The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

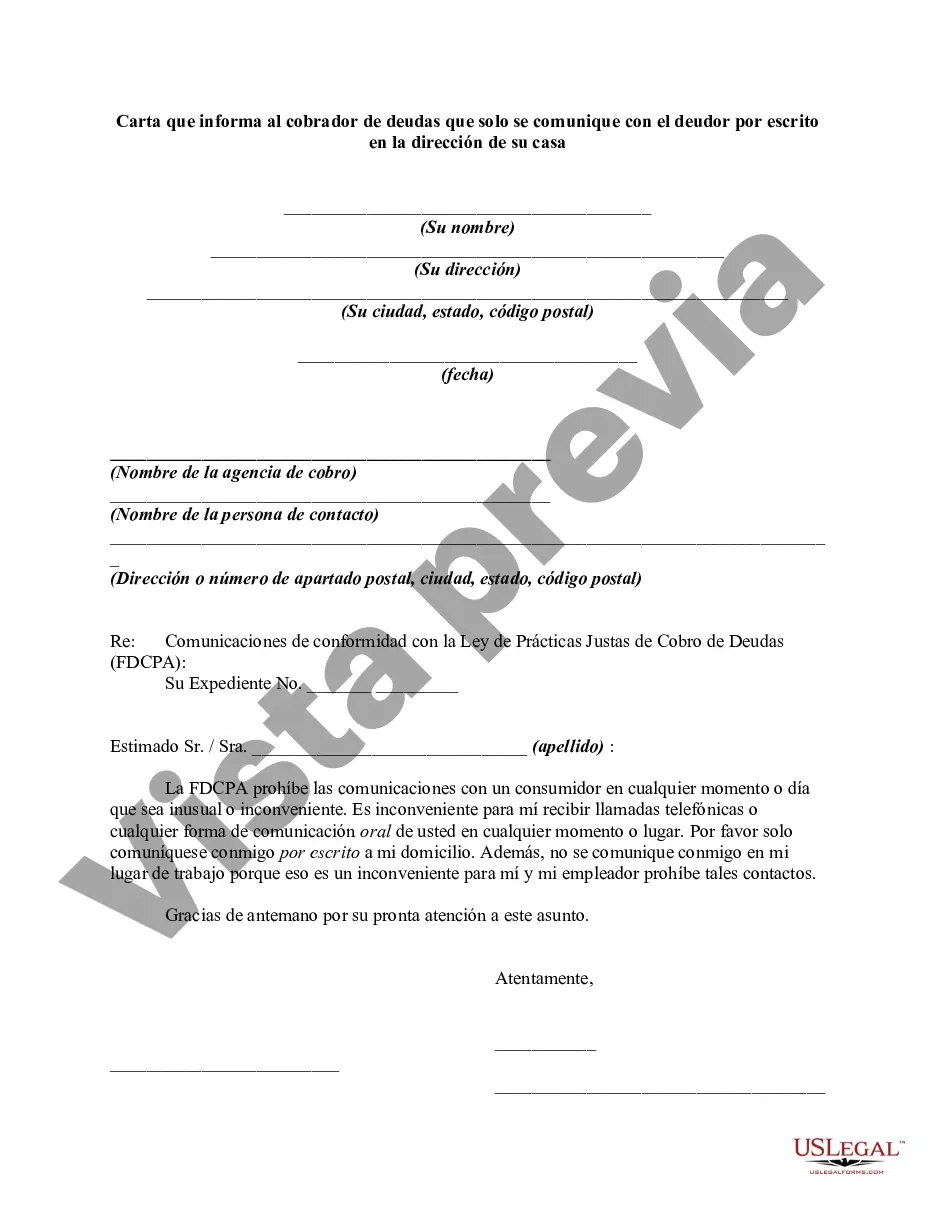

Title: Maryland Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address Introduction: In Maryland, individuals have the right to protect themselves from undue harassment by debt collectors. By sending a formal letter, debtors can request that the debt collector communicates with them exclusively in writing and only at their home address. This detailed description will provide insights into the content of such a letter, including important keywords to ensure its effectiveness. Additionally, we will discuss different types of Maryland letters that debtors may use to suit their specific needs. Keywords: Maryland, letter, debt collector, communicate, writing, home address, protection, harassment, formal, effectiveness. Content: 1. Heading: Your Name Your Address City, State, Zip Code Debt Collector's Name Debt Collector's Address City, State, Zip Code 2. Date: Include the current date on the letter. 3. Subject: Clearly state the purpose of the letter by using a subject line like "Request for Exclusive Written Communication at Home Address." 4. Salutation: Begin with a formal salutation such as "Dear [Debt Collector's Name]." 5. First Paragraph: State your intention to communicate in writing only and provide your home address as the preferred method of contact. Use specific language such as, "I am writing to request that all future communications regarding the above-mentioned debt are conducted exclusively in writing and sent to my home address." 6. Second Paragraph: Highlight your rights under the Fair Debt Collection Practices Act (FD CPA) and the Maryland Consumer Debt Collection Act (MC DCA). Emphasize that you are exercising your rights to protect yourself from harassment or unwanted contact. Briefly mention the specific sections of the Acts relevant to your request, such as Section 805(c) of the FD CPA and Section 14-202(7) of the MC DCA. 7. Third Paragraph: Mention any previous attempts made by the debt collector to contact you via phone, email, or in-person. Politely but firmly request that they cease all other forms of communication and adhere to your preferred method of communication—writing at your home address. 8. Fourth Paragraph: State a deadline by which you expect the debt collector to acknowledge and honor your request. Offering a reasonable timeline, such as 15 or 30 days, will ensure that they are given ample opportunity to comply. 9. Closing: End the letter on a polite note, for example, "Thank you for your immediate attention to this matter." 10. Proof of Delivery: Consider sending the letter as certified mail with a return receipt requested. This will provide proof that the debt collector received your request. Types of Maryland Letters: 1. Initial Request Letter: This is the standard letter used when debtors want to request exclusive written communication at their home address. 2. Follow-up Letter: In cases where the debt collector does not honor the initial request, debtors may need to send a follow-up letter to assert their rights once again and reinforce their demand for written communication at the home address. 3. Cease and Desist Letter: If debt collectors continue to contact you despite your request, a cease and desist letter can be sent, warning them to stop contacting you completely. This letter should be drafted with the assistance of an attorney to ensure compliance with relevant laws. Conclusion: Maryland debtors have the right to limit debt collectors' communication to writing at their home address. By using a formal letter and sending it via certified mail, debtors can assert their rights and protect themselves from unwanted harassment or contact. Choose the appropriate type of letter based on your specific situation and advocate for your rights under the FD CPA and MC