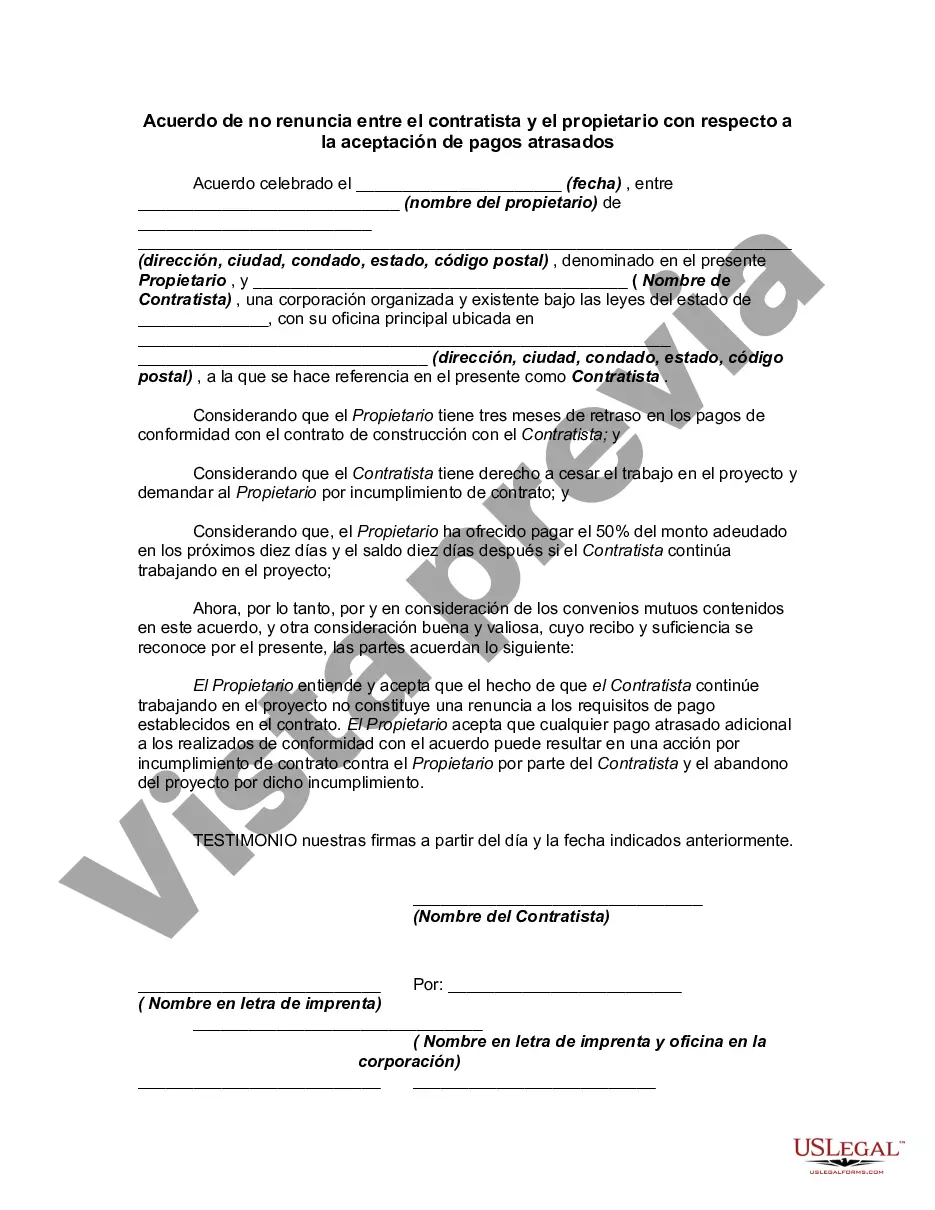

This form is a sample agreement between the owner of property and the contractor agreeing that acceptance by contractor of late payments as described in the agreement do not constitute a waiver of the right to receive timely payments pursuant to the agreement in the future.

