A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

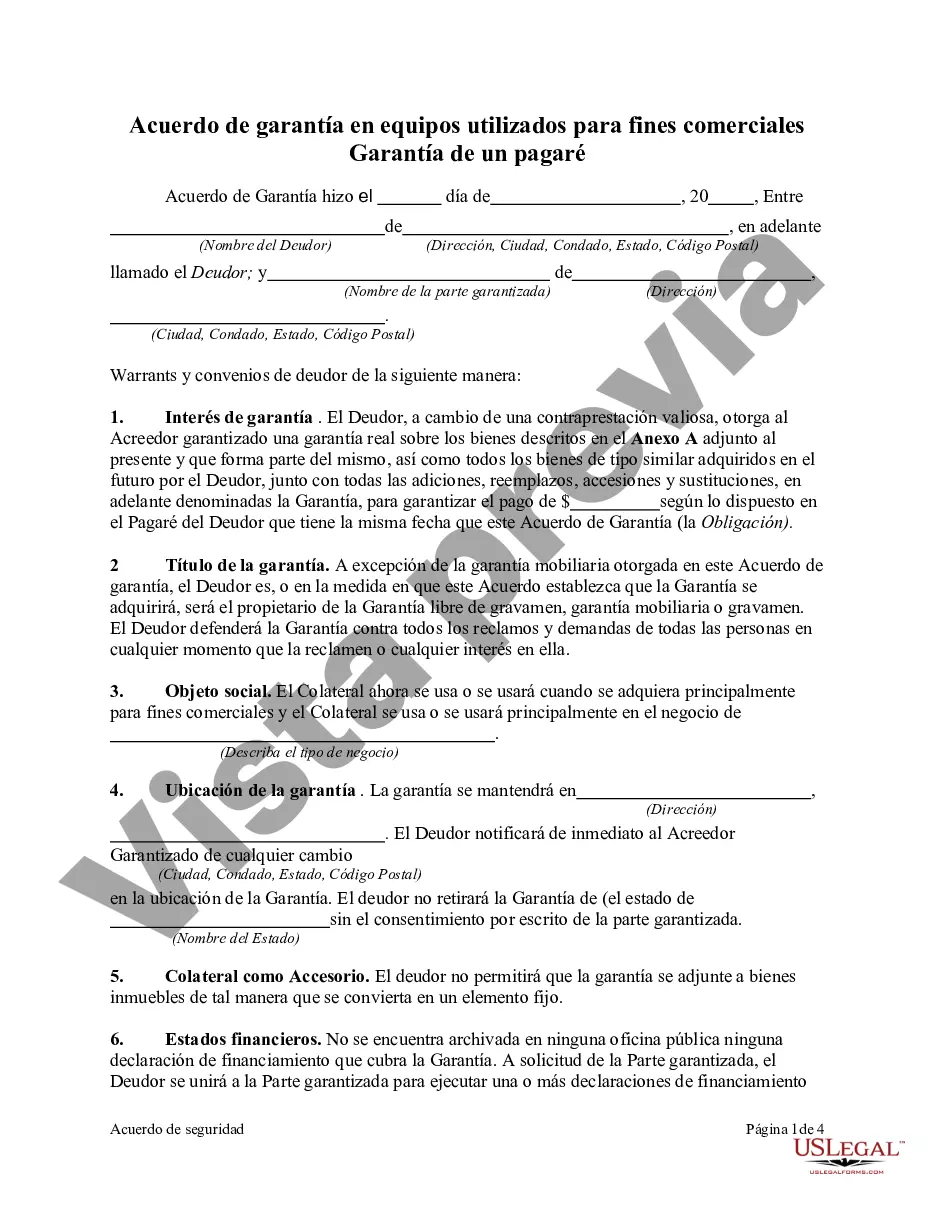

A Maryland Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that establishes the lender's security interest in specific equipment owned by the borrower. This agreement ensures that if the borrower fails to repay the promissory note, the lender has the right to take possession of the equipment to recover their investment. The Maryland Security Agreement in Equipment for Business Purposes is designed to protect lenders and provide them with a means of recourse if the borrower defaults on their loan obligations. By establishing a security interest in the equipment, the lender can have a priority claim on the equipment over other creditors in case of bankruptcy or liquidation. The agreement outlines the terms and conditions of the security interest, including a detailed description of the equipment being used as collateral. The description should include make, model, serial number, and any other identifying information necessary to unequivocally identify the equipment. This ensures that there is no ambiguity when it comes to determining which specific equipment is covered by the agreement. In Maryland, there are no specific types of security agreements for equipment based on the purpose of the loan. However, different industries may have specific requirements or regulations that need to be considered when drafting a security agreement. For example, the construction industry may require additional provisions to address situations where equipment might be affixed to real property. Some relevant keywords related to the Maryland Security Agreement in Equipment for Business Purposes — Securing Promissory Note might include: 1. Equipment financing: The agreement provides a means for businesses to secure financing by offering their equipment as collateral. 2. Lender's security interest: The agreement establishes the lender's legal right to repossess the equipment if the borrower defaults on the loan. 3. Promissory note: Refers to the legal document that outlines the borrower's promise to repay the loan under specified terms. 4. Collateral: The equipment being used as security for the loan. 5. Priority claim: The lender's ability to have a higher preference over other creditors in recovering debt by possessing the equipment. 6. Bankruptcy: The legal process where individuals or businesses are unable to repay their debts, potentially leading to liquidation and the sale of assets. 7. Recourse: The lender's right to seek legal action or take possession of the collateralized equipment to recover the outstanding debt. 8. Make, model, and serial number: Specific details required to accurately identify the equipment being used as collateral. While there may not be different types of Maryland Security Agreements for equipment based on the purpose, the agreement's key components remain consistent regardless of the industry or business type. It is essential for both lenders and borrowers to ensure they understand the agreement's terms and consult legal professionals to ensure compliance with