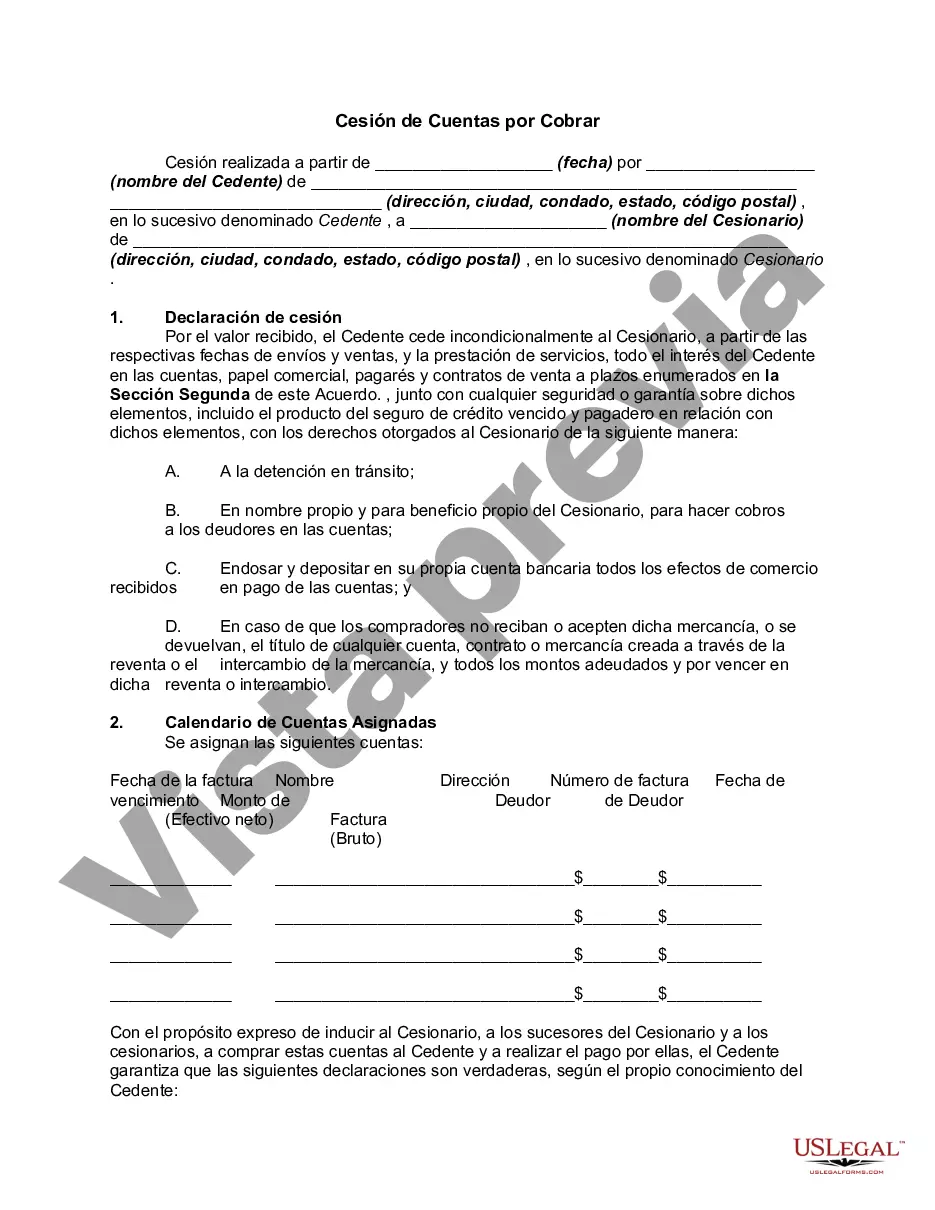

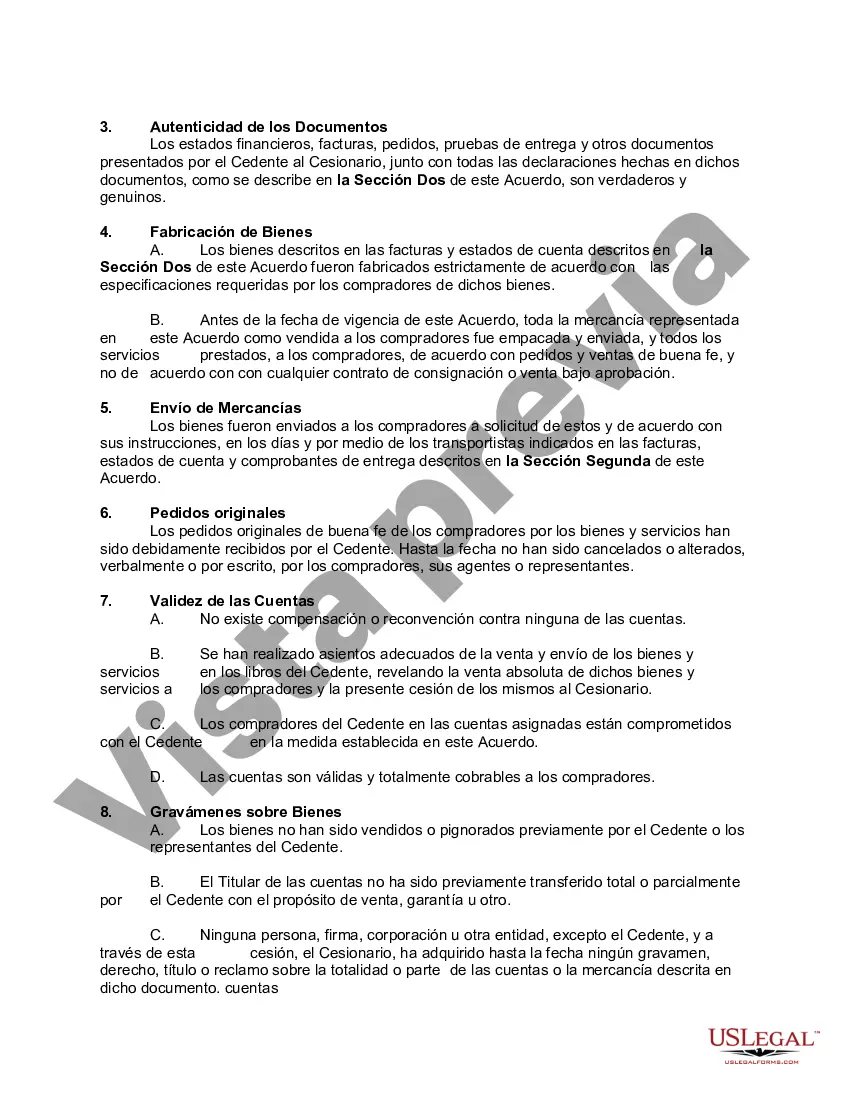

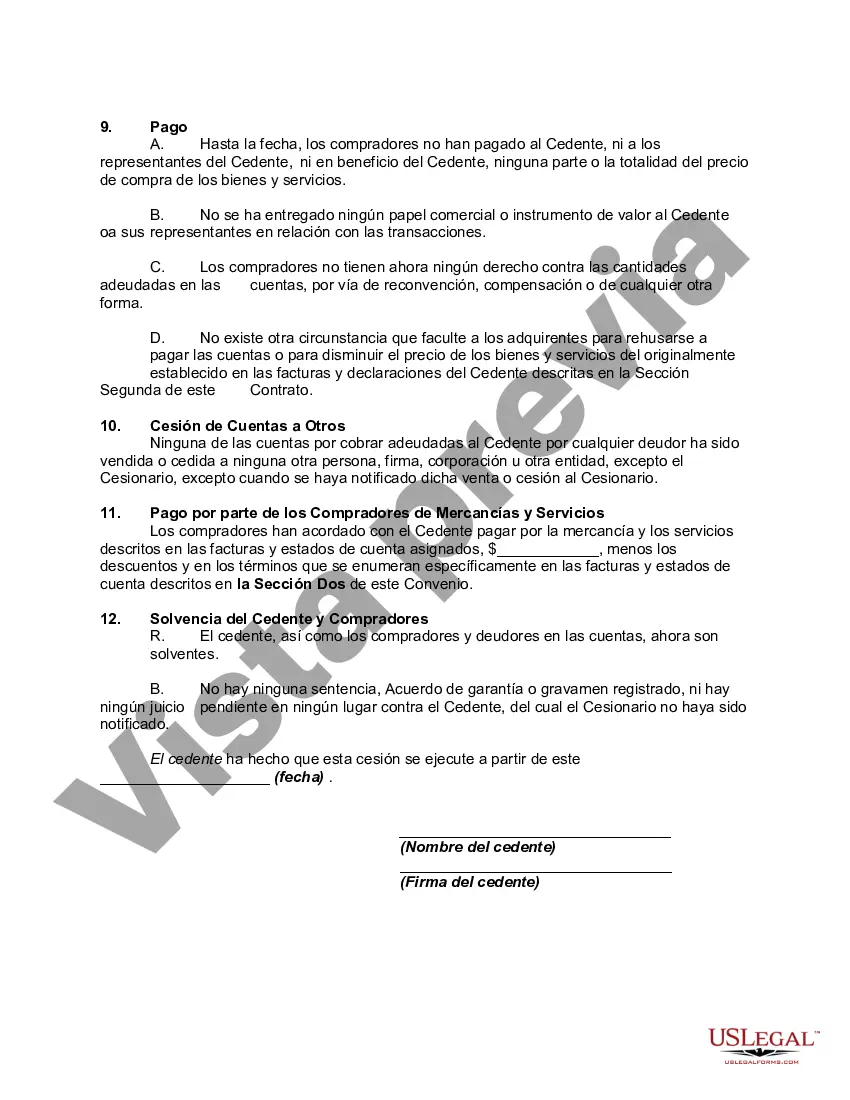

Maryland Assignment of Accounts Receivable is a legal agreement that allows businesses located in Maryland to transfer their accounts receivable rights to another entity. This agreement is commonly used to address cash flow issues or to finance business operations. By assigning their accounts receivable, businesses can generate immediate funds as the assignee assumes the responsibility of collecting payments from customers. The Maryland Assignment of Accounts Receivable involves three parties: the assignor (the business transferring the rights), the assignee (the entity receiving the rights), and the debtor (the customer liable for the payment). This agreement clearly outlines the terms and conditions, including the effective date, assignment amount, fees, and how disputes will be resolved. Furthermore, the Maryland Uniform Commercial Code (UCC) governs the assignment of accounts receivable in Maryland. Under the UCC Article 9, there are two types of Maryland Assignment of Accounts Receivable: 1. Absolute Assignment: In this type, the assignor transfers all rights, title, and interest in the accounts receivable to the assignee. The assignee has full control over collecting the payments and assumes the risk of non-payment. The assignor has no further claims to the assigned accounts receivable, and the transaction is irrevocable. 2. Collateral Assignment: This type grants the assignee a security interest in the accounts receivable. By assigning them as collateral, the assignor provides the assignee with a form of security against a loan or debt. In the event of default, the assignee can seize and liquidate