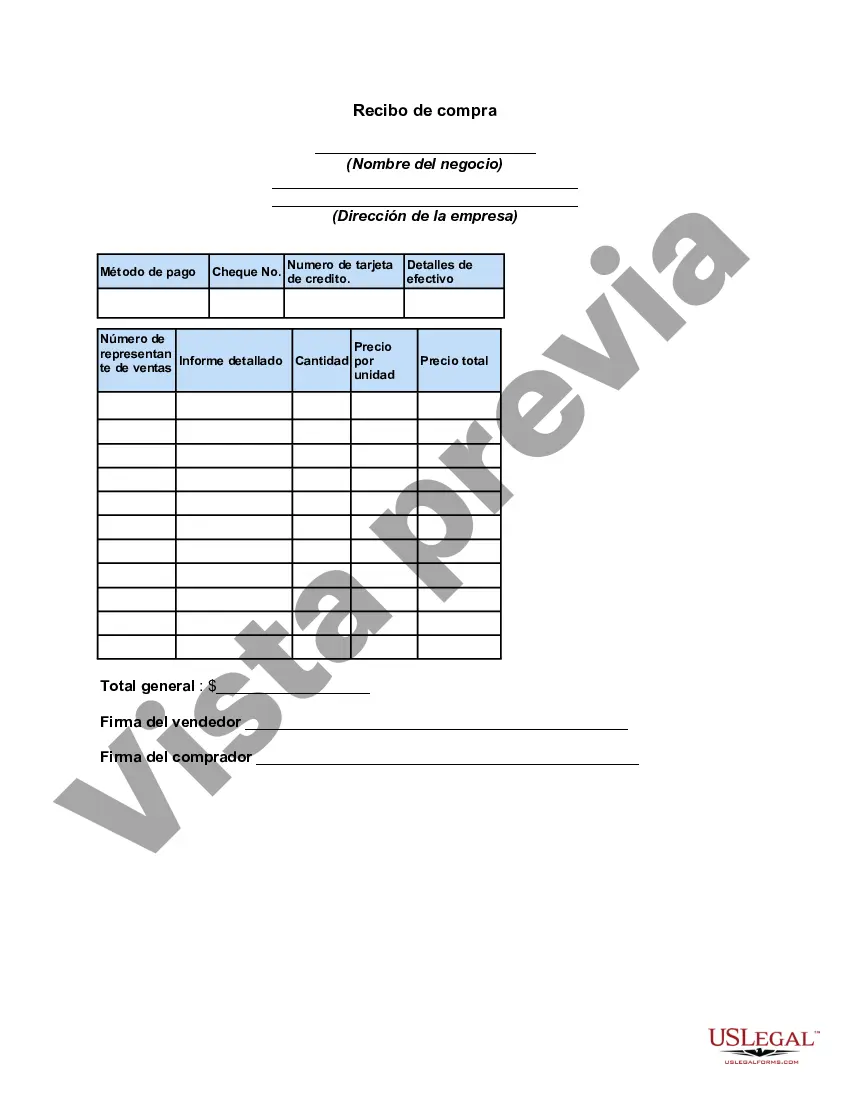

A Maryland Sales Receipt is an important document that serves as proof of a transaction between a buyer and a seller in the state of Maryland. It contains key details about the sale, including the items purchased, their prices, and any taxes or fees that apply. The Maryland Sales Receipt is typically issued by the seller to the buyer at the time of purchase. It is important for both parties to keep a copy of the receipt for record-keeping and potential future reference. This document not only helps the buyer track their purchases but also acts as evidence of the transaction, which can be useful for warranties, returns, or exchanges. A Maryland Sales Receipt usually includes the following information: 1. Date and time of the transaction: The exact date and time when the sale took place are recorded on the receipt, ensuring accurate documentation of the purchase. 2. Seller information: The receipt mentions the seller's name, address, and contact details. This information helps buyers contact the seller if there are any issues or queries related to the purchase. 3. Buyer information: The buyer's name and contact information may also be included on the receipt. This helps in identifying the party involved in the transaction. 4. Description of items purchased: The receipt provides a detailed list of the items bought, including the quantity, description, and price of each item. This information allows buyers to verify the items purchased and their associated costs. 5. Subtotal and total amount: The receipt calculates and displays the subtotal of all items purchased, excluding any taxes or additional charges. It also includes the total amount owed by the buyer, including applicable taxes and fees. 6. Payment method: The receipt indicates the mode of payment used for the transaction, such as cash, credit card, check, or electronic payment. This helps in cross-referencing payments and resolving any discrepancies if necessary. 7. Taxes and fees: If applicable, the Maryland Sales Receipt includes the details of taxes and fees levied on the purchase. This information is vital for accurately calculating the total amount owed by the buyer. Different types of Maryland Sales Receipts may include variants based on the nature of the transaction or the industry. For example: 1. Retail sales receipt: Used in retail settings, this type of receipt includes information about products purchased, prices, and any applicable taxes. It is commonly issued by stores and shops to individual customers. 2. Restaurant sales receipt: A sales receipt issued by restaurants or food establishments, it typically includes details of the food and beverages ordered, any additional services, taxes, and the total bill. 3. Automotive sales receipt: In the context of vehicle sales, this receipt includes specific details about the vehicle, such as make, model, year, VIN number, price, taxes, and any applicable documentation fees. 4. Online sales receipt: With the rise of e-commerce, online sales receipts are becoming increasingly common. They include details about the purchased items, shipping information, payment method, and any applicable taxes or fees. By accurately documenting the details of a transaction, a Maryland Sales Receipt provides a clear record for both buyers and sellers and ensures a transparent and accountable business environment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Recibo de compra - Sales Receipt

Description

How to fill out Maryland Recibo De Compra?

If you need to full, download, or print lawful document web templates, use US Legal Forms, the biggest selection of lawful types, which can be found on-line. Use the site`s easy and hassle-free look for to get the files you will need. Different web templates for company and personal functions are sorted by classes and says, or keywords and phrases. Use US Legal Forms to get the Maryland Sales Receipt in just a few click throughs.

When you are already a US Legal Forms client, log in to the accounts and click the Obtain button to find the Maryland Sales Receipt. You can also entry types you previously delivered electronically in the My Forms tab of your respective accounts.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for your appropriate area/nation.

- Step 2. Make use of the Review option to look through the form`s information. Don`t forget about to read through the description.

- Step 3. When you are not satisfied with all the kind, use the Lookup field near the top of the screen to discover other versions of your lawful kind template.

- Step 4. Upon having identified the shape you will need, go through the Acquire now button. Select the pricing strategy you choose and add your references to sign up for the accounts.

- Step 5. Process the purchase. You may use your charge card or PayPal accounts to accomplish the purchase.

- Step 6. Select the structure of your lawful kind and download it on your own gadget.

- Step 7. Complete, modify and print or indicator the Maryland Sales Receipt.

Each and every lawful document template you acquire is the one you have forever. You may have acces to each kind you delivered electronically in your acccount. Select the My Forms area and choose a kind to print or download once again.

Be competitive and download, and print the Maryland Sales Receipt with US Legal Forms. There are thousands of skilled and condition-particular types you can utilize for the company or personal requirements.