Maryland Invoice Template for Self Employed

Description

How to fill out Invoice Template For Self Employed?

Are you situated in a location where you need documentation for either business or personal activities almost every day.

There are numerous legal document templates accessible online, but locating forms you can trust isn't straightforward.

US Legal Forms provides a vast array of templates, such as the Maryland Invoice Template for Self Employed, designed to comply with state and federal regulations.

Select the pricing plan you prefer, fill out the required information to create your account, and complete your order using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Maryland Invoice Template for Self Employed at any time, if needed. Just click the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can employ for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Maryland Invoice Template for Self Employed template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Acquire the form you require and ensure it is for the correct city/state.

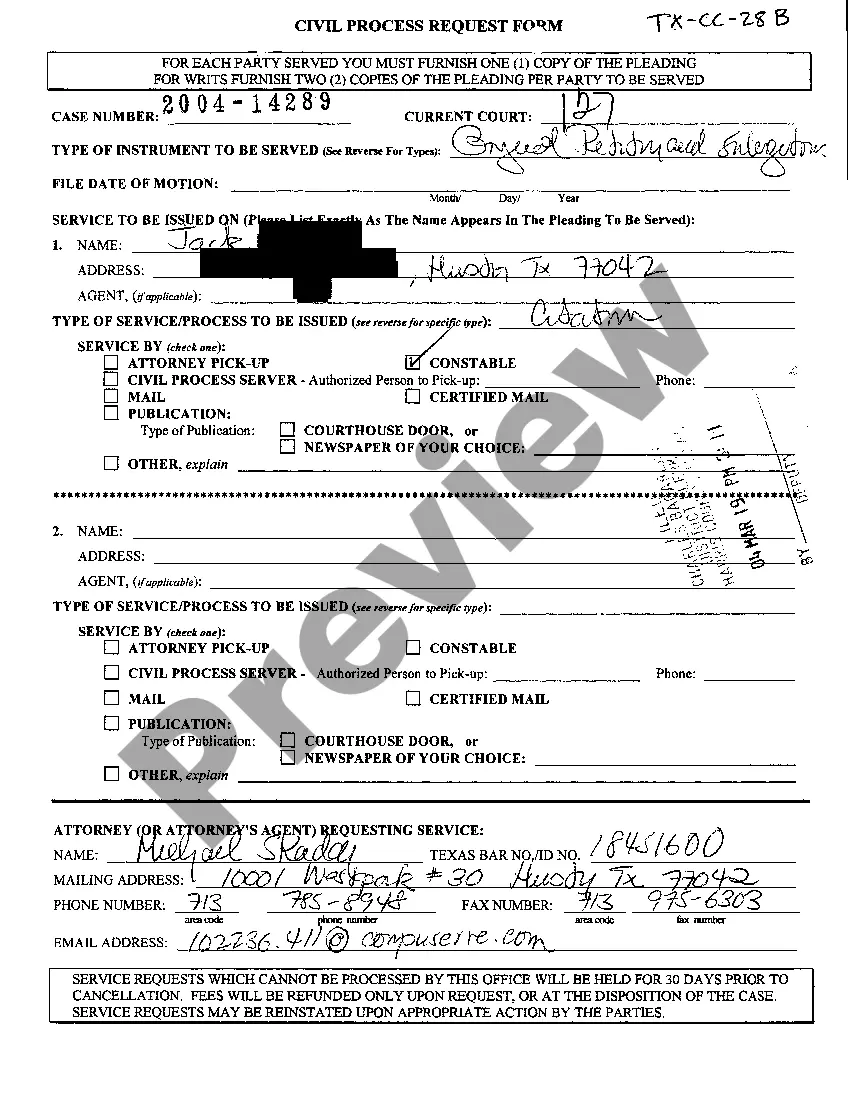

- Utilize the Preview button to review the document.

- Check the description to make sure you have chosen the correct form.

- If the document isn't what you need, use the Lookup field to find the form that suits your requirements.

- If you find the right form, simply click Get now.

Form popularity

FAQ

To create a self employed invoice, start by collecting your business details, including your name, address, and contact information. Next, list the services you provided along with their corresponding costs. Utilize a reliable Maryland Invoice Template for Self Employed to ensure a professional appearance and proper formatting. Finally, include payment terms and send the invoice to your client promptly.

To submit an invoice to an independent contractor, start by preparing a detailed invoice using a Maryland Invoice Template for Self Employed. Include all relevant service details, payment terms, and your contact information. Once completed, send it using email or a secure invoicing platform to ensure it reaches the contractor quickly.

Creating receipts for self-employment is straightforward and important for record-keeping. Use a Maryland Invoice Template for Self Employed to guide you on what information to include, such as the date, amount received, and services rendered. Always ensure your receipts are clear and provide a copy to your clients immediately.

To legally send an invoice, ensure it includes all necessary business information, like your business name and contact details. Using a Maryland Invoice Template for Self Employed can help you include these elements efficiently. Send your invoice via a method that provides delivery confirmation, such as email or a reputable invoicing service to maintain a record.

Sending a self-employed invoice involves a few straightforward steps. First, prepare your invoice using a Maryland Invoice Template for Self Employed. Then, send it through email or an invoicing platform that allows for easy tracking. Don’t forget to keep a copy for your records so you can follow up if needed.

When sending an invoice as an independent contractor, first ensure your invoice is clear and professional. Use a Maryland Invoice Template for Self Employed to help format it correctly. After preparing the invoice, send it via email or your preferred invoicing software to ensure it's received promptly. Always follow up if you do not receive confirmation.

To create a self-employed invoice, start with a clear template. A Maryland Invoice Template for Self Employed includes your name, contact information, and your client's details. Next, list the services you provided, along with the corresponding costs. Finally, ensure to include payment terms and any relevant tax information.

Filling in an invoice template requires attention to detail. Start with your business and contact information, then format the top section with your client's details, followed by the invoice number and date. Finally, list your services, include the costs, and state the payment terms clearly. Using a Maryland Invoice Template for Self Employed helps keep everything organized and easy to follow.

The correct format for an invoice includes several key elements: your name and contact information, invoice number, date, and client details. Follow this with a detailed list of services, rates, and the total amount due. A well-crafted Maryland Invoice Template for Self Employed arrays this information neatly, ensuring clarity and professionalism for you and your client.

Writing a simple invoice template involves creating a header with your business name and contact information. Underneath, clearly state the invoice number, date, and client information. Use a straightforward list to detail the services provided and their corresponding fees, and don’t forget to include the total amount due. A Maryland Invoice Template for Self Employed can serve as a great starting point for creating your own simple invoice.