the assigned accounts receivable to recover their debt. It is important to note that Maryland has specific requirements and regulations when executing an Assignment of Accounts Receivable. The agreement must be in writing, signed by the assignor, and sufficiently describe the accounts being assigned. Additionally, the assignor may need to notify the debtors of the assignment to inform them about the change in payment remittance instructions. In conclusion, the Maryland Assignment of Accounts Receivable allows businesses to transfer their rights to collect outstanding payments to another entity. It serves as a means to obtain immediate funding or secure a loan. The two types of assignments, absolute and collateral, provide different levels of rights and responsibilities to the assignee. Compliance with Maryland's UCC and specific documentation requirements is essential when executing this agreement.

Maryland Assignment of Accounts Receivable is a legal agreement that allows businesses located in Maryland to transfer their accounts receivable rights to another entity. This agreement is commonly used to address cash flow issues or to finance business operations. By assigning their accounts receivable, businesses can generate immediate funds as the assignee assumes the responsibility of collecting payments from customers. The Maryland Assignment of Accounts Receivable involves three parties: the assignor (the business transferring the rights), the assignee (the entity receiving the rights), and the debtor (the customer liable for the payment). This agreement clearly outlines the terms and conditions, including the effective date, assignment amount, fees, and how disputes will be resolved. Furthermore, the Maryland Uniform