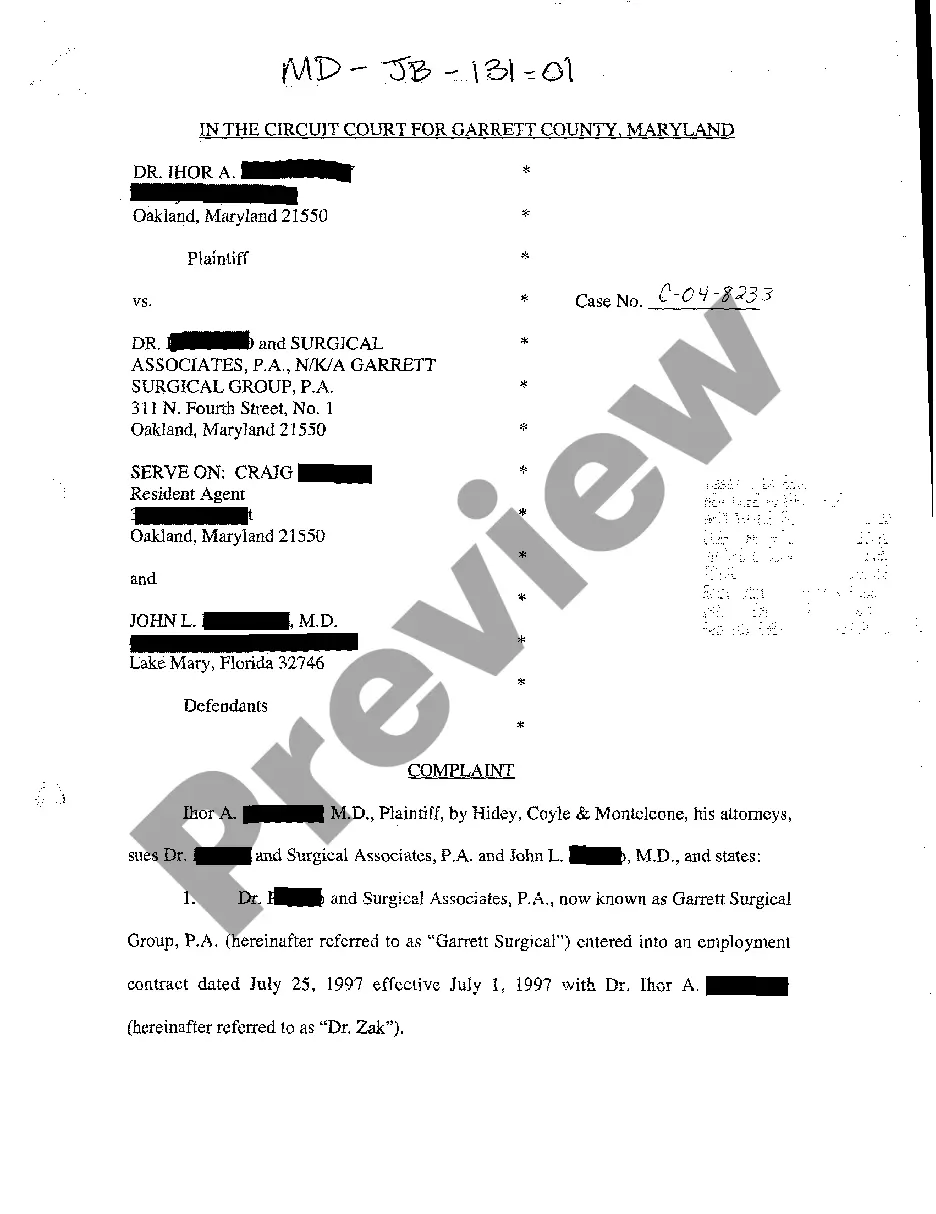

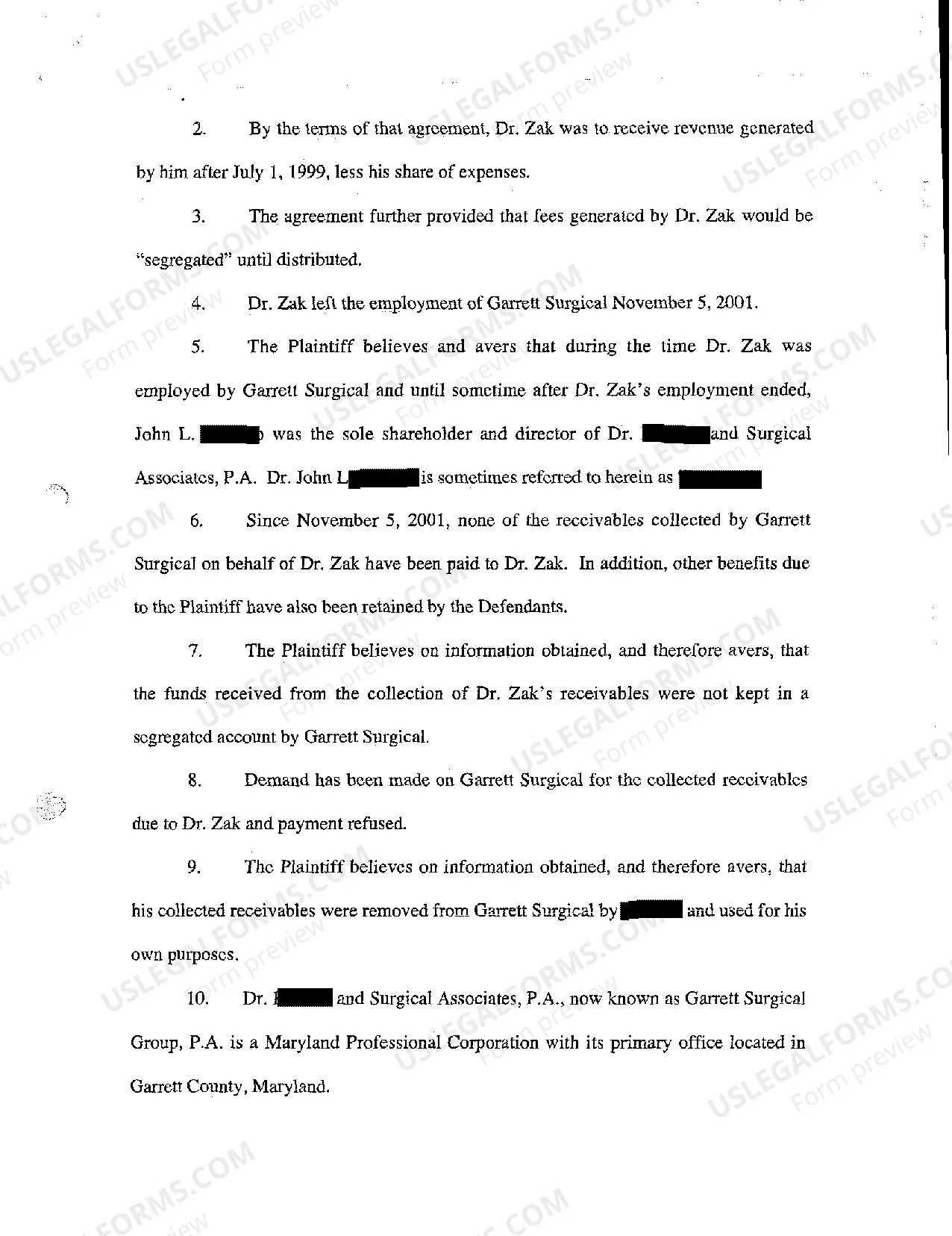

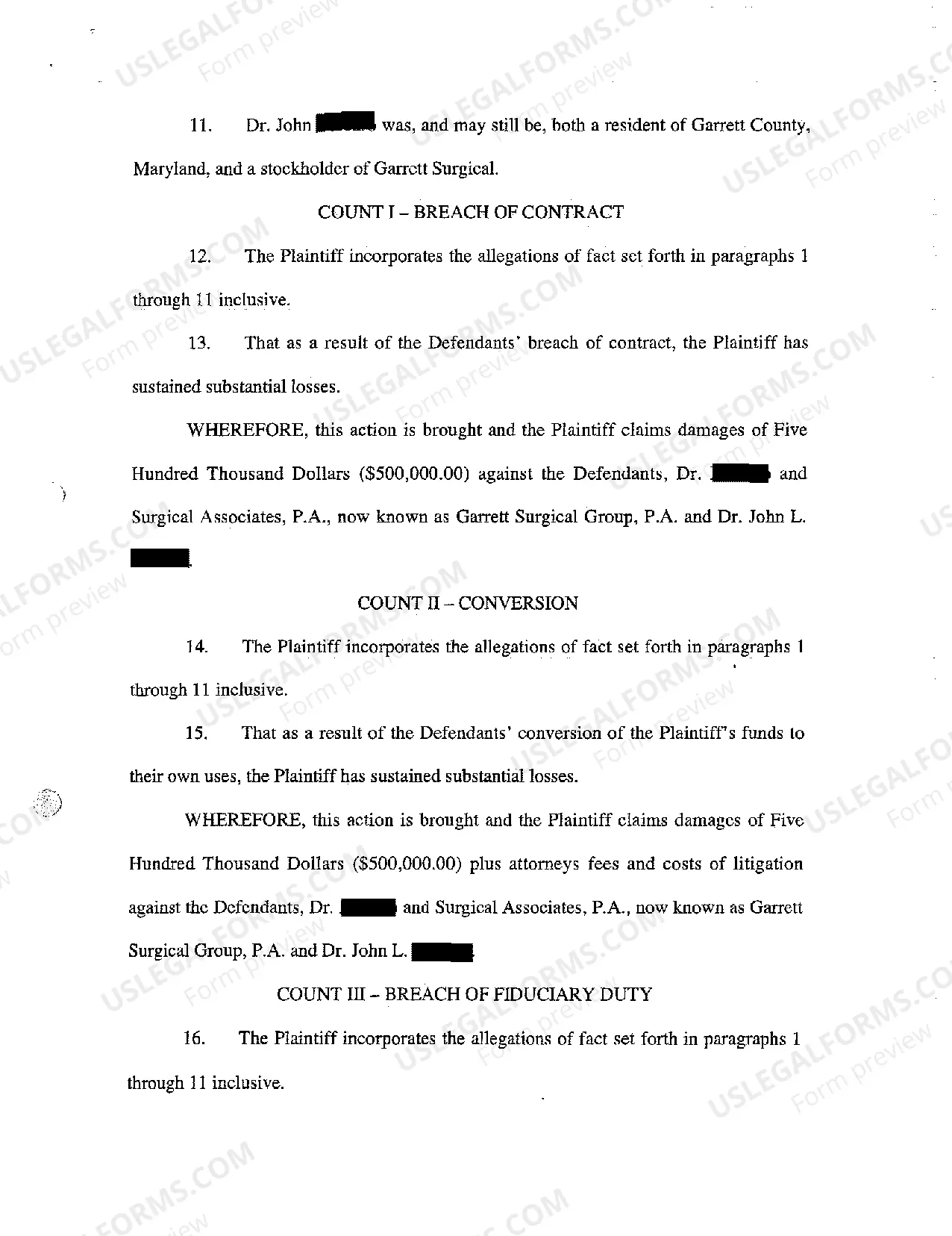

Maryland Complaint for Breach of Employment Agreement to Pay Employee Fees Generated

Description

How to fill out Maryland Complaint For Breach Of Employment Agreement To Pay Employee Fees Generated?

