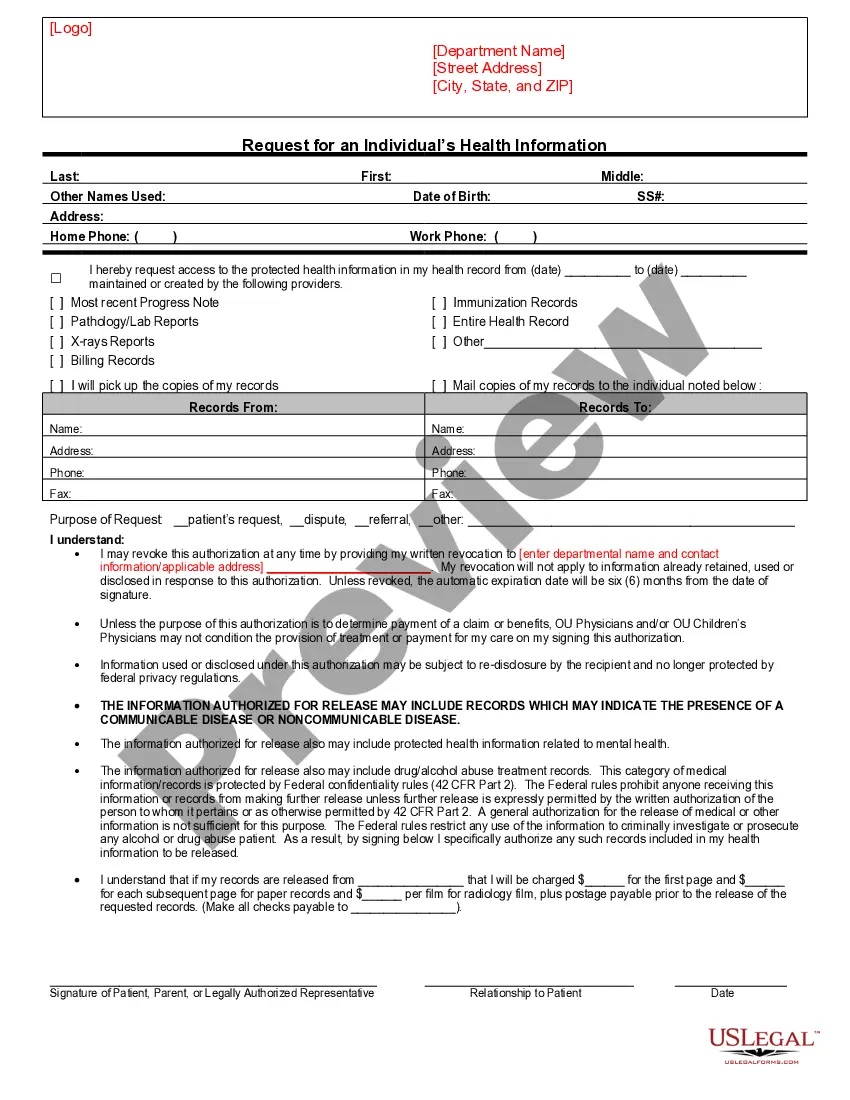

Massachusetts Employment Agreement with Executive Vice President and Chief Financial Officer Introduction: A Massachusetts Employment Agreement with an Executive Vice President and Chief Financial Officer (CFO) is a legally binding document that outlines the terms and conditions of employment between a company and its CFO in the state of Massachusetts. This agreement serves as a critical tool to define the roles, responsibilities, compensation, benefits, and other important aspects of the employment relationship. Keywords: — Massachusetts EmploymenAgreementen— - Executive Vice President — Chief Financial Office— - Employment terms and conditions — Roles anresponsibilitiesie— - Compensation — Benefits Types of Massachusetts Employment Agreements with Executive Vice President and CFO: 1. Standard Employment Agreement: This is the most common type of agreement where the company and the CFO define the terms of their working relationship. The agreement covers various aspects such as the CFO's job title, reporting structure, job responsibilities, compensation package, and benefits. It may also outline the termination and severance provisions. 2. Non-Compete Employment Agreement: When necessary to protect the company's interests, a non-compete agreement may be included in the employment agreement. It prohibits the CFO from engaging in competitive activities during their employment and for a prescribed period after leaving the company. Non-compete agreements must comply with Massachusetts state law to be enforceable. 3. Equity-Based Employment Agreement: In cases where the company offers equity or stock options as part of the CFO's compensation package, an equity-based employment agreement may be established. This agreement outlines the specific terms relating to equity grants, vesting schedules, and any other relevant provisions related to the CFO's ownership stake in the company. 4. Change in Control Employment Agreement: A change in control agreement may be incorporated into the Massachusetts employment agreement in situations where a potential change in ownership or control of the company is anticipated. This type of agreement typically provides the CFO with specific rights and benefits in the event of a change in control, such as severance packages, accelerated vesting of equity, or other financial protections. Main Contents of a Massachusetts Employment Agreement with Executive Vice President and CFO: 1. Parties: Clearly identifies the parties involved, namely the company and the CFO, along with their official names and addresses. 