Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

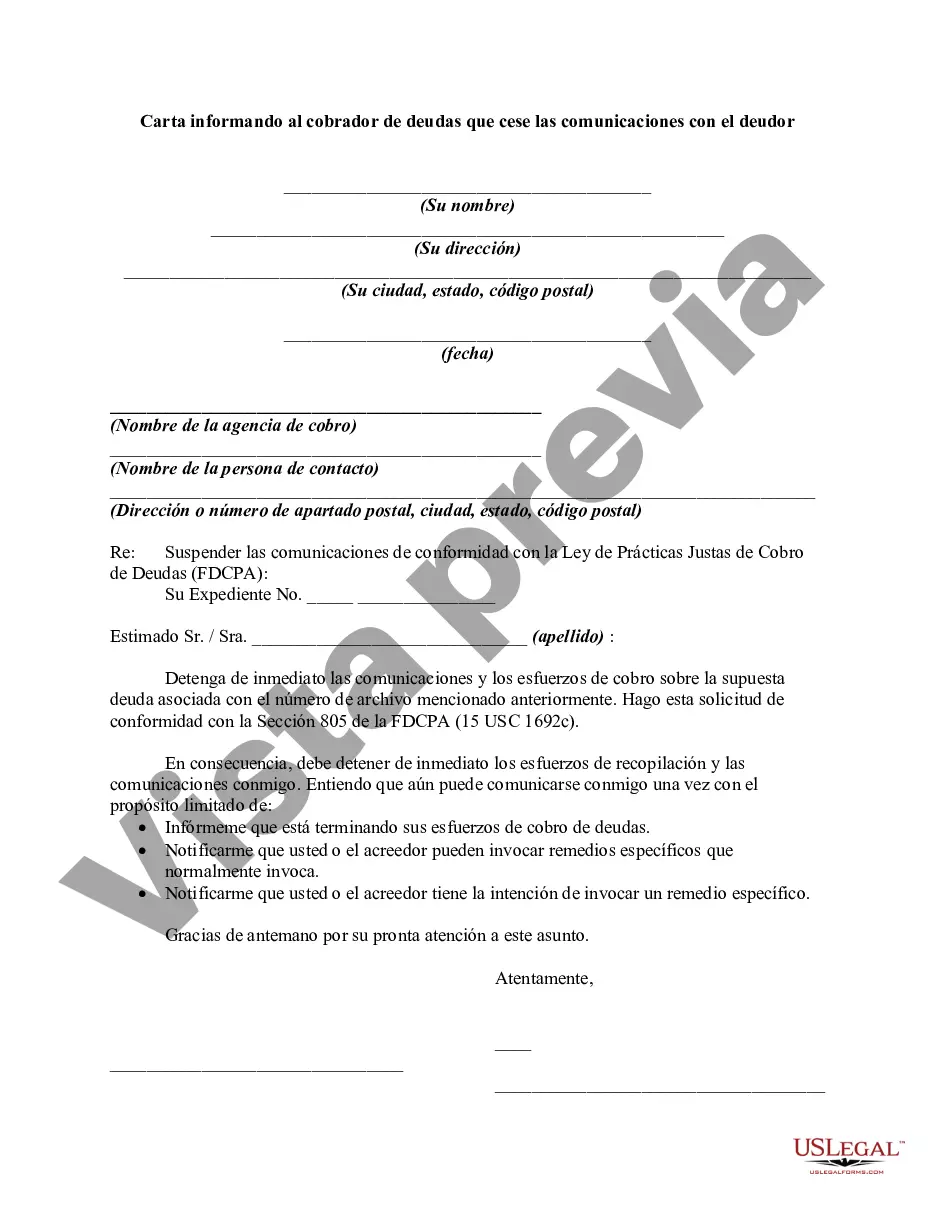

A Maryland Letter Informing to Debt Collector to Cease Communications with Debtor is a written document sent by a debtor to a debt collector, demanding them to stop contacting the debtor regarding the owed debt. In the United States, debtors are granted legal rights under the Fair Debt Collection Practices Act (FD CPA) to protect them from harassment and unfair practices employed by debt collectors. The purpose of this letter is to inform the debt collector that their continuous contact is causing the debtor distress, and the debtor wishes for all communication to cease. By sending this letter, the debtor exercises their rights and seeks relief from the collector's persistent attempts to collect the debt. A Maryland Letter Informing to Debt Collector to Cease Communications with Debtor typically includes the following essential elements: 1. Debtor's Information: The letter should begin by providing the debtor's full name, address, phone number, and any other relevant contact details. This will help the debt collector identify and locate the debtor's specific account. 2. Debt Collector's Information: The debtor should mention the debt collector's full name, address, phone number, and any other relevant contact details. This ensures that the letter is directed to the correct recipient and can be used as evidence of notification. 3. Account Information and Verification: The debtor should include information related to the debt, such as the account number, date of the debt, and the original creditor's name. This information helps the debt collector accurately identify the specific account in question. 4. Request to Cease Communication: The debtor should explicitly state their request for the debt collector to stop all communication attempts immediately. They should emphasize that these communications are causing them distress or harassment. 5. Legal Basis and Citing Rights: The debtor should mention the specific laws that protect them from harassment, such as the FD CPA or Maryland collection laws. By citing these laws, the debtor strengthens their position and highlights the seriousness of their request. 6. Restriction on Third-Party Communication: The debtor should assert that the debt collector must not disclose any information about the debt to third parties, except as permitted by law. This provision protects the debtor's privacy and prevents the collector from spreading details about the debt to unauthorized individuals. 7. Demand for Written Confirmation: The debtor should request written confirmation from the debt collector, acknowledging receipt of the letter and their commitment to cease communication. This confirmation provides evidence of compliance in case the debt collector violates the debtor's rights. Different types of Maryland Letter Informing to Debt Collector to Cease Communications with Debtor may include variations in language or structure, but the essential elements outlined above should be present in all such letters. It is important to note that seeking legal advice or consulting with a consumer rights attorney before sending such a letter may provide additional guidance and protection during the debt collection process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.