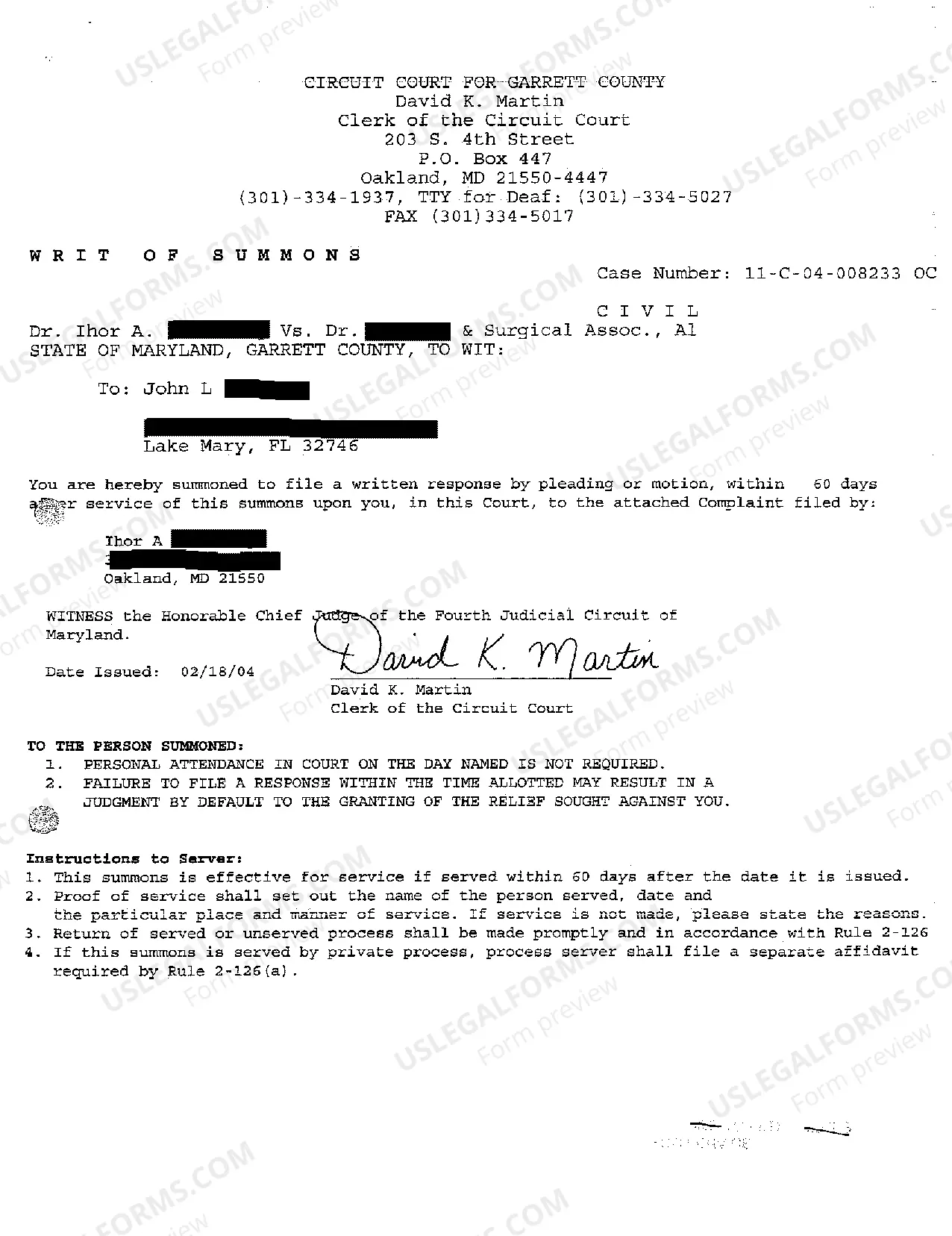

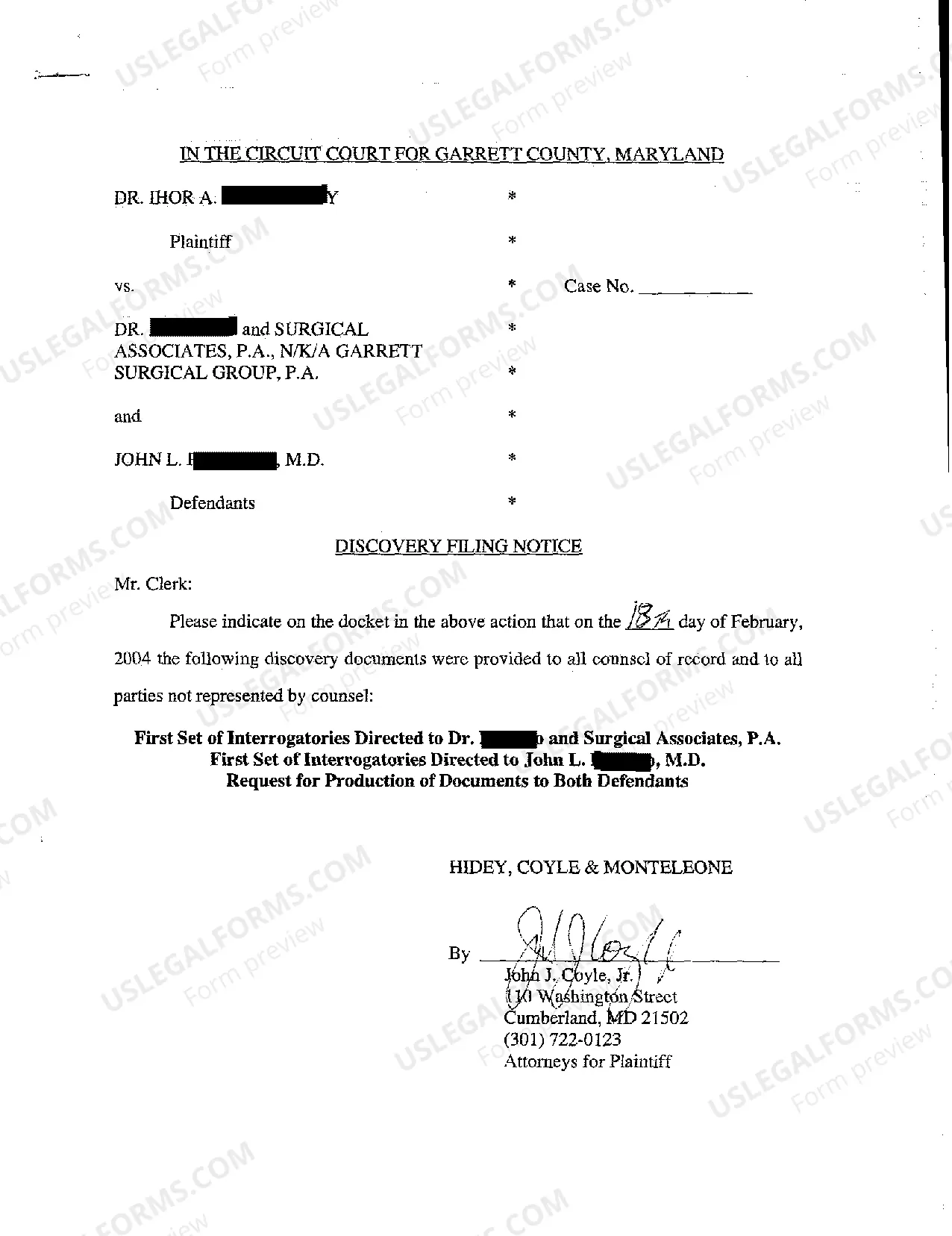

You are welcome to the greatest legal files library, US Legal Forms. Right here you will find any sample such as Maryland Complaint for Breach of Employment Agreement to Pay Employee Fees Generated forms and save them (as many of them as you wish/need to have). Make official files with a several hours, instead of days or even weeks, without having to spend an arm and a leg on an attorney. Get the state-specific example in clicks and feel assured knowing that it was drafted by our accredited attorneys.

If you’re already a subscribed consumer, just log in to your account and click Download near the Maryland Complaint for Breach of Employment Agreement to Pay Employee Fees Generated you want. Because US Legal Forms is online solution, you’ll always get access to your downloaded templates, no matter the device you’re utilizing. Find them within the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check our guidelines below to start:

- If this is a state-specific document, check out its applicability in your state.

- View the description (if offered) to learn if it’s the proper example.

- See much more content with the Preview function.

- If the document fulfills all your needs, just click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to join.

- Download the file in the format you require (Word or PDF).

- Print out the document and fill it out with your/your business’s information.

When you’ve filled out the Maryland Complaint for Breach of Employment Agreement to Pay Employee Fees Generated, send it to your legal professional for verification. It’s an extra step but a necessary one for being certain you’re entirely covered. Become a member of US Legal Forms now and get a large number of reusable samples.

