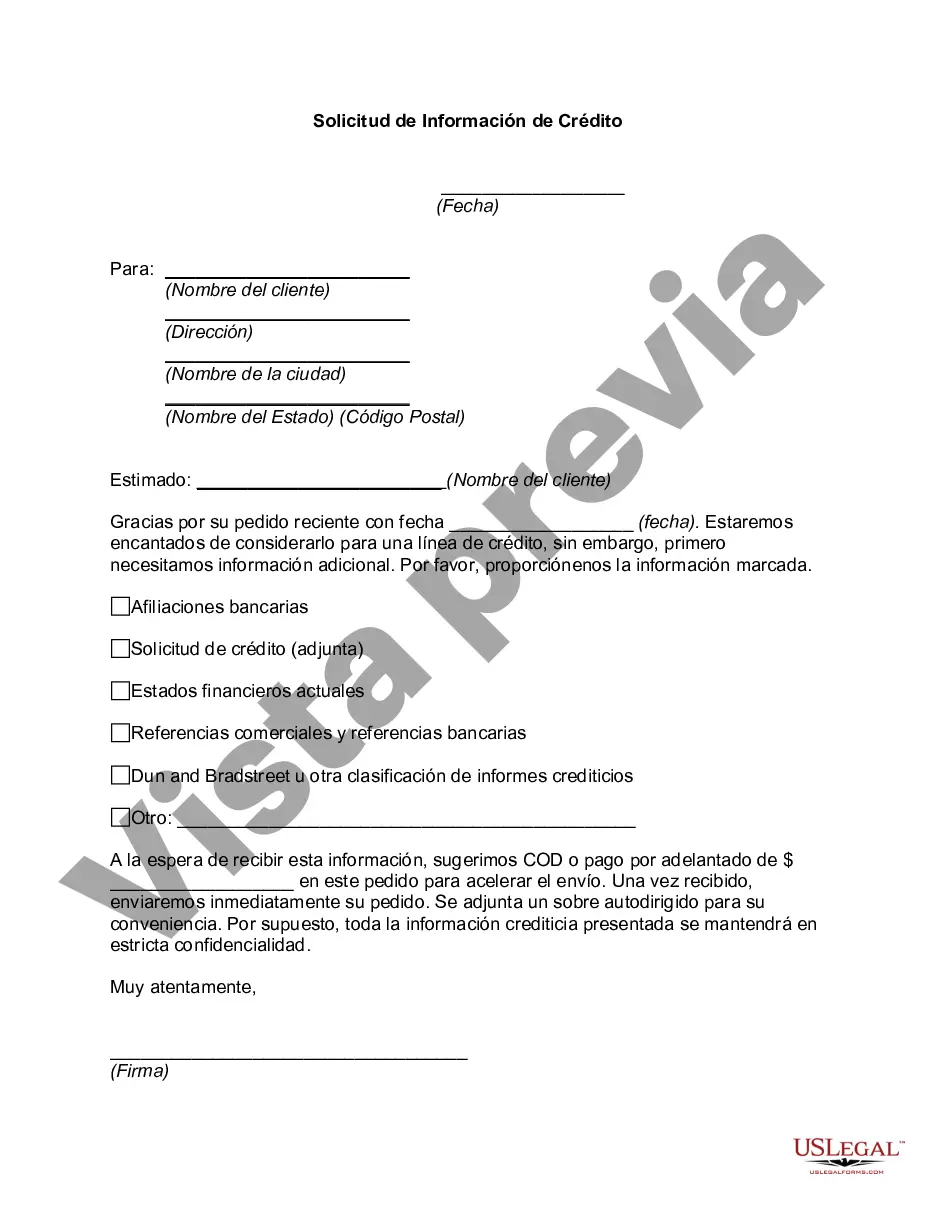

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Massachusetts Solicitud De Información De Crédito?

Choosing the best lawful document design can be a have difficulties. Naturally, there are a variety of layouts available on the net, but how will you discover the lawful kind you will need? Make use of the US Legal Forms web site. The services gives a huge number of layouts, including the Massachusetts Credit Information Request, that you can use for organization and personal needs. All the kinds are inspected by pros and fulfill federal and state specifications.

If you are previously registered, log in to your profile and click on the Down load key to obtain the Massachusetts Credit Information Request. Utilize your profile to look throughout the lawful kinds you have ordered earlier. Visit the My Forms tab of the profile and get an additional duplicate in the document you will need.

If you are a fresh user of US Legal Forms, here are basic recommendations so that you can follow:

- Initially, ensure you have chosen the proper kind for the city/area. It is possible to look over the shape making use of the Preview key and look at the shape description to guarantee it will be the best for you.

- In case the kind fails to fulfill your preferences, use the Seach discipline to discover the proper kind.

- When you are positive that the shape is acceptable, click the Purchase now key to obtain the kind.

- Choose the rates prepare you desire and enter the needed information. Make your profile and pay for your order utilizing your PayPal profile or Visa or Mastercard.

- Opt for the submit file format and down load the lawful document design to your product.

- Comprehensive, revise and produce and indication the received Massachusetts Credit Information Request.

US Legal Forms is definitely the largest catalogue of lawful kinds where you can discover various document layouts. Make use of the company to down load appropriately-made papers that follow state specifications.