Maryland's laws and regulations.A Maryland Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that establishes the lender's security interest in specific equipment owned by the borrower. This agreement ensures that if the borrower fails to repay the promissory note, the lender has the right to take possession of the equipment to recover their investment. The Maryland Security Agreement in Equipment for Business Purposes is designed to protect lenders and provide them with a means of recourse if the borrower defaults on their loan obligations. By establishing a security interest in the equipment, the lender can have a priority claim on the equipment over other creditors in case of bankruptcy or liquidation. The agreement outlines the terms and conditions of the security interest, including a detailed description of the equipment being used as collateral. The description should include make, model, serial number, and any other identifying information necessary to unequivocally identify the equipment. This ensures that there is no ambiguity when it comes to determining which specific equipment is covered by the agreement. In Maryland, there are no specific types of security agreements for equipment based on the purpose of the loan. However, different industries may have specific requirements or regulations that need to be considered when drafting a security agreement. For example, the construction industry may require additional provisions to address situations where equipment might be affixed to real property. Some relevant keywords related to the Maryland Security Agreement in Equipment for Business Purposes — Securing Promissory Note might include: 1. Equipment financing: The agreement provides a means for businesses to secure financing by offering their equipment as collateral. 2. Lender's security interest: The agreement establishes the lender's legal right to repossess the equipment if the borrower defaults on the loan. 3. Promissory note: Refers to the legal document that outlines the borrower's promise to repay the loan under specified terms. 4. Collateral: The equipment being used as security for the loan. 5. Priority claim: The lender's ability to have a higher preference over other creditors in recovering debt by possessing the equipment. 6. Bankruptcy: The legal process where individuals or businesses are unable to repay their debts, potentially leading to liquidation and the sale of assets. 7. Recourse: The lender's right to seek legal action or take possession of the collateralized equipment to recover the outstanding debt. 8. Make, model, and serial number: Specific details required to accurately identify the equipment being used as collateral. While there may not be different types of Maryland Security Agreements for equipment based on the purpose, the agreement's key components remain consistent regardless of the industry or business type. It is essential for both lenders and borrowers to ensure they understand the agreement's terms and consult legal professionals to ensure compliance with Maryland's laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.