Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

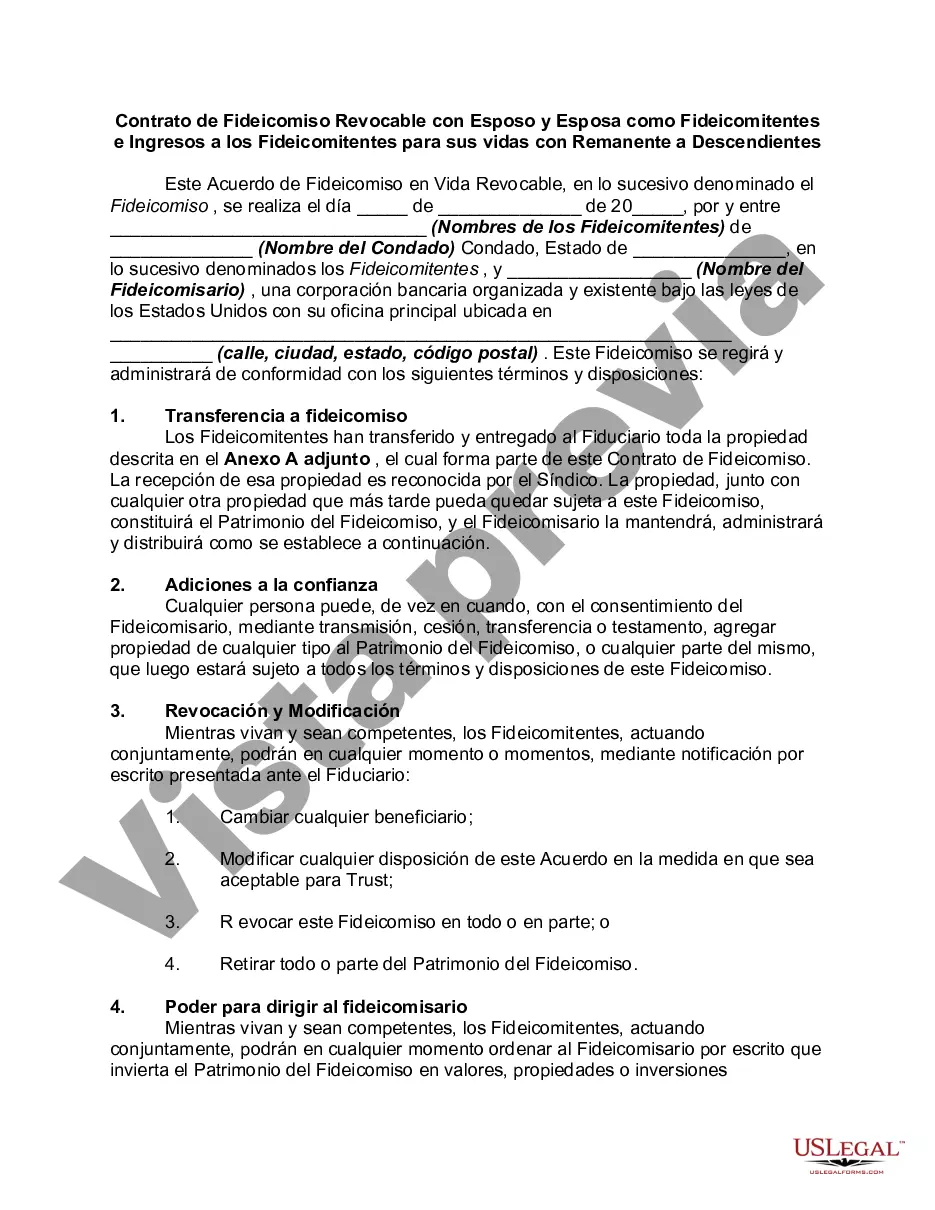

Maryland Revocable Trust Agreement with Husband and Wife as Trustees and Income To A Maryland Revocable Trust Agreement with Husband and Wife as Trustees and Income To is a legal document that allows a married couple to create a trust for their assets and designate the income to be generated from the trust. This type of trust provides numerous benefits for estate planning, asset protection, and efficient management of assets during the trust or's lifetime and after their passing. In Maryland, there are different types of Revocable Trust Agreements with Husband and Wife as Trustees and Income To that couples can establish, depending on their specific needs and goals. Some of these are: 1. Maryland Living Trust: This type of trust allows the trustees (husband and wife) to transfer their assets into the trust during their lifetime. The trustees can retain control over the assets and use the income generated from the trust during their lifetime. Upon their passing, the trust assets are distributed to the beneficiaries, avoiding probate and ensuring a smooth transfer of assets. 2. Maryland Family Trust: This trust is specifically designed to protect and provide for the family members of the trustees. The trustees can name their children or other family members as beneficiaries and ensure that income generated from the trust is used for their benefit. This type of trust can also include provisions for the care of minor children or individuals with special needs. 3. Maryland Charitable Remainder Trust: This trust allows the trustees to provide income to themselves during their lifetime, with the remainder of the trust assets going to a charitable organization of their choice upon their passing. By establishing a charitable remainder trust, the trustees can enjoy tax benefits while supporting a cause that is close to their hearts. 4. Maryland Qualified Terminable Interest Property Trust (TIP Trust): This trust is often used by couples in blended families as it allows the trustees to provide income to their surviving spouse while ensuring that the trust assets ultimately pass to their children from previous relationships. The trustees can determine the specific terms and conditions under which the assets are distributed to achieve their desired estate planning goals. In summary, a Maryland Revocable Trust Agreement with Husband and Wife as Trustees and Income To provides married couples with a comprehensive tool for managing their assets, protecting their family's future, and achieving their estate planning objectives. The specific type of trust agreement chosen will depend on the couple's unique circumstances, goals, and the intended use