The Maryland Non-Waiver Agreement is a legally binding contract between a contractor and an owner that outlines the terms and conditions for accepting late payment. This agreement is designed to protect the contractor's right to receive payment on time, while also providing the owner with certain rights and responsibilities. In Maryland, there are several types of Non-Waiver Agreements between contractors and owners regarding accepting late payments. These agreements may include: 1. Maryland Non-Waiver Agreement for Residential Construction Projects: This type of agreement is specifically tailored for contractors and owners involved in residential construction projects. It covers aspects such as payment schedules, late payment charges, and dispute resolution procedures. 2. Maryland Non-Waiver Agreement for Commercial Construction Projects: This agreement is suitable for contractors and owners engaged in commercial construction projects. It covers similar areas as the residential agreement but may include additional provisions tailored to the unique aspects of commercial construction projects. 3. Maryland Non-Waiver Agreement for Renovation Projects: This type of agreement is specifically designed for contractors and owners involved in renovation projects. It focuses on payment terms, timelines, and potential modifications to the original scope of work. 4. Maryland Non-Waiver Agreement for Maintenance and Repair Services: This agreement is applicable to contractors and owners engaged in maintenance and repair services. It outlines payment terms, penalties for late payments, and procedures for addressing disputes. Regardless of the specific type of Maryland Non-Waiver Agreement, the overall purpose remains the same — to establish clear guidelines for accepting late payments while protecting the contractor's rights. It typically includes provisions such as: — Payment deadlines: The agreement will specify the dates by which the owner must make payments to the contractor. — Late payment charges: The agreement may outline the penalties or interest rates that will be imposed on overdue payments. — Acceptance of late payments: The agreement may include provisions that allow the contractor to accept late payments but without waiving their right to enforce prompt payment in the future. — Notice requirements: The agreement may outline the procedure for providing notice to the owner regarding late payments, as well as the consequences for failing to provide such notice. — Dispute resolution: The agreement may include a mechanism for resolving disputes related to late payments, such as mediation, arbitration, or litigation. It is crucial for both parties involved to carefully review and understand the terms of the Maryland Non-Waiver Agreement before signing to ensure that their rights and obligations are protected. Consulting with legal professionals familiar with Maryland construction laws is highly recommended ensuring compliance with all applicable regulations.The Maryland Non-Waiver Agreement is a legally binding contract between a contractor and an owner that outlines the terms and conditions for accepting late payment. This agreement is designed to protect the contractor's right to receive payment on time, while also providing the owner with certain rights and responsibilities. In Maryland, there are several types of Non-Waiver Agreements between contractors and owners regarding accepting late payments. These agreements may include: 1. Maryland Non-Waiver Agreement for Residential Construction Projects: This type of agreement is specifically tailored for contractors and owners involved in residential construction projects. It covers aspects such as payment schedules, late payment charges, and dispute resolution procedures. 2. Maryland Non-Waiver Agreement for Commercial Construction Projects: This agreement is suitable for contractors and owners engaged in commercial construction projects. It covers similar areas as the residential agreement but may include additional provisions tailored to the unique aspects of commercial construction projects. 3. Maryland Non-Waiver Agreement for Renovation Projects: This type of agreement is specifically designed for contractors and owners involved in renovation projects. It focuses on payment terms, timelines, and potential modifications to the original scope of work. 4. Maryland Non-Waiver Agreement for Maintenance and Repair Services: This agreement is applicable to contractors and owners engaged in maintenance and repair services. It outlines payment terms, penalties for late payments, and procedures for addressing disputes. Regardless of the specific type of Maryland Non-Waiver Agreement, the overall purpose remains the same — to establish clear guidelines for accepting late payments while protecting the contractor's rights. It typically includes provisions such as: — Payment deadlines: The agreement will specify the dates by which the owner must make payments to the contractor. — Late payment charges: The agreement may outline the penalties or interest rates that will be imposed on overdue payments. — Acceptance of late payments: The agreement may include provisions that allow the contractor to accept late payments but without waiving their right to enforce prompt payment in the future. — Notice requirements: The agreement may outline the procedure for providing notice to the owner regarding late payments, as well as the consequences for failing to provide such notice. — Dispute resolution: The agreement may include a mechanism for resolving disputes related to late payments, such as mediation, arbitration, or litigation. It is crucial for both parties involved to carefully review and understand the terms of the Maryland Non-Waiver Agreement before signing to ensure that their rights and obligations are protected. Consulting with legal professionals familiar with Maryland construction laws is highly recommended ensuring compliance with all applicable regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.