Massachusetts Model Statement of ERISA Rights

Description

How to fill out Model Statement Of ERISA Rights?

US Legal Forms - one of the largest collections of legal documents in the country - provides a plethora of legal template options that you can download or print.

By using the website, you can access thousands of forms for commercial and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents like the Massachusetts Model Statement of ERISA Rights in a matter of minutes.

If you already possess a subscription, Log In and download the Massachusetts Model Statement of ERISA Rights from the US Legal Forms library. The Download button will be visible on each form you view.

Choose the format and download the form to your device.

Make amendments. Fill out, modify, and print and sign the saved Massachusetts Model Statement of ERISA Rights.

- If you are interested in using US Legal Forms for the first time, here are some straightforward steps to get you started.

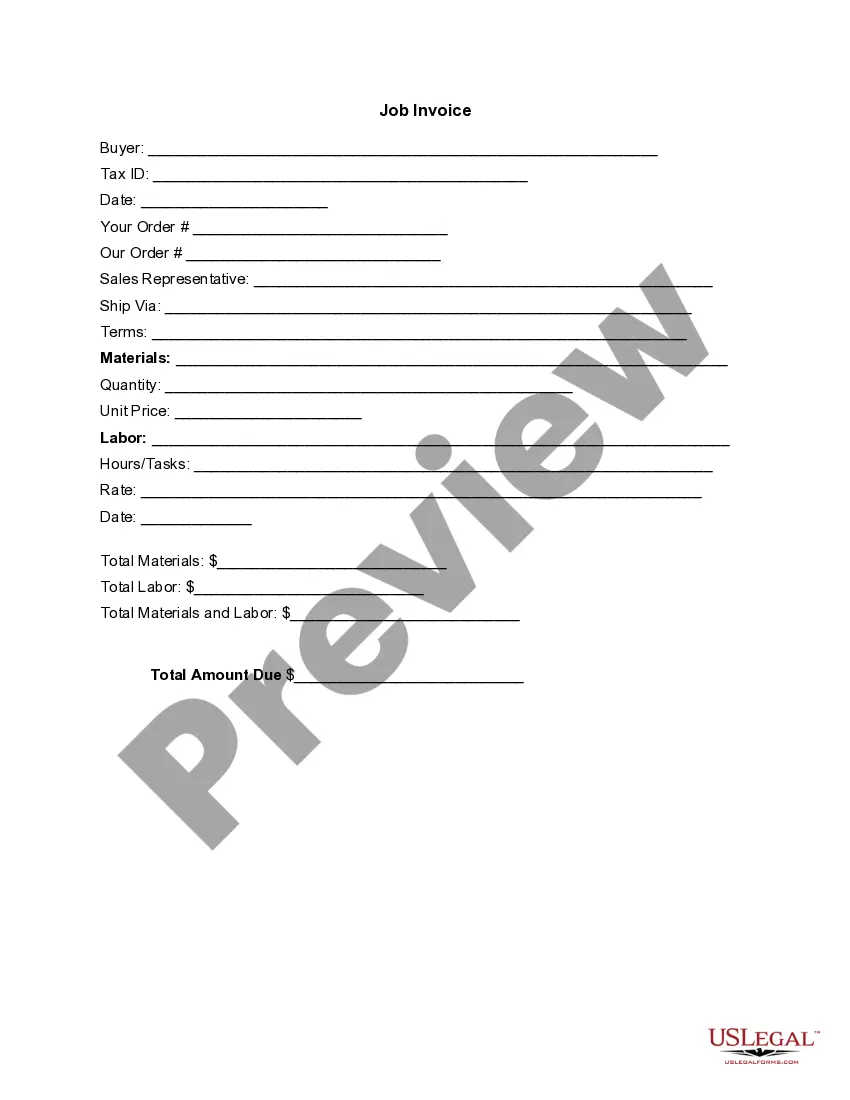

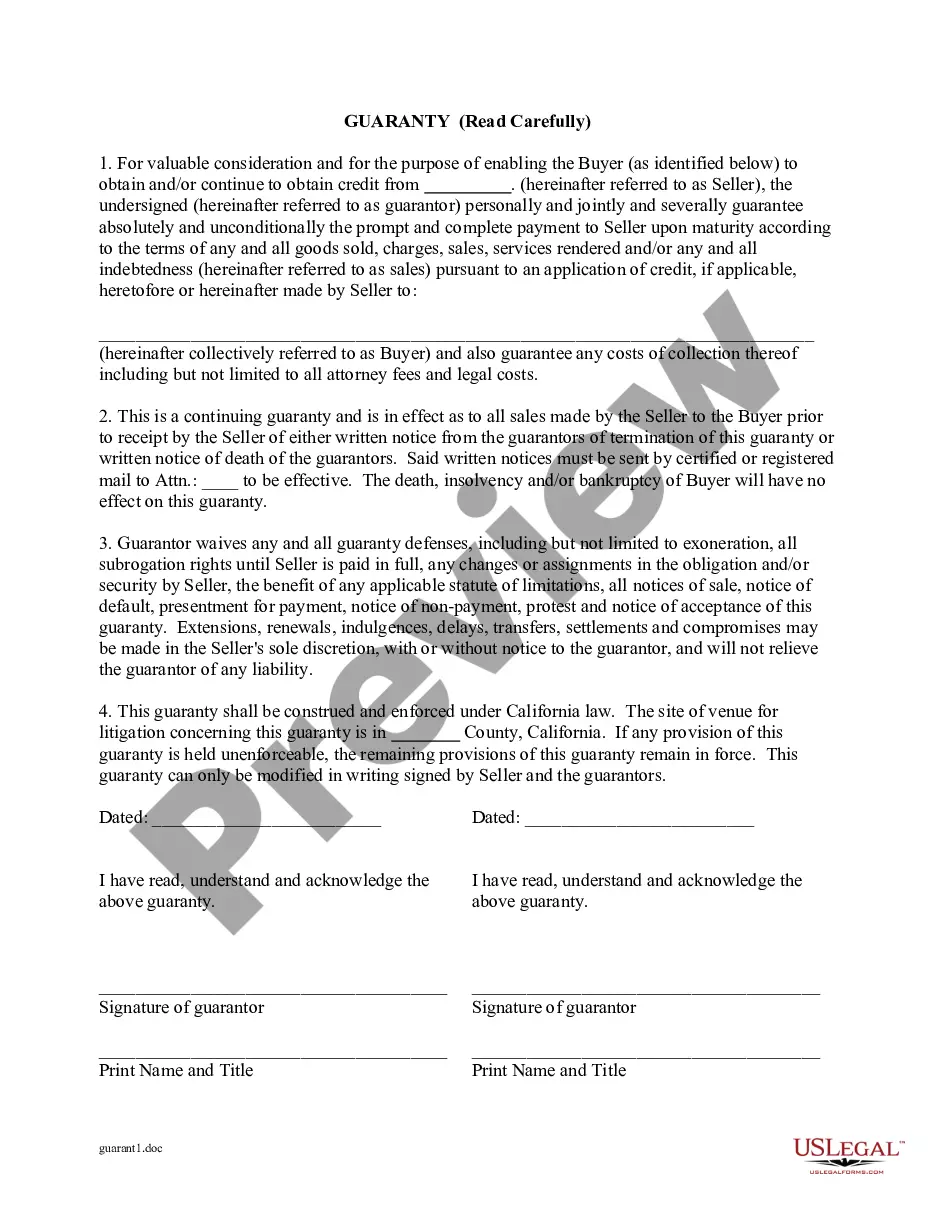

- Ensure you have selected the correct form for your town/state. Click on the Preview button to examine the form's content.

- Check the form summary to confirm that you have chosen the right form.

- Should the form not meet your criteria, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, affirm your selection by clicking on the Buy now button. Then, select the pricing plan you prefer and provide your details to sign up for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Form popularity

FAQ

In general, ERISA does not cover group health plans established or maintained by governmental entities, churches for their employees, or plans which are maintained solely to comply with applicable workers compensation, unemployment, or disability laws.

ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to

2 ERISA does not apply to plans administered by federal, state, or local governments. It does not apply to plans established solely to meet state workers' compensation, unemployment compensation, or disability insurance laws.

ERISA requires a formal written plan document, a summary plan description (SPD), and a summary of benefits & coverage (SBC). Each of these requirements is discussed in more detail below. A formal plan document is required for every ERISA plan.

Accounts Covered by ERISA ERISA can cover both defined-benefit and defined-contribution plans offered by employers. Common types of employer-sponsored retirement accounts that fall under ERISA include 401(k) plans, pensions, deferred-compensation plans, and profit-sharing plans.

ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to

ERISA only applies to private companies, so benefits offered by public employers at all levelslocal, state, and federalare exempt from these regulations.

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

Under ERISA, anyone who exercises discretionary authority over plan assets or plan management has a fiduciary duty toward the plan's participants. As a result, fiduciaries must run the plan solely for the benefit of its participants, and failure to do so is an ERISA violation.

ERISA prohibits fiduciaries from misusing funds and also sets minimum standards for participation, vesting, benefit accrual, and funding of retirement plans. It also grants retirement plan participants the right to sue for benefits and breaches of fiduciary duty.