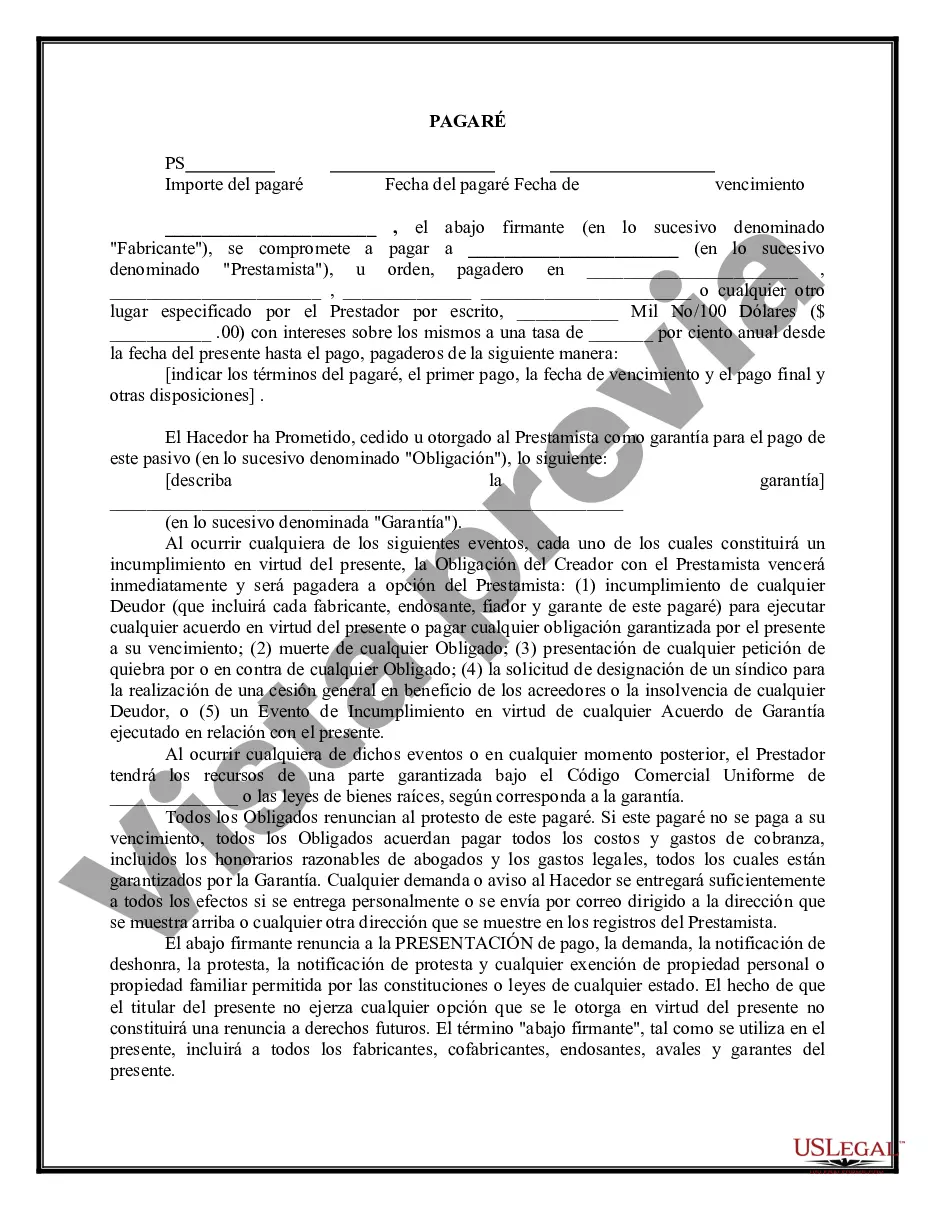

A Maryland Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower, where the borrower pledges collateral to secure the repayment of the loan. This type of note is commonly used in Maryland to ensure that the lender is protected in case of default. The Maryland Secured Promissory Note includes important details such as the principal amount of the loan, interest rate, repayment schedule, and any fees or penalties associated with the loan. Additionally, it specifies the collateral that the borrower is pledging, which can be a valuable asset such as real estate, vehicles, or other valuable property. By using a Maryland Secured Promissory Note, the lender has a legal claim to the collateral in the event of non-payment, allowing them to sell the asset to recoup the outstanding debt. This provides the lender with added security compared to an unsecured loan, where there is no collateral backing the loan. Different types of Maryland Secured Promissory Notes may exist based on the nature of the loan or collateral involved: 1. Real Estate Secured Promissory Note: This type of note is commonly used when the collateral is real estate property, such as a house or land. It ensures that the lender has a valid claim over the property in case of default. 2. Vehicle Secured Promissory Note: When the borrower is using a vehicle as collateral, a Vehicle Secured Promissory Note is utilized. It allows the lender to take possession of the vehicle if the borrower fails to repay the loan. 3. Personal Property Secured Promissory Note: This type of note applies to loans secured against personal property, such as valuable assets like jewelry, artwork, or expensive electronics. It outlines the terms of the loan and the consequences of non-payment. In conclusion, a Maryland Secured Promissory Note is a legally binding document that protects both lenders and borrowers in loan transactions. The note includes all essential terms, such as the principal amount, interest rate, repayment schedule, and collateral information. Different types of secured promissory notes exist in Maryland, such as Real Estate Secured, Vehicle Secured, and Personal Property Secured Notes, depending on the type of collateral involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland pagaré garantizado - Secured Promissory Note

Description

How to fill out Maryland Pagaré Garantizado?

Are you currently inside a place the place you require documents for possibly business or individual reasons nearly every time? There are plenty of lawful record themes available on the net, but getting types you can depend on is not effortless. US Legal Forms delivers 1000s of develop themes, such as the Maryland Secured Promissory Note, that are composed to satisfy state and federal needs.

When you are already acquainted with US Legal Forms site and possess a merchant account, just log in. Following that, you may obtain the Maryland Secured Promissory Note web template.

Unless you come with an bank account and want to begin to use US Legal Forms, adopt these measures:

- Discover the develop you require and ensure it is for the appropriate metropolis/county.

- Take advantage of the Preview option to analyze the shape.

- Read the explanation to ensure that you have selected the correct develop.

- If the develop is not what you`re searching for, make use of the Research field to find the develop that fits your needs and needs.

- Once you find the appropriate develop, simply click Acquire now.

- Select the costs program you desire, submit the required information to produce your money, and buy the transaction making use of your PayPal or charge card.

- Decide on a handy document file format and obtain your backup.

Locate all of the record themes you might have purchased in the My Forms food selection. You can get a more backup of Maryland Secured Promissory Note at any time, if required. Just select the essential develop to obtain or printing the record web template.

Use US Legal Forms, probably the most substantial variety of lawful kinds, in order to save time as well as avoid faults. The assistance delivers skillfully manufactured lawful record themes that you can use for a selection of reasons. Produce a merchant account on US Legal Forms and initiate making your lifestyle a little easier.