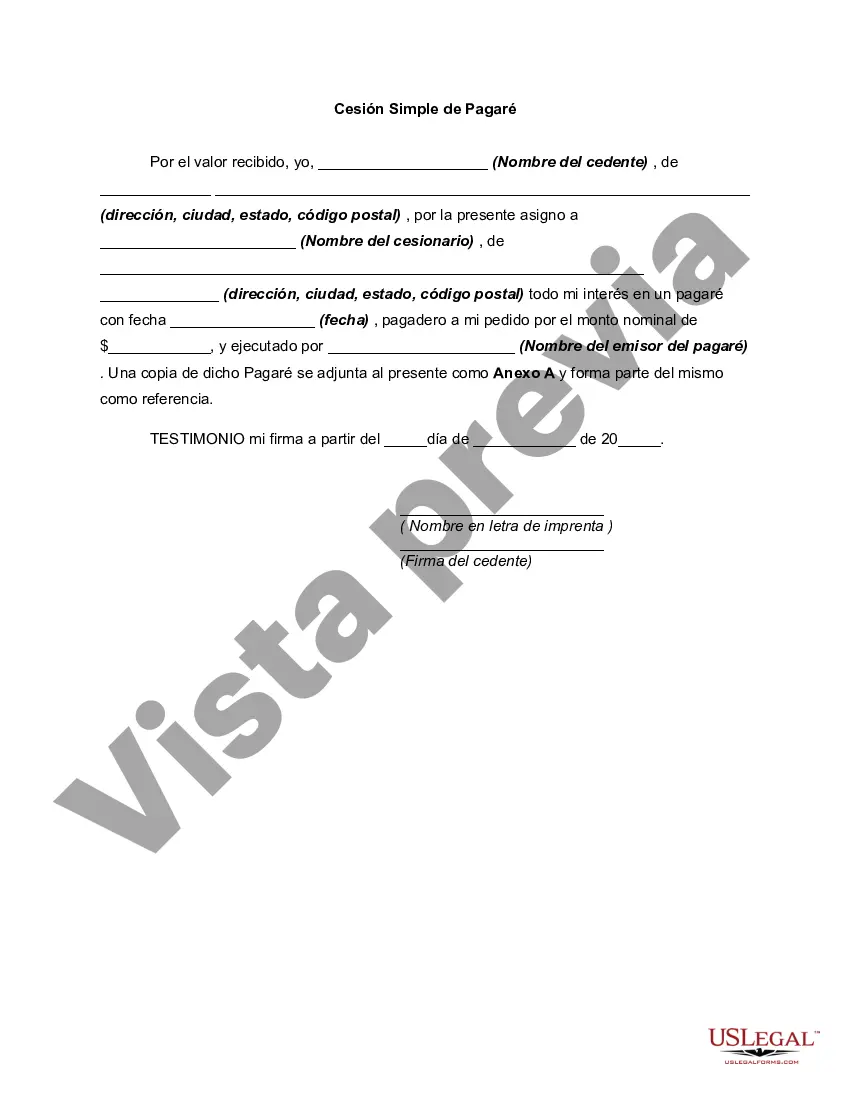

A Maryland Simple Promissory Note for Tuition Fee is a legal document that outlines the agreement between a borrower and a lender regarding the repayment of tuition fees borrowed by the borrower. This type of promissory note is specific to the state of Maryland and is used to protect both parties' rights and obligations. The Maryland Simple Promissory Note for Tuition Fee typically includes essential details such as the names and contact information of both the borrower and the lender, the loan amount, the interest rate (if applicable), the repayment terms, including the schedule and method of repayment, and any applicable penalties or late fees. This document serves as evidence of the borrower's commitment to repay the loan along with the agreed terms. It is important to note that there might be different types of Maryland Simple Promissory Notes for Tuition Fee, often named based on certain factors such as the duration of repayment or the involvement of a co-signer. Some common variations may include: 1. Maryland Short-term Simple Promissory Note for Tuition Fee: This type of promissory note is suitable for loans with a relatively short repayment period, typically within a year. It allows for quick repayment of tuition fees borrowed. 2. Maryland Long-term Simple Promissory Note for Tuition Fee: This promissory note is appropriate for loans with an extended repayment period, often extending beyond a year. It provides a more extended timeframe for the borrower to repay the tuition fees borrowed. 3. Maryland Simple Promissory Note for Tuition Fee with Co-signer: In certain cases, a lender may require a co-signer to guarantee the repayment of the loan. This promissory note includes the details of both the borrower and the co-signer, providing additional security for the lender. Overall, a Maryland Simple Promissory Note for Tuition Fee is a vital legal document that clarifies the terms and conditions of the loan, ensuring a smooth and transparent borrowing and repayment process. It is advisable for both the borrower and the lender to carefully review and understand the terms before entering into any financial agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

How to fill out Maryland Pagaré Simple De Matrícula?

If you want to full, down load, or produce authorized record web templates, use US Legal Forms, the largest selection of authorized kinds, which can be found on-line. Take advantage of the site`s basic and practical look for to discover the files you require. Numerous web templates for organization and individual functions are sorted by types and suggests, or key phrases. Use US Legal Forms to discover the Maryland Simple Promissory Note for Tutition Fee in just a number of clicks.

Should you be currently a US Legal Forms customer, log in in your accounts and click the Down load key to obtain the Maryland Simple Promissory Note for Tutition Fee. You can even gain access to kinds you formerly delivered electronically in the My Forms tab of the accounts.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have selected the shape for your correct metropolis/country.

- Step 2. Use the Review method to look through the form`s content material. Do not overlook to see the description.

- Step 3. Should you be not satisfied with all the type, utilize the Search area towards the top of the display screen to get other models from the authorized type web template.

- Step 4. After you have found the shape you require, go through the Get now key. Choose the prices prepare you favor and add your accreditations to register for an accounts.

- Step 5. Process the purchase. You can utilize your charge card or PayPal accounts to finish the purchase.

- Step 6. Pick the formatting from the authorized type and down load it on the system.

- Step 7. Total, change and produce or sign the Maryland Simple Promissory Note for Tutition Fee.

Every authorized record web template you purchase is the one you have for a long time. You possess acces to every single type you delivered electronically in your acccount. Click the My Forms portion and decide on a type to produce or down load once more.

Remain competitive and down load, and produce the Maryland Simple Promissory Note for Tutition Fee with US Legal Forms. There are millions of professional and status-distinct kinds you may use for your organization or individual needs.