DCA.Title: Maryland Letter Informing Debt Collector to Only Communicate with Debtor in Writing at Debtor's Home Address Introduction: In Maryland, individuals have the right to protect themselves from undue harassment by debt collectors. By sending a formal letter, debtors can request that the debt collector communicates with them exclusively in writing and only at their home address. This detailed description will provide insights into the content of such a letter, including important keywords to ensure its effectiveness. Additionally, we will discuss different types of Maryland letters that debtors may use to suit their specific needs. Keywords: Maryland, letter, debt collector, communicate, writing, home address, protection, harassment, formal, effectiveness. Content: 1. Heading: Your Name Your Address City, State, Zip Code Debt Collector's Name Debt Collector's Address City, State, Zip Code 2. Date: Include the current date on the letter. 3. Subject: Clearly state the purpose of the letter by using a subject line like "Request for Exclusive Written Communication at Home Address." 4. Salutation: Begin with a formal salutation such as "Dear [Debt Collector's Name]." 5. First Paragraph: State your intention to communicate in writing only and provide your home address as the preferred method of contact. Use specific language such as, "I am writing to request that all future communications regarding the above-mentioned debt are conducted exclusively in writing and sent to my home address." 6. Second Paragraph: Highlight your rights under the Fair Debt Collection Practices Act (FD CPA) and the Maryland Consumer Debt Collection Act (MC DCA). Emphasize that you are exercising your rights to protect yourself from harassment or unwanted contact. Briefly mention the specific sections of the Acts relevant to your request, such as Section 805(c) of the FD CPA and Section 14-202(7) of the MC DCA. 7. Third Paragraph: Mention any previous attempts made by the debt collector to contact you via phone, email, or in-person. Politely but firmly request that they cease all other forms of communication and adhere to your preferred method of communication—writing at your home address. 8. Fourth Paragraph: State a deadline by which you expect the debt collector to acknowledge and honor your request. Offering a reasonable timeline, such as 15 or 30 days, will ensure that they are given ample opportunity to comply. 9. Closing: End the letter on a polite note, for example, "Thank you for your immediate attention to this matter." 10. Proof of Delivery: Consider sending the letter as certified mail with a return receipt requested. This will provide proof that the debt collector received your request. Types of Maryland Letters: 1. Initial Request Letter: This is the standard letter used when debtors want to request exclusive written communication at their home address. 2. Follow-up Letter: In cases where the debt collector does not honor the initial request, debtors may need to send a follow-up letter to assert their rights once again and reinforce their demand for written communication at the home address. 3. Cease and Desist Letter: If debt collectors continue to contact you despite your request, a cease and desist letter can be sent, warning them to stop contacting you completely. This letter should be drafted with the assistance of an attorney to ensure compliance with relevant laws. Conclusion: Maryland debtors have the right to limit debt collectors' communication to writing at their home address. By using a formal letter and sending it via certified mail, debtors can assert their rights and protect themselves from unwanted harassment or contact. Choose the appropriate type of letter based on your specific situation and advocate for your rights under the FD CPA and MC DCA.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.