Massachusetts Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

Finding the appropriate legal document format can be a challenge. Certainly, there are numerous templates available online, but how do you find the specific legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Massachusetts Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, which can be utilized for business and personal needs. All the forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Massachusetts Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. Use your account to search for the legal forms you may have acquired previously. Go to the My documents section of your account and retrieve an additional copy of the document you need.

Finally, complete, edit, print, and sign the received Massachusetts Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. US Legal Forms is the largest library of legal forms where you can discover various document templates. Use this service to download professionally crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

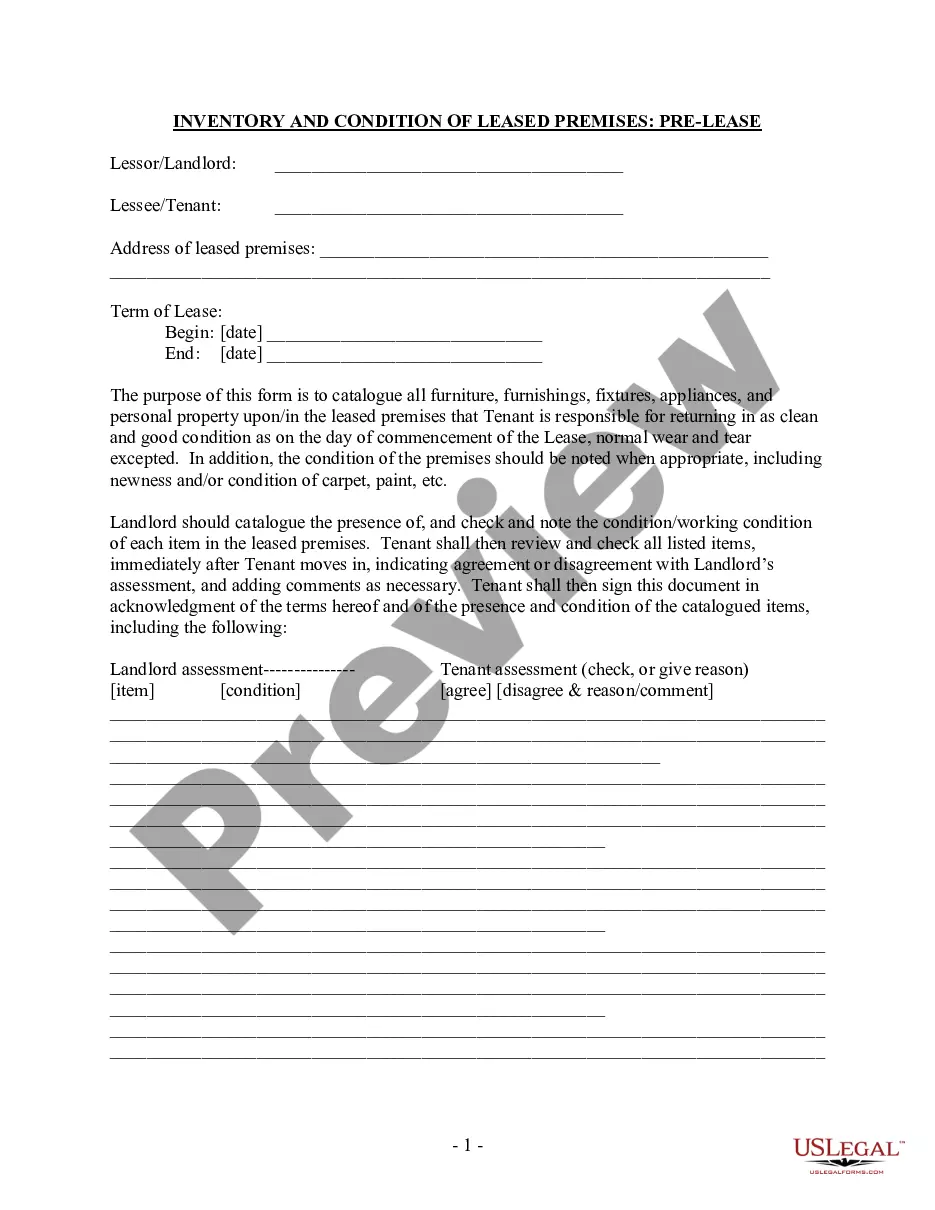

- First, ensure you have selected the correct form for your region/county. You can browse the form using the Preview option and read the form description to make sure it is the right one for you.

- If the form does not meet your needs, use the Search field to find the correct form.

- Once you are certain that the form is appropriate, click on the Get now button to acquire the form.

- Select the pricing plan you wish and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

Form popularity

FAQ

In Massachusetts, a limited liability company (LLC) must have at least one owner, known as a member. This flexibility allows individuals to start an LLC alone or join with others. It's essential to consider that as your LLC grows, you may want to hold a meeting of LLC members to specify important matters, such as the amount of annual disbursements to members of the company. Utilizing a Massachusetts Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company can help you establish clear financial guidelines and enhance operational efficiency.

Unlike LLCs, corporations are required to make resolutions. Therefore, they are used to preparing them when shareholders or the board of directors make decisions. Although an LLC is not required to make resolutions, there are many reasons for getting in the habit of maintaining resolutions.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

All foreign and domestic corporations registered in Massachusetts are required to file an annual report with the Secretary of the Commonwealth within two and one-half months after the close of their fiscal year. To learn about the various types of corporations select here.

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...