The Massachusetts Clawback Guaranty, also known as the Clawback Guarantee, refers to a legal provision in Massachusetts that aims to protect creditors in certain financial transactions. It acts as a safety net for lenders by allowing them to recover or "claw back" funds or assets that were distributed to a borrower or debtor within a specified time frame before their bankruptcy filing. This guaranty is particularly crucial in cases where lenders suspect that borrowers may be attempting to defraud creditors or hide assets. It helps prevent fraudulent transfers and ensures that creditors are given a fair chance to recover their debts. There are two primary types of Massachusetts Clawback Guaranty: 1. Preference Clawback: Under this provision, if a debtor knowingly transfers assets to another party (such as a family member or close associate) within 90 days before filing for bankruptcy, the creditor can initiate a clawback action. This allows the creditor to reclaim the transferred property or the equivalent value from the recipient. The objective is to prevent a debtor from favoring certain individuals or entities over others before bankruptcy proceedings. 2. Fraudulent Transfer Clawback: In cases where a debtor intentionally transfers assets with the intention of defrauding creditors, the fraudulent transfer clawback comes into play. This provision allows creditors to recover assets that were fraudulently transferred within four years before the bankruptcy filing. Creditors must prove that the transfer was made with fraudulent intent or to hinder the ability of creditors to collect their debts. By implementing these Massachusetts Clawback Guaranty provisions, the state aims to protect the rights and interests of creditors and maintain the integrity of the bankruptcy process. These guaranties ensure a fair distribution of assets among all creditors and discourage debtors from attempting to manipulate the system for personal gain. Overall, the Massachusetts Clawback Guaranty safeguards against fraudulent transfers and preferences while emphasizing equitable treatment of creditors during bankruptcy proceedings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Garantía de recuperación - Clawback Guaranty

Description

How to fill out Massachusetts Garantía De Recuperación?

It is possible to devote hours online attempting to find the lawful file design that fits the federal and state specifications you will need. US Legal Forms gives a huge number of lawful varieties which are analyzed by professionals. It is simple to down load or print out the Massachusetts Clawback Guaranty from my support.

If you already have a US Legal Forms account, you may log in and click on the Acquire button. Next, you may comprehensive, edit, print out, or sign the Massachusetts Clawback Guaranty. Every lawful file design you purchase is the one you have eternally. To obtain another version of any obtained form, go to the My Forms tab and click on the related button.

If you work with the US Legal Forms web site initially, adhere to the easy recommendations below:

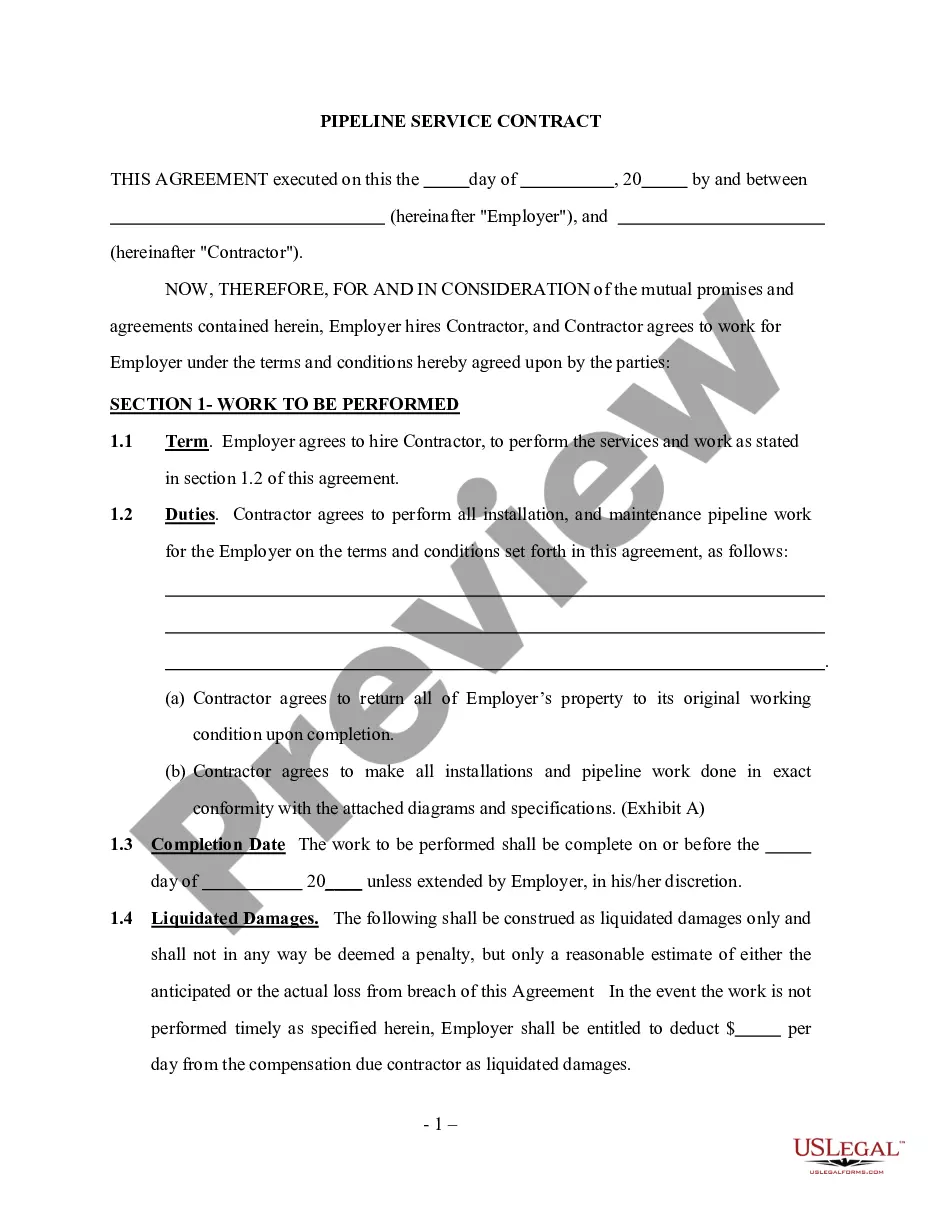

- Very first, make certain you have selected the correct file design to the state/city that you pick. See the form information to make sure you have picked the proper form. If accessible, take advantage of the Review button to check through the file design at the same time.

- If you wish to locate another version from the form, take advantage of the Search discipline to get the design that fits your needs and specifications.

- When you have located the design you want, just click Acquire now to proceed.

- Find the prices program you want, type in your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can utilize your Visa or Mastercard or PayPal account to purchase the lawful form.

- Find the format from the file and down load it to your device.

- Make alterations to your file if required. It is possible to comprehensive, edit and sign and print out Massachusetts Clawback Guaranty.

Acquire and print out a huge number of file templates making use of the US Legal Forms site, that offers the greatest selection of lawful varieties. Use skilled and express-particular templates to handle your company or specific requirements.