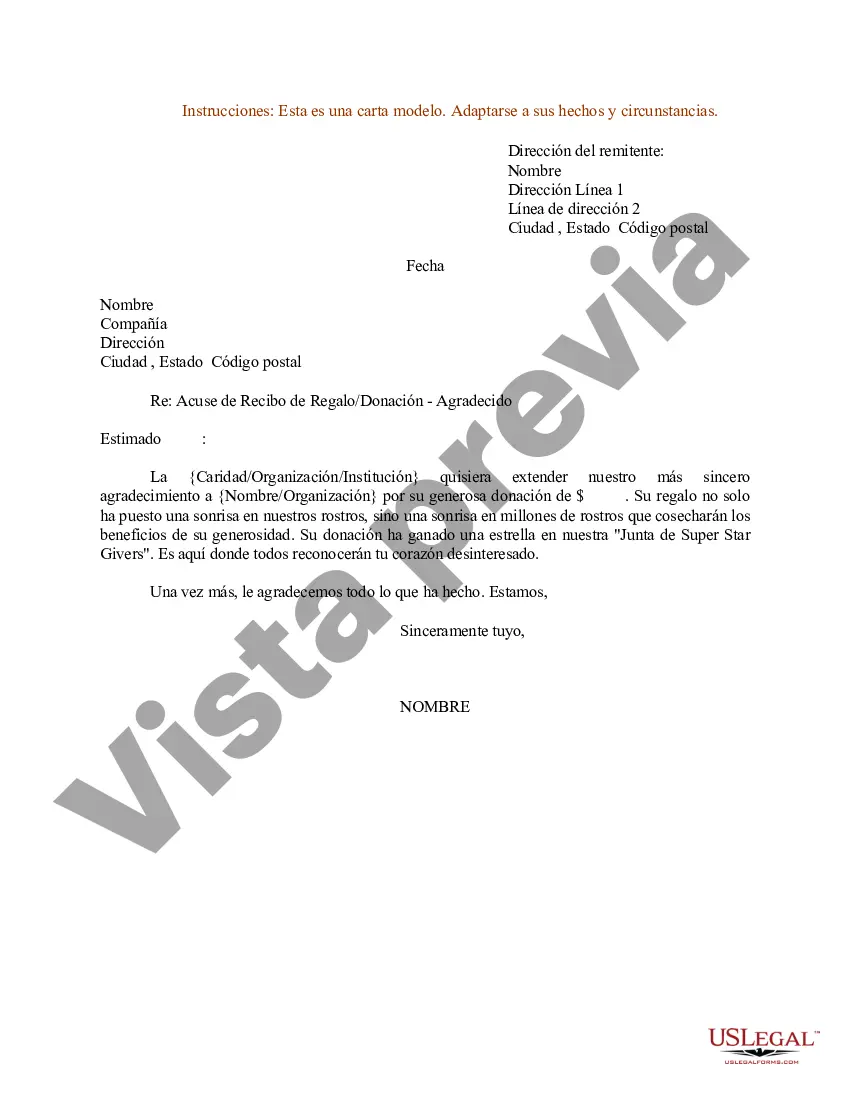

Maryland is a state located in the Mid-Atlantic region of the United States. It is known for its rich history, vibrant culture, and diverse landscapes. In Maryland, there are several sample letters that can be used for acknowledging the receipt of a gift or donation with a tone of appreciation. One type of Maryland sample letter for acknowledgment of receipt of a gift or donation is the "Appreciative" letter. This type of letter is meant to express gratitude and thankfulness to the recipient for their generous contribution. Keywords that can be used to describe this type of letter include "gratitude," "thankfulness," "generosity," "appreciation," and "acknowledgment." The letter should convey a sense of genuine appreciation for the gift or donation received and express how it will make a positive impact on the organization or cause it supports. It is essential for this type of letter to be personalized and unique, addressing the donor by name and mentioning the specific gift or donation they made. Including specific details about how the contribution will be used or highlighting any special projects it will support can help strengthen the bond between the organization and the donor. The "Appreciative" letter should be written in a professional yet warm and friendly tone. It should be concise and easy to read, avoiding excessive jargon or complicated language. The letter should also include the organization's contact information, making it easy for the donor to get in touch if they have any further questions or wish to discuss their contribution in more detail. In summary, a Maryland sample letter for acknowledgment of receipt of a gift or donation — appreciative, is a personalized letter expressing gratitude and appreciation to the donor for their generous contribution. It should be written in a friendly and approachable tone, highlighting the impact the gift or donation will have on the organization or cause.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Ejemplo de carta de acuse de recibo de obsequio o donación - Agradecimiento - Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative

Description

How to fill out Maryland Ejemplo De Carta De Acuse De Recibo De Obsequio O Donación - Agradecimiento?

Finding the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have chosen the right form for your city or county. You can review the form using the Review option and check the form details to confirm it is suitable for you. If the form does not meet your needs, use the Search area to find the correct form. Once you are sure the form is correct, click on the Purchase now option to obtain the form. Select the pricing plan you want and enter the required information. Create your account and place an order using your PayPal account or Visa or Mastercard. Choose the download file format and save the legal document template to your device. Finally, complete, edit, print, and sign the received Maryland Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative. US Legal Forms boasts the largest collection of legal forms where you can find various document templates. Use the service to download professionally crafted paperwork that meet state requirements.

- The service provides thousands of templates, including the Maryland Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative, which you can use for both business and personal purposes.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download option to retrieve the Maryland Sample Letter for Acknowledgment of Receipt of Gift or Donation - Appreciative.

- Use your account to browse the legal forms you have previously ordered.

- Go to the My documents tab of your account and obtain another copy of the document you need.

Form popularity

FAQ

To serve both these purposes, your donation receipt should contain the following information:The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.More items...?2 Sept 2021

Put your personal spin on any of these ideas to show donors that you care!Letter or Email Acknowledgement. Direct mail and email are the most common ways to thank your donors because you can send multiple letters at once.Public Thank You.Social Media Shout Out.Donor Gift.Website Appreciation Page.

What do you need to include in your donation acknowledgment letter?The name of your donor.The full legal name of your organization.A declaration of your organization's tax-exempt status.Your organization's employer identification number.The date the gift was received.A description of the gift and the amount received.More items...?

Gift acknowledgement letters are important for two reasons. First, they provide proof so donors can claim a U.S. tax exemption. Second, they let you thank donors for their generosity, helping you build a relationship for future support.

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

Thank you for your generous gift to name of organization. We are thrilled to have your support. Through your donation we have been able to accomplish goal and continue working towards purpose of organization. You truly make the difference for us, and we are extremely grateful!

An acknowledgement letter is a receipt in the form of a formal letter confirming receipt of the document or shipment. They are usually short and are mainly used to confirm certain documents or goods received legally on a particular date.

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

A donor or donation acknowledgment letter, or charitable contribution acknowledgment letter, is a letter nonprofits send to thanking their donors for their gift. As we'll discuss below, it's also an opportunity for you to provide the official documentation required by the IRS to donors who have given a gift over $250.

A formal donor acknowledgment letter should include the following information:A statement declaring the nonprofit's tax-exempt status as a 501c3.The name of the donor that they used to make their gift.The date the gift was received by your nonprofit.A description of the donation.

Interesting Questions

More info

Donations are always considered gifts under any category you can think of, regardless of whether the recipient is receiving the gift. Gifts do not receive the same treatment as donors. Donations receive the same rules as gifts in any of the donor categories below, and also receive the normal 5% matching of donations from the organization. Donating to a Charitable Organization If you are donating to a charity, you can still do it this way, but there are some important differences from when donating to a charitable organization with regular checks or through a payroll deduction. You must select a charity or other organization that accepts contributions that meet a minimum standard, which you must also agree to before completing your donation. That minimum standard includes the value of the donated item (a coat you donate for a person in the cold weather).