Maryland Simple Promissory Note for Family Loan: A Comprehensive Guide A Maryland Simple Promissory Note for Family Loan is a legally binding document that outlines the terms and conditions of a loan agreement between family members in the state of Maryland. When a family member lends money to another family member, it is crucial to have a clear and concise agreement to avoid any misunderstandings or conflicts. The purpose of this Promissory Note is to establish a formal agreement between parties involved, specifying the loan amount, interest rate (if applicable), repayment terms, and any other relevant terms and conditions. This note ensures that both the lender and borrower are aware of their rights and obligations throughout the loan repayment process. Although Maryland does not have specific laws or regulations concerning promissory notes for family loans, it is highly recommended having a written agreement to protect all parties involved. By documenting the loan details, it helps ensure that everyone is on the same page and minimizes any potential disputes in the future. Key Elements of a Maryland Simple Promissory Note for Family Loan: 1. Identification of Parties: Clearly state the names and addresses of both the lender (family member providing the loan) and the borrower (family member receiving the loan). 2. Loan Amount: Specify the exact amount of money being loaned. It is essential to be precise to avoid confusion and potential conflicts. 3. Interest Rate (if applicable): If the loan includes an interest rate, it must be clearly stated in the promissory note. However, family loans often do not require interest charges. 4. Repayment Terms: Outline the agreed-upon repayment plan, including the amount to be repaid periodically, the frequency of payments (monthly, quarterly, etc.), and the duration of the loan. 5. Due Date: Specify the date by which the loan must be repaid in full. It is important to include the exact day, month, and year to eliminate any ambiguity. 6. Late Fees (if applicable): If the lender wishes to include late fees for overdue payments, it should be explicitly mentioned within the promissory note. 7. Collateral (if applicable): If the loan is secured by collateral, such as a property or vehicle, it should be stated in the agreement. However, family loans typically do not require collateral. 8. Signatures: Both the lender and borrower must sign and date the promissory note to signify their acceptance and agreement to the terms mentioned. Types of Maryland Simple Promissory Notes for Family Loans: 1. Lump-Sum Payment Note: This type of promissory note requires the borrower to repay the entire loan amount in one payment once the due date arrives. 2. Installment Payment Note: This type of promissory note allows the borrower to repay the loan amount in multiple installments over a predetermined period, typically with interest. 3. Interest-Free Note: In this type of promissory note, the loan is provided without charging any interest to the borrower. The borrower only repays the principal amount. In conclusion, a Maryland Simple Promissory Note for Family Loan is an essential document that outlines the terms and conditions for loans between family members in Maryland. While specific types of promissory notes may vary based on the repayment structure, having a written agreement ensures clarity and protects all parties involved. It is advisable to consult legal professionals or online resources to draft a comprehensive promissory note that complies with Maryland laws and meets the specific requirements of the family loan.

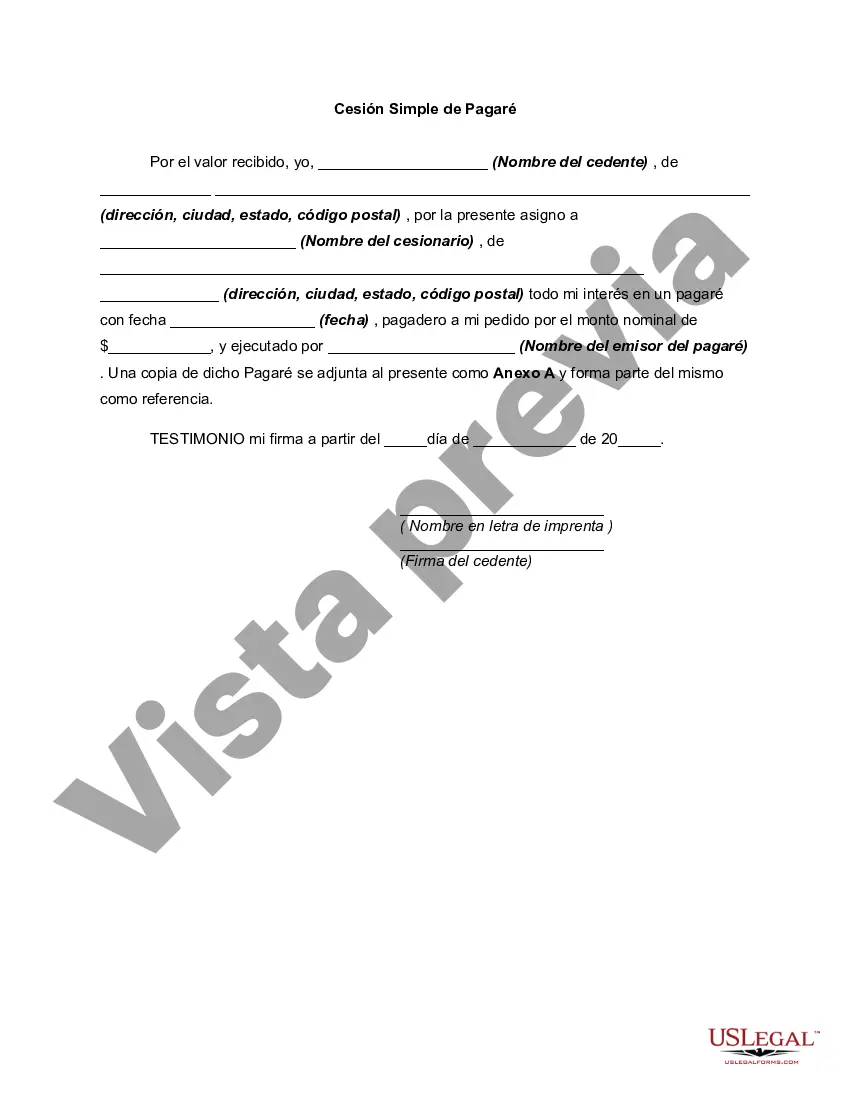

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Maryland Pagaré Simple Para Préstamo Familiar?

If you have to full, acquire, or print legal record templates, use US Legal Forms, the biggest selection of legal kinds, which can be found on-line. Use the site`s basic and hassle-free research to discover the files you require. Various templates for business and personal functions are categorized by types and claims, or keywords and phrases. Use US Legal Forms to discover the Maryland Simple Promissory Note for Family Loan with a few mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your profile and then click the Down load option to have the Maryland Simple Promissory Note for Family Loan. You can also accessibility kinds you formerly downloaded inside the My Forms tab of the profile.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the form to the correct metropolis/land.

- Step 2. Utilize the Preview solution to examine the form`s content material. Never forget to learn the information.

- Step 3. Should you be unhappy together with the develop, take advantage of the Look for area at the top of the display screen to discover other versions from the legal develop template.

- Step 4. After you have discovered the form you require, select the Acquire now option. Choose the prices strategy you prefer and put your references to sign up on an profile.

- Step 5. Approach the transaction. You may use your charge card or PayPal profile to accomplish the transaction.

- Step 6. Pick the format from the legal develop and acquire it on the system.

- Step 7. Complete, change and print or indication the Maryland Simple Promissory Note for Family Loan.

Each and every legal record template you get is the one you have forever. You may have acces to every develop you downloaded in your acccount. Select the My Forms portion and decide on a develop to print or acquire yet again.

Be competitive and acquire, and print the Maryland Simple Promissory Note for Family Loan with US Legal Forms. There are thousands of specialist and state-distinct kinds you can utilize to your business or personal needs.