Massachusetts Returned Items Report, also known as the Returned Item List, is a document generated by financial institutions to provide a comprehensive overview of all returned checks and other payment instruments within a specific time period. This report is an essential tool for tracking and managing bounced or unpaid payments, helping financial institutions monitor their account holders' transactional activities. The Massachusetts Returned Items Report includes detailed information about each item that was returned, such as check number, amount, date, and the reason for its return, which can vary from insufficient funds to stop payment requests or closed accounts. By examining this report, banks and credit unions can effectively identify individuals or businesses with a history of returned payments, which may indicate financial instability. This report plays a crucial role in safeguarding the banking system and maintaining financial integrity. It enables financial institutions to promptly take appropriate actions to minimize losses and protect their customers' interests. Additionally, it helps prevent fraudulent activities, as it reveals patterns of non-payment or fraudulent behavior exhibited by certain account holders. Different types of Massachusetts Returned Items Reports may include: 1. Monthly Returned Items Report: This report provides a comprehensive overview of all returned items for a particular month. It allows financial institutions to review the previous month's activity and identify recurring issues or patterns among account holders. 2. Top Returners Report: This report highlights the individuals or businesses that frequently have their payments returned. It helps financial institutions prioritize their efforts in contacting and resolving issues with these account holders. 3. Return Reason Analysis Report: This type of report categorizes returned items based on the reason for their return. By analyzing the data, financial institutions can identify common problems, such as insufficient funds or fraudulent activity, and develop appropriate strategies to address these issues. 4. Trend Analysis Report: This report evaluates returned items over a specified period, aiming to identify any shifts or trends in non-payment behavior. It facilitates the detection of emerging risks or changes in account holders' financial circumstances. Overall, the Massachusetts Returned Items Report is an essential tool for financial institutions in managing and addressing returned payments effectively. It helps maintain account holder satisfaction, minimize losses, and protect against fraudulent activities, ensuring the integrity of the banking system.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Informe de artículos devueltos - Returned Items Report

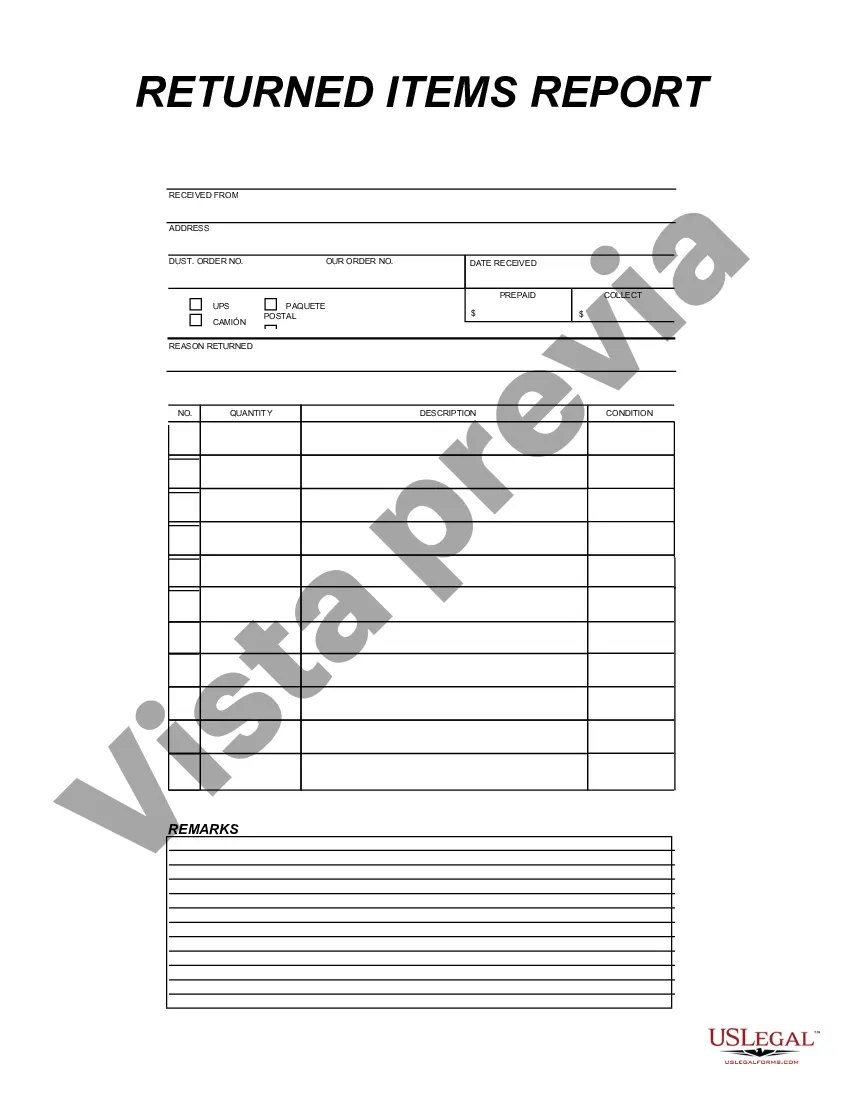

Description

How to fill out Massachusetts Informe De Artículos Devueltos?

Are you within a placement in which you need to have documents for possibly business or specific reasons virtually every day? There are tons of authorized document templates accessible on the Internet, but getting ones you can rely on is not straightforward. US Legal Forms delivers thousands of form templates, much like the Massachusetts Returned Items Report, which are published to satisfy state and federal requirements.

In case you are previously acquainted with US Legal Forms web site and possess a free account, just log in. Afterward, you can obtain the Massachusetts Returned Items Report design.

Should you not come with an bank account and need to begin using US Legal Forms, abide by these steps:

- Discover the form you need and ensure it is to the right town/state.

- Take advantage of the Preview button to check the form.

- See the description to ensure that you have chosen the proper form.

- In the event the form is not what you`re trying to find, take advantage of the Search industry to get the form that fits your needs and requirements.

- Once you obtain the right form, just click Get now.

- Select the rates program you want, fill in the desired info to produce your bank account, and purchase the order making use of your PayPal or bank card.

- Decide on a hassle-free data file structure and obtain your backup.

Locate each of the document templates you may have purchased in the My Forms food list. You may get a further backup of Massachusetts Returned Items Report at any time, if needed. Just select the essential form to obtain or printing the document design.

Use US Legal Forms, one of the most considerable selection of authorized kinds, to conserve time as well as steer clear of blunders. The assistance delivers expertly manufactured authorized document templates which you can use for a variety of reasons. Make a free account on US Legal Forms and initiate creating your way of life a little easier.