Form popularity

FAQ

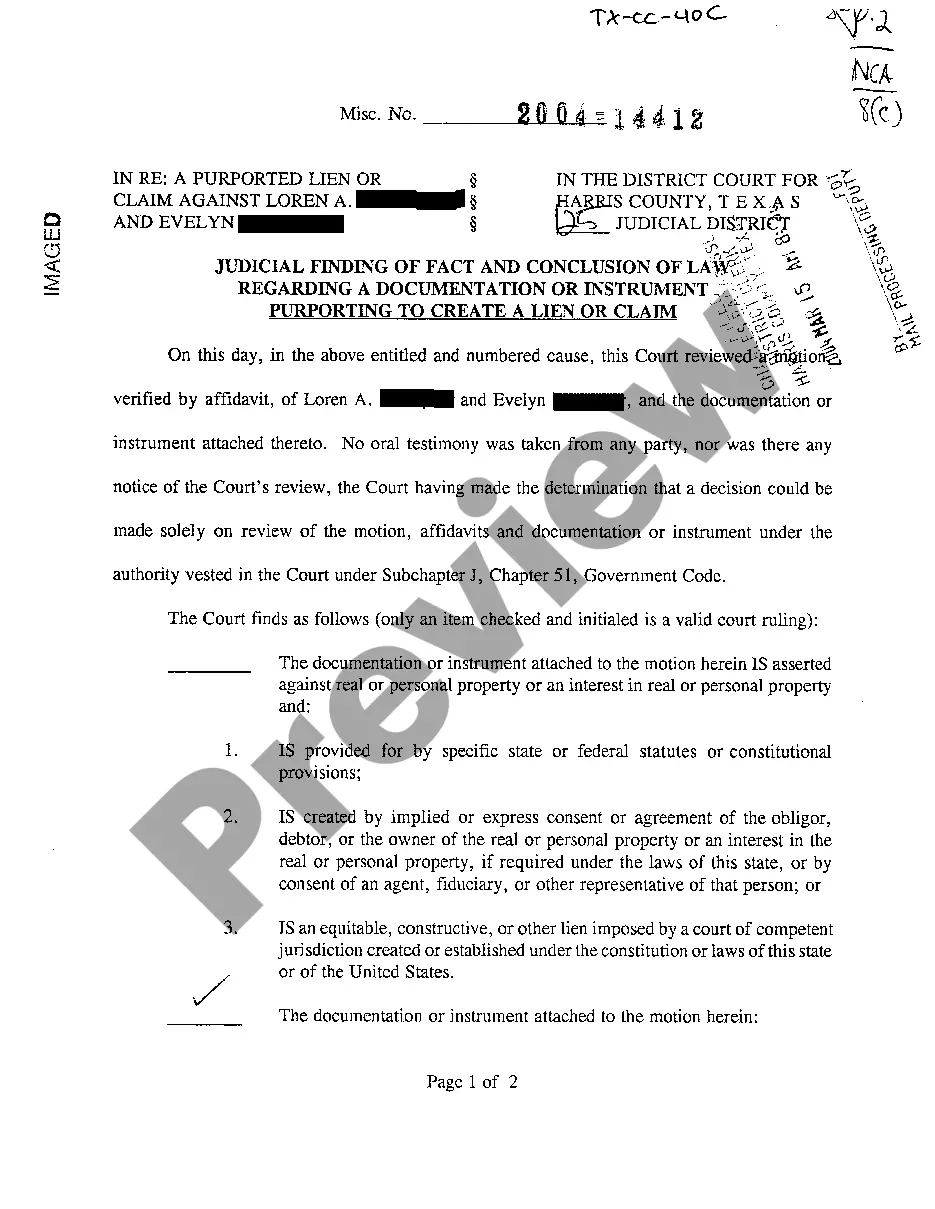

A) Approach Labour Commissioner:If an employer doesn't pay up your salary, you can approach the labour commissioner. They will help you to reconcile this matter and if no solution is reached labour commissioner will hand over this matter to the court whereby a case against your employer may be pursued.

Under a Title VII wage discrimination claim, an employee must first prove: 1) membership in a protected group and that he or she was qualified for the position worked in; 2) an employer is practicing wage differentials based on the employee's membership in the protected group and this has given rise to an inference of

In California, you can file an unpaid wage claim to recover wages that your employer has failed to pay.Filing a wage claim with the California Division of Labor Standards Enforcement. Filing a wage claim with a federal agency.

You shouldn't be afraid to take action if you know your employer is withholding wages from you. The Fair Labor Standards Act (FLSA) enforces the payment of wages to employees. You can file a claim against your employer to receive backpay. If necessary, you can sue your employer for liquidated damages, as well.

When an employer fails to pay an employee the applicable minimum wage or the agreed wage for all hours worked, the employee has a legal claim for damages against the employer. To recover the unpaid wages, the employee can either bring a lawsuit in court or file an administrative claim with the state's labor department.

Unpaid wages, unused vacation or accrued vacation time, or. any other time off accumulated by the employee (for instance, vacation days or PTO). vii

You are entitled to the same pay as anyone doing the same or broadly similar job, or a job of equal value, regardless of gender. There are strict time limits on when you can lodge a claim. If your employer is not treating you equally, they are breaking the law.

But in general, you may do the following if you're not paid on time or on a regular basis: Contact your employer (preferably in writing) and ask for the wages owed to you. If your employer refuses to do so, consider filing a claim with your state's labor agency.

If your complaint is about pay, conditions or workplace rights under Commonwealth legislation, enterprise agreements or modern awards, you should contact the Fair Work Ombudsman's Infoline on 13 13 94.