Maryland Acceptance of Claim by Collection Agency and Report of Experience with Debtor is a legal process that involves the acceptance of a claim by a collection agency in the state of Maryland. This process allows a collection agency to report their experience with a debtor, providing valuable information and documentation related to the debt. The Maryland Acceptance of Claim by Collection Agency and Report of Experience with Debtor is crucial for both the collection agency and the debtor. It serves as an official record of the debt collection proceedings, ensuring transparency and accountability throughout the process. There are several types of Maryland Acceptance of Claim by Collection Agency and Report of Experience with Debtor that can be categorized based on the specific circumstances. Here are a few examples: 1. Maryland Acceptance of Claim by Collection Agency — Consumer Debt: This type of acceptance of claim is typically used when a collection agency is pursuing the repayment of consumer debt. It involves documenting the debtor's personal information, such as name, address, and contact information, along with details of the debt owed. 2. Maryland Acceptance of Claim by Collection Agency — Commercial Debt: In cases where the debt in question is related to a commercial transaction, this type of acceptance of claim is used. It includes additional details such as the debtor's business name, registered address, and other relevant commercial information. 3. Maryland Acceptance of Claim by Collection Agency — Medical Debt: When a collection agency is involved in the recovery of unpaid medical bills or healthcare-related debts, this type of acceptance of claim is utilized. It may require additional documentation, such as copies of medical invoices, insurance claims, or correspondence related to the debt. The Report of Experience with Debtor section of this process is equally important as it provides essential information regarding the collection agency's interactions and experiences with the debtor. It may include details of communication attempts, payment arrangements, legal actions taken, or any other relevant information pertinent to the debt collection process. Overall, the Maryland Acceptance of Claim by Collection Agency and Report of Experience with Debtor is a necessary process in ensuring the proper handling of debt collection cases in the state of Maryland. Collection agencies rely on this process to document their interactions and provide a comprehensive report of the debtor's experience during this period. Properly executing this process helps foster better communication and transparency among all parties involved, ensuring a smoother debt collection process.

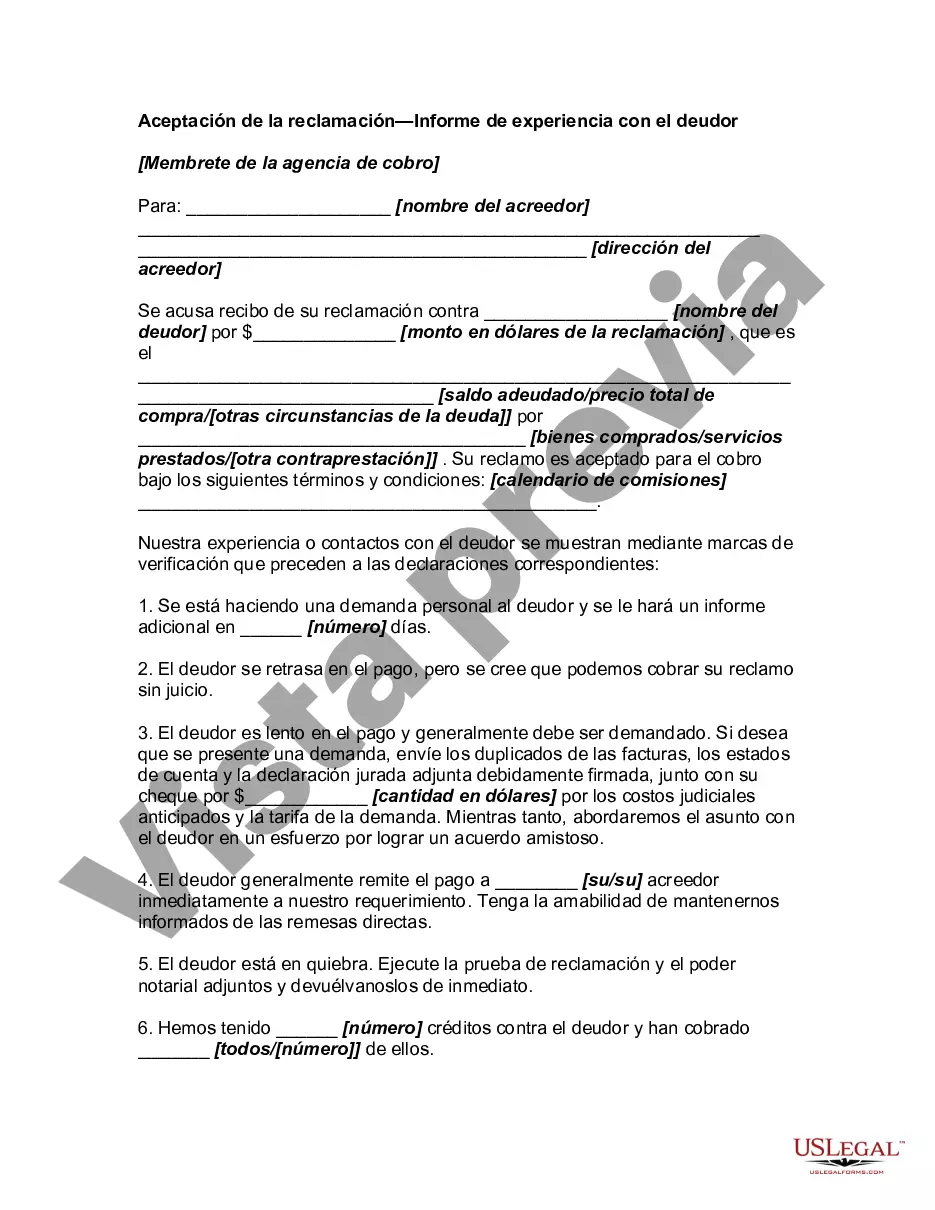

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Maryland Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

You are able to invest hours on the Internet searching for the legal file template that fits the federal and state demands you will need. US Legal Forms gives 1000s of legal forms which are examined by pros. You can easily down load or printing the Maryland Acceptance of Claim by Collection Agency and Report of Experience with Debtor from our service.

If you have a US Legal Forms account, it is possible to log in and click on the Download option. After that, it is possible to full, modify, printing, or signal the Maryland Acceptance of Claim by Collection Agency and Report of Experience with Debtor. Every single legal file template you purchase is your own forever. To acquire one more version of any purchased kind, proceed to the My Forms tab and click on the related option.

If you are using the US Legal Forms site initially, follow the simple recommendations beneath:

- First, be sure that you have chosen the proper file template to the county/metropolis that you pick. See the kind outline to make sure you have selected the right kind. If available, utilize the Review option to check throughout the file template at the same time.

- If you wish to get one more edition of your kind, utilize the Lookup area to discover the template that suits you and demands.

- Once you have found the template you desire, just click Acquire now to continue.

- Find the prices strategy you desire, type in your qualifications, and register for a free account on US Legal Forms.

- Full the purchase. You can utilize your bank card or PayPal account to purchase the legal kind.

- Find the file format of your file and down load it in your device.

- Make adjustments in your file if needed. You are able to full, modify and signal and printing Maryland Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

Download and printing 1000s of file templates utilizing the US Legal Forms Internet site, that offers the greatest assortment of legal forms. Use professional and express-specific templates to deal with your small business or person requires.