2. Employment Terms: Defines the start date of employment and the term of the agreement, whether it is for a fixed period or an indefinite term. It may also include provisions about the working hours, location, and any travel requirements. 3. Roles and Responsibilities: Details the specific duties, responsibilities, and authority of the CFO within the company. It may outline reporting lines, interaction with the board of directors, and any specific projects or initiatives the CFO is expected to undertake. 4. Compensation: Specifies the CFO's base salary, bonus structure, and any other forms of compensation such as profit-sharing, commissions, or incentive programs. It may also cover details about salary reviews, raises, and other compensation-related matters. 5. Benefits and Perks: Outlines the CFO's entitlement to employee benefits provided by the company, including health insurance, retirement plans, vacation days, sick leave, and any other relevant benefits or perks. 6. Confidentiality and Non-Disclosure: Includes provisions to safeguard the company's confidential information and trade secrets, as well as any non-disclosure requirements during and after the CFO's employment. 7. Termination and Severance: Defines the circumstances under which either party can terminate the employment agreement, including notice periods, grounds for termination, and any severance package the CFO is entitled to upon termination. 8. Governing Law and Dispute Resolution: Specifies that the agreement is subject to Massachusetts state laws and outlines the preferred method of dispute resolution, such as arbitration or mediation, to address any potential conflicts or disagreements. Conclusion: A Massachusetts Employment Agreement with an Executive Vice President and Chief Financial Officer is a comprehensive legal document that ensures a clear understanding between the company and its CFO. By delineating roles, responsibilities, compensation, benefits, and other important details, this agreement protects both parties' interests and helps foster a successful working relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Acuerdo Laboral con Vicepresidente Ejecutivo y Director Financiero - Employment Agreement with Executive Vice President and Chief Financial Officer