Commercial Code (UCC) governs the assignment of accounts receivable in Maryland. Under the UCC Article 9, there are two types of Maryland Assignment of Accounts Receivable: 1. Absolute Assignment: In this type, the assignor transfers all rights, title, and interest in the accounts receivable to the assignee. The assignee has full control over collecting the payments and assumes the risk of non-payment. The assignor has no further claims to the assigned accounts receivable, and the transaction is irrevocable. 2. Collateral Assignment: This type grants the assignee a security interest in the accounts receivable. By assigning them as collateral, the assignor provides the assignee with a form of security against a loan or debt. In the event of default, the assignee can seize and liquidate the assigned accounts receivable to recover their debt. It is important to note that Maryland has specific requirements and regulations when executing an Assignment of Accounts Receivable. The agreement must be in writing, signed by the assignor, and sufficiently describe the accounts being assigned. Additionally, the assignor may need to notify the debtors of the assignment to inform them about the change in payment remittance instructions. In conclusion, the Maryland Assignment of Accounts Receivable allows businesses to transfer their rights to collect outstanding payments to another entity. It serves as a means to obtain immediate funding or secure a loan. The two types of assignments, absolute and collateral, provide different levels of rights and responsibilities to the assignee. Compliance with Maryland's UCC and specific documentation requirements is essential when executing this agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.