of the trust income.Maryland Revocable Trust Agreement with Husband and Wife as Trustees and Income To A Maryland Revocable Trust Agreement with Husband and Wife as Trustees and Income To is a legal document that allows a married couple to create a trust for their assets and designate the income to be generated from the trust. This type of trust provides numerous benefits for estate planning, asset protection, and efficient management of assets during the trust or's lifetime and after their passing. In Maryland, there are different types of Revocable Trust Agreements with Husband and Wife as Trustees and Income To that couples can establish, depending on their specific needs and goals. Some of these are: 1. Maryland Living Trust: This type of trust allows the trustees (husband and wife) to transfer their assets into the trust during their lifetime. The trustees can retain control over the assets and use the income generated from the trust during their lifetime. Upon their passing, the trust assets are distributed to the beneficiaries, avoiding probate and ensuring a smooth transfer of assets. 2. Maryland Family Trust: This trust is specifically designed to protect and provide for the family members of the trustees. The trustees can name their children or other family members as beneficiaries and ensure that income generated from the trust is used for their benefit. This type of trust can also include provisions for the care of minor children or individuals with special needs. 3. Maryland Charitable Remainder Trust: This trust allows the trustees to provide income to themselves during their lifetime, with the remainder of the trust assets going to a charitable organization of their choice upon their passing. By establishing a charitable remainder trust, the trustees can enjoy tax benefits while supporting a cause that is close to their hearts. 4. Maryland Qualified Terminable Interest Property Trust (TIP Trust): This trust is often used by couples in blended families as it allows the trustees to provide income to their surviving spouse while ensuring that the trust assets ultimately pass to their children from previous relationships. The trustees can determine the specific terms and conditions under which the assets are distributed to achieve their desired estate planning goals. In summary, a Maryland Revocable Trust Agreement with Husband and Wife as Trustees and Income To provides married couples with a comprehensive tool for managing their assets, protecting their family's future, and achieving their estate planning objectives. The specific type of trust agreement chosen will depend on the couple's unique circumstances, goals, and the intended use of the trust income.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.