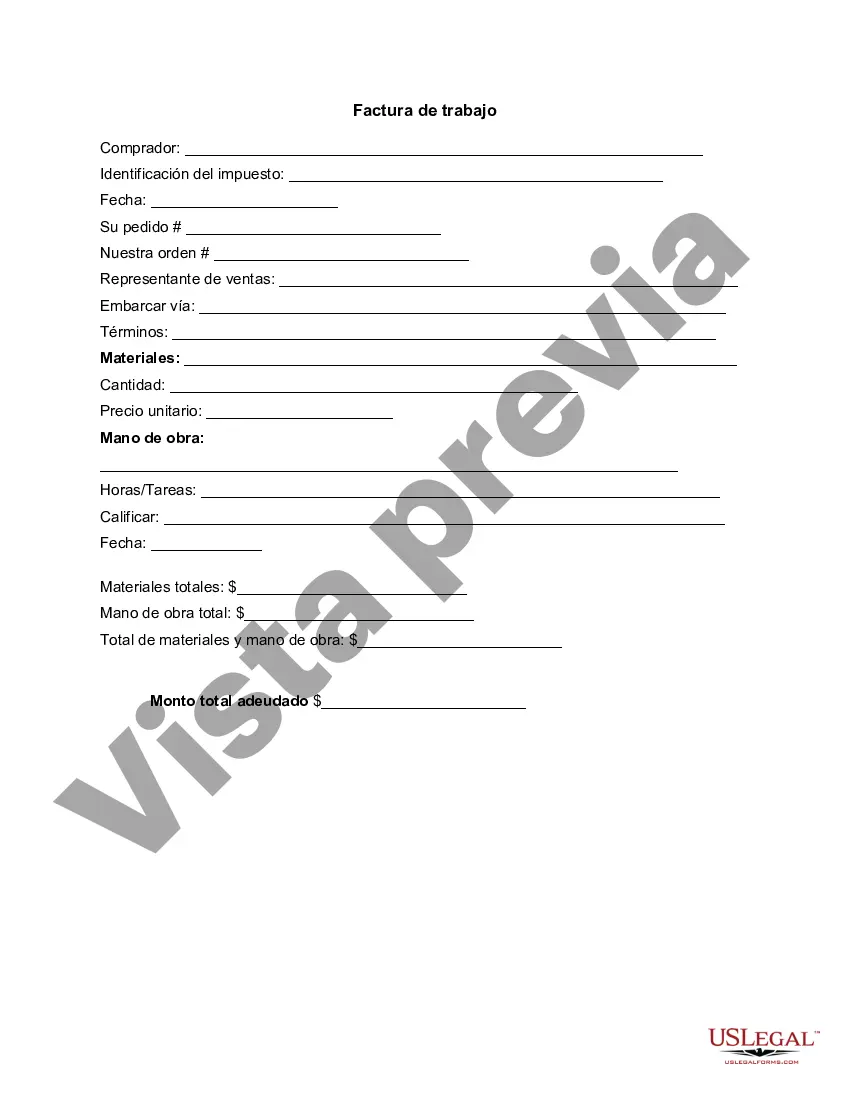

Maryland Invoice Template for Branch Manager is a pre-designed document that assists branch managers in issuing invoices for the products or services they provide. These templates are specifically tailored to comply with the invoicing regulations and requirements of the state of Maryland. By utilizing an invoice template, branch managers can easily generate professional and accurate invoices without the need for extensive manual formatting. Some essential elements included in a Maryland Invoice Template for Branch Manager are: 1. Business Information: The template includes the branch manager's company name, address, contact details, and logo. This section represents the identity of the business and ensures the client can easily identify the sender of the invoice. 2. Client Information: This section records the name, address, and contact information of the client or customer receiving the invoice. It is crucial to accurately input this information to ensure proper communication and record-keeping. 3. Invoice Number and Date: A unique invoice number is assigned to each invoice, making it easier to track and reference. The date of issuance is also mentioned, allowing both parties to keep track of payment deadlines and timelines. 4. Itemized Description: The template provides designated spaces to itemize the products or services provided. Branch managers can include a detailed description, quantity, unit price, and any applicable taxes or discounts per item. This section allows for clear communication of charges and facilitates transparency in billing. 5. Subtotal, Taxes, and Total Amount: The invoice template will automatically calculate the subtotal of all listed items. It will then add any applicable taxes, such as sales tax or service tax, based on Maryland's tax regulations. Finally, it will provide the grand total amount payable by the client. 6. Payment Terms and Options: Maryland Invoice Templates for Branch Managers should include clear payment terms, specifying the due date, payment methods accepted, and information on late payment penalties, if applicable. This section ensures both parties are aware of the payment expectations and helps avoid any miscommunication or disputes. 7. Additional Notes: This section allows branch managers to include any additional information they deem necessary, such as specific payment instructions, terms of sale, or company policies relevant to the invoice. Different types of Maryland Invoice Templates for Branch Managers may vary based on industry or specific business needs. For example: 1. Service-Based Invoice Template: Primarily used by branch managers in service-oriented industries, this template focuses on detailing labor or professional fees and any associated expenses. 2. Retail or Product-Based Invoice Template: This type of invoice template is designed for branch managers who sell tangible goods to clients. It emphasizes listing individual products, quantity, and pricing. It may also include additional columns for SKU numbers or a product description. 3. Contract-Based Invoice Template: Branch managers engaged in long-term projects or contracts may require a more comprehensive template. This template includes sections for milestone payments, project descriptions, or detailed terms and conditions. 4. Contractor Invoice Template: Specifically designed for branch managers who subcontract work to individual contractors, this template includes sections to list subcontracted services, contractor details, and any necessary legal clauses. By utilizing Maryland Invoice Templates for Branch Managers, professionals can expedite their invoicing process, maintain accuracy, and present a professional image to their clients.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Plantilla de factura para gerente de sucursal - Invoice Template for Branch Manager

Description

How to fill out Maryland Plantilla De Factura Para Gerente De Sucursal?

If you need to comprehensive, download, or printing legitimate document templates, use US Legal Forms, the largest assortment of legitimate varieties, which can be found on the Internet. Make use of the site`s basic and hassle-free lookup to obtain the paperwork you need. Various templates for business and individual purposes are sorted by types and says, or key phrases. Use US Legal Forms to obtain the Maryland Invoice Template for Branch Manager with a number of click throughs.

Should you be previously a US Legal Forms consumer, log in to the accounts and click on the Obtain button to have the Maryland Invoice Template for Branch Manager. You may also accessibility varieties you previously acquired inside the My Forms tab of the accounts.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have selected the form for your correct area/country.

- Step 2. Make use of the Preview method to check out the form`s articles. Never neglect to read the description.

- Step 3. Should you be not satisfied together with the type, take advantage of the Search field towards the top of the screen to locate other versions of your legitimate type design.

- Step 4. When you have identified the form you need, select the Get now button. Pick the pricing strategy you like and put your references to register for the accounts.

- Step 5. Process the financial transaction. You