The Massachusetts Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a legal document that governs the sale of a corporation's assets. This comprehensive agreement outlines the terms and conditions of the sale, including the allocation of the purchase price to both tangible and intangible assets. In Massachusetts, there are different types of agreements for the sale of assets that may vary based on specific business requirements. Some of these types include: 1. General Agreement for Sale of all Assets: This type of agreement encompasses the sale of all assets owned by the corporation, including tangible assets such as property, equipment, inventory, etc., and intangible assets such as patents, trademarks, customer databases, etc. It allows for the allocation of the purchase price to different categories of assets. 2. Agreement for Sale of Tangible Business Assets Only: This agreement focuses solely on the sale of tangible assets owned by the corporation. It excludes any intangible assets like intellectual property rights or proprietary information. The purchase price is allocated specifically to tangible assets. 3. Agreement for Sale of Intangible Business Assets Only: This specific agreement concentrates on the sale of intangible assets possessed by the corporation, while excluding any tangible assets. It covers assets such as copyrights, trademarks, trade secrets, licenses, and goodwill. The purchase price is allocated exclusively to intangible assets. Regardless of the specific type, the Massachusetts Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets includes crucial elements such as the purchase price, payment terms, representations and warranties, conditions precedent, closing procedures, post-closing obligations, and dispute resolution mechanisms. It is imperative to consult with legal professionals or experts specializing in corporate law while drafting or reviewing such agreements to ensure compliance with Massachusetts state laws and to protect the interests of all parties involved.

Massachusetts Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

US Legal Forms - one of many biggest libraries of legal kinds in the USA - gives a wide range of legal document themes you can down load or printing. While using website, you may get a huge number of kinds for business and specific uses, sorted by types, suggests, or keywords and phrases.You will discover the latest versions of kinds such as the Massachusetts Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets within minutes.

If you currently have a subscription, log in and down load Massachusetts Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets in the US Legal Forms collection. The Obtain switch can look on every single type you view. You have accessibility to all earlier downloaded kinds from the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, listed here are basic instructions to help you get started:

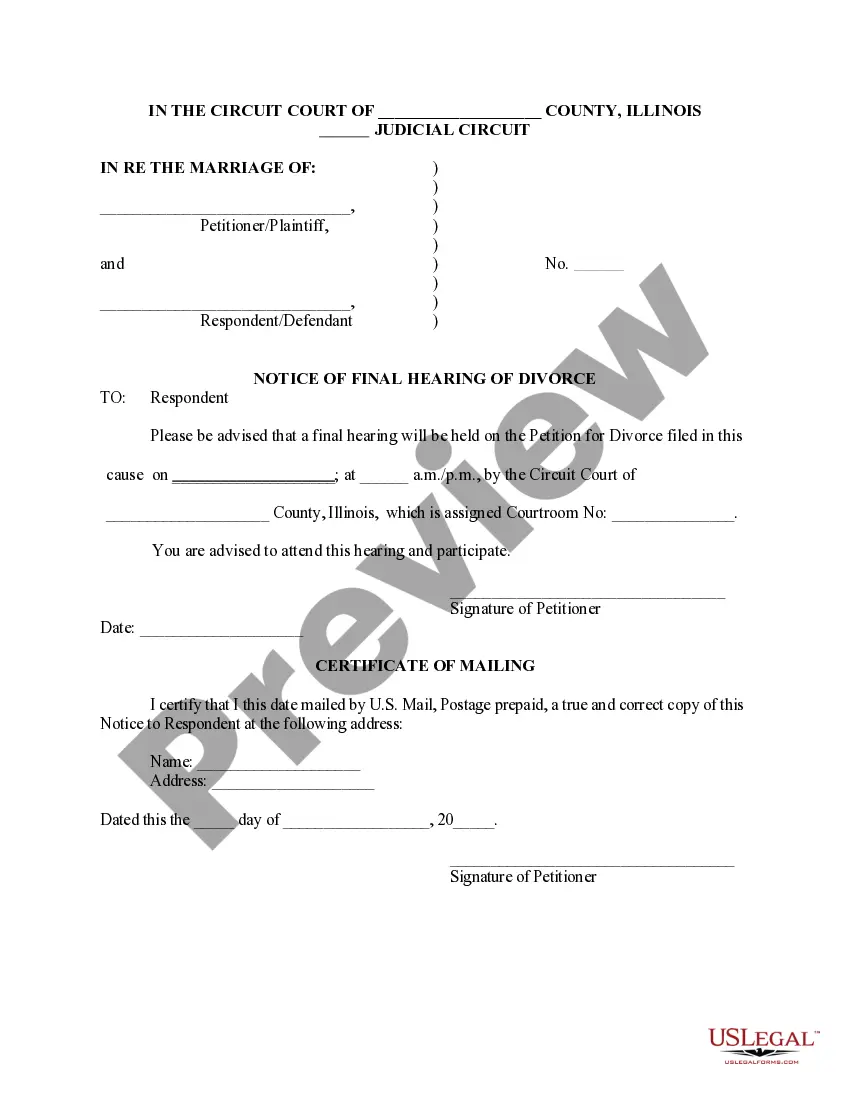

- Be sure to have picked the right type for your personal town/county. Click the Review switch to examine the form`s articles. See the type explanation to actually have selected the proper type.

- In case the type doesn`t fit your demands, utilize the Search industry at the top of the monitor to obtain the the one that does.

- When you are content with the shape, validate your decision by clicking the Buy now switch. Then, choose the prices program you want and supply your qualifications to sign up for the accounts.

- Approach the purchase. Make use of Visa or Mastercard or PayPal accounts to perform the purchase.

- Select the formatting and down load the shape on your product.

- Make modifications. Load, edit and printing and indicator the downloaded Massachusetts Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

Every design you put into your money does not have an expiry date and it is the one you have eternally. So, if you would like down load or printing one more duplicate, just visit the My Forms area and then click about the type you require.

Obtain access to the Massachusetts Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets with US Legal Forms, one of the most substantial collection of legal document themes. Use a huge number of specialist and express-certain themes that satisfy your small business or specific requirements and demands.

Form popularity

FAQ

An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.