Description

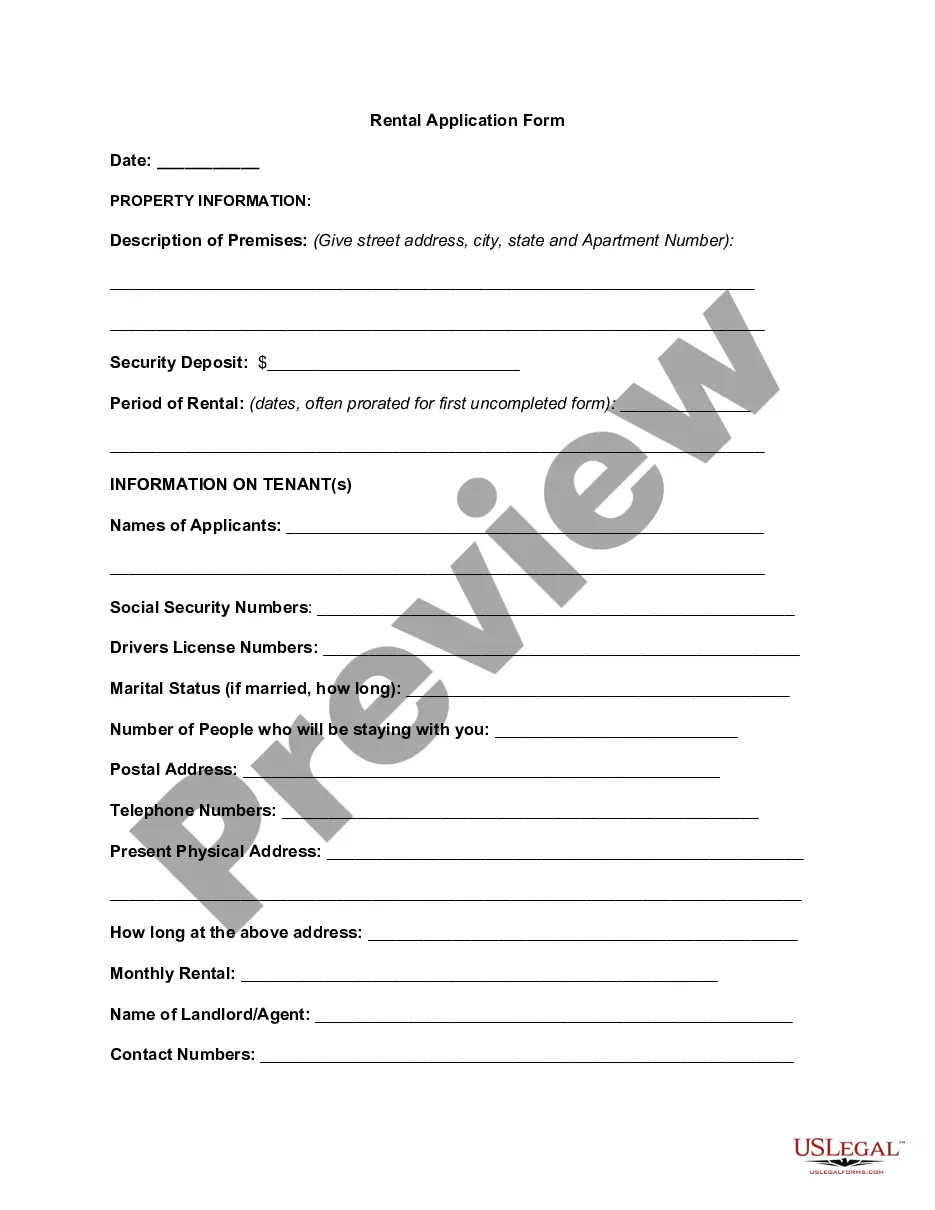

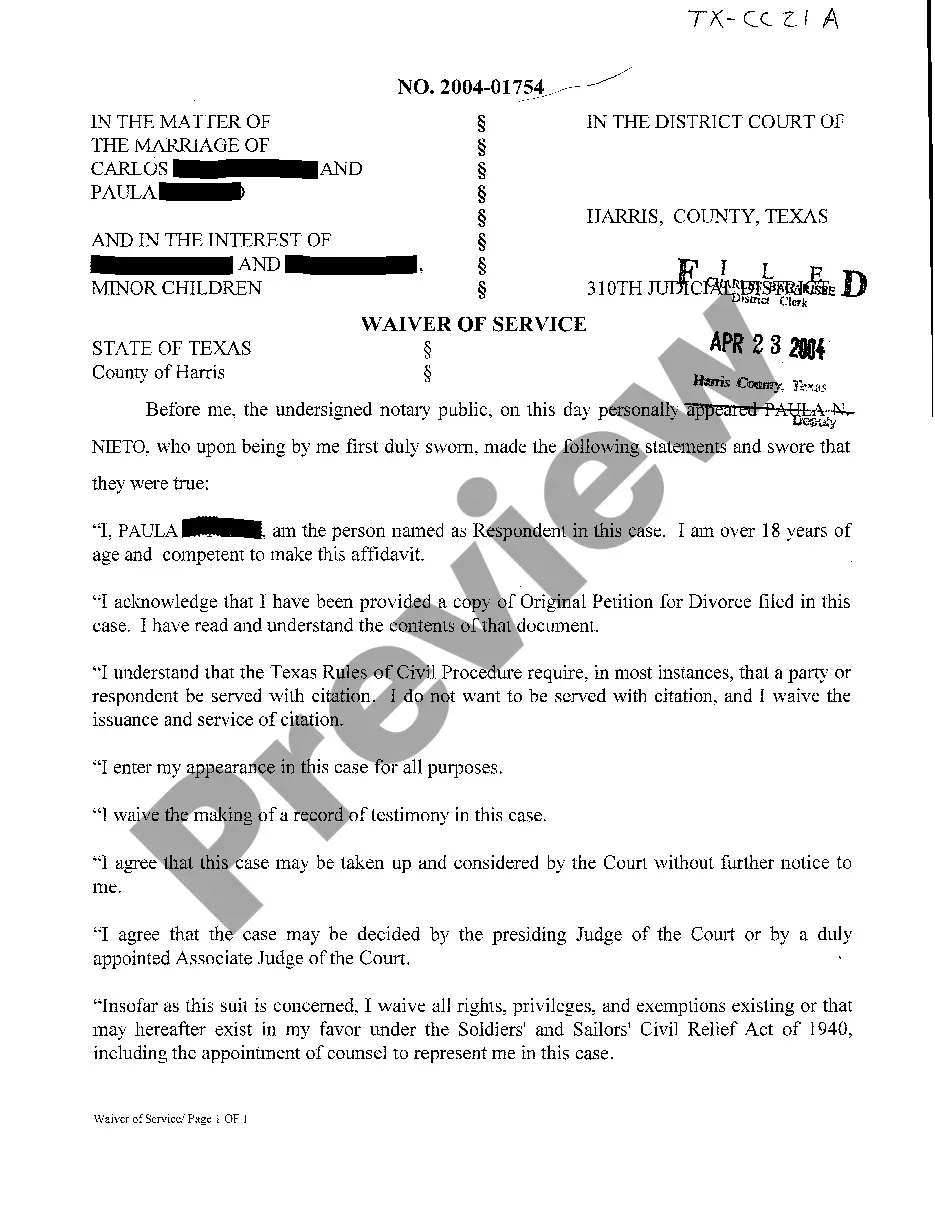

How to fill out Massachusetts Acuerdo Laboral Con Vicepresidente Ejecutivo Y Director Financiero?

You can devote hours on-line attempting to find the authorized file template which fits the state and federal requirements you need. US Legal Forms offers 1000s of authorized varieties that happen to be analyzed by specialists. It is possible to obtain or produce the Massachusetts Employment Agreement with Executive Vice President and Chief Financial Officer from my assistance.

If you already possess a US Legal Forms accounts, it is possible to log in and then click the Acquire switch. Next, it is possible to comprehensive, edit, produce, or sign the Massachusetts Employment Agreement with Executive Vice President and Chief Financial Officer. Every single authorized file template you purchase is the one you have eternally. To acquire yet another version associated with a acquired type, proceed to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms web site initially, keep to the basic recommendations beneath:

- First, be sure that you have chosen the correct file template to the state/area of your choosing. Read the type description to ensure you have picked out the correct type. If accessible, make use of the Review switch to check from the file template at the same time.

- In order to locate yet another version from the type, make use of the Research industry to discover the template that meets your requirements and requirements.

- Upon having identified the template you would like, click Acquire now to carry on.

- Choose the prices prepare you would like, enter your qualifications, and register for an account on US Legal Forms.

- Full the financial transaction. You can use your credit card or PayPal accounts to fund the authorized type.

- Choose the structure from the file and obtain it in your product.

- Make modifications in your file if required. You can comprehensive, edit and sign and produce Massachusetts Employment Agreement with Executive Vice President and Chief Financial Officer.

Acquire and produce 1000s of file web templates while using US Legal Forms web site, that provides the biggest assortment of authorized varieties. Use expert and express-distinct web templates to deal with your organization or individual requirements.