Maryland Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

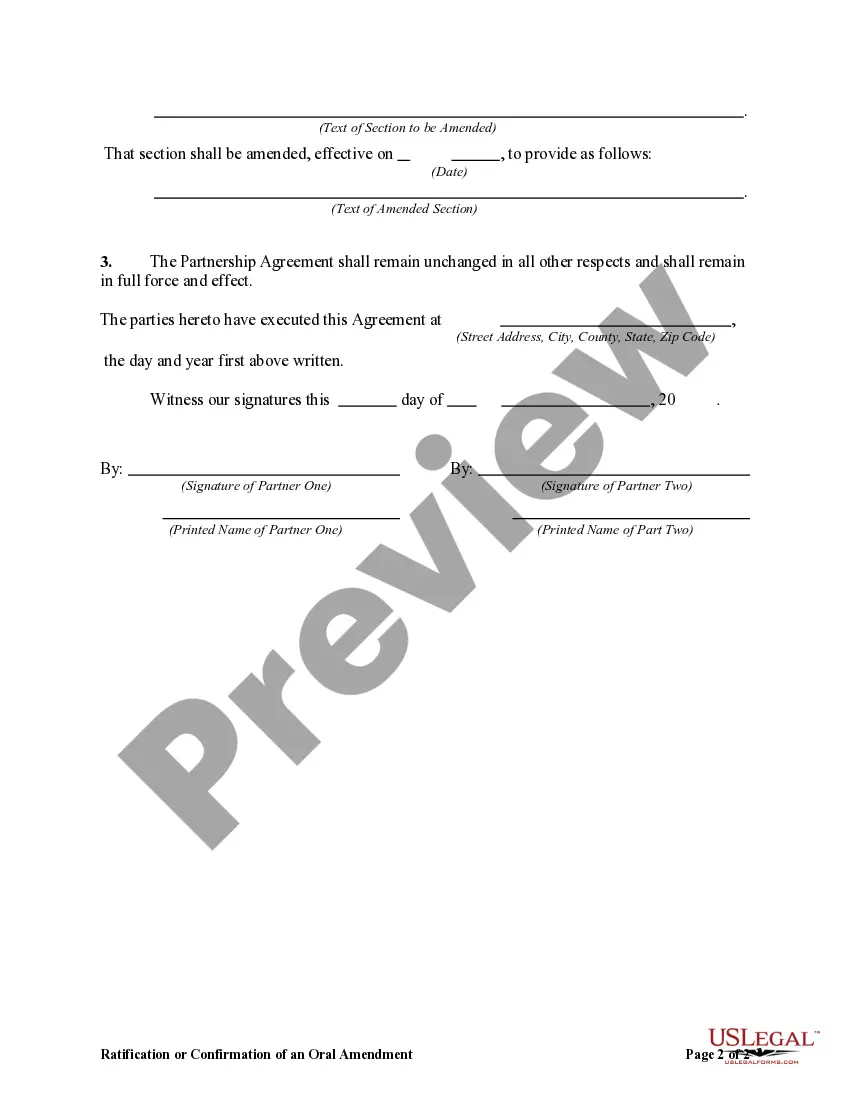

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

Selecting the appropriate authorized document format can be challenging.

Naturally, there are numerous templates accessible online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Maryland Ratification or Confirmation of an Oral Amendment to a Partnership Agreement, that you can use for business and personal purposes.

You can view the form using the Preview button and read the form description to ensure it is the right one for you.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to get the Maryland Ratification or Confirmation of an Oral Amendment to a Partnership Agreement.

- Use your account to browse through the legal forms you have purchased previously.

- Visit the My documents tab in your account and obtain another copy of the file you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your jurisdiction.

Form popularity

FAQ

As stated before, a partnership agreement can be oral or in writing. It is not the general practice to enter into a preliminary agreement to enter into a regular partnership agreement.

As stated before, a partnership agreement can be oral or in writing. It is not the general practice to enter into a preliminary agreement to enter into a regular partnership agreement.

There are 4 steps to follow for changing the partnership deed:Step 1: Take the mutual consent of partners.Step 2: Prepare for making a supplementary partnership deed.Step 3: Executing supplementary partnership deed.Step 4: Do the filing with Registrar of Firm (RoF).

Partnerships can be formed with a handshake--and often they are. In fact, partnerships are the only business entities that can be formed by oral agreement. Of course, as with any important legal relationship, oral agreements often lead to misunderstandings, which often lead to disputes.

As stated before, a partnership agreement can be oral or in writing. It is not the general practice to enter into a preliminary agreement to enter into a regular partnership agreement.

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner.

A Partnership Amendment, also called a Partnership Addendum, is used to modify, add, or remove terms in a Partnership Agreement. A Partnership Amendment is usually attached to an existing Partnership Agreement to reflect any changes.

You do not have to do anything to make it official with the IRS other than enter the appropriate percentages of ownership for each member of the LLC. However, the partnership agreement (LLC operating agreement) must specifically allow for any change.

A Partnership Amendment, also called a Partnership Addendum, is used to modify, add, or remove terms in a Partnership Agreement. A Partnership Amendment is usually attached to an existing Partnership Agreement to reflect any changes.

Under the Partnership Act, 1932 it is not at all binding to have a partnership agreement in writing. However in order to avoid misunderstandings and dispute among the partners it is recommended to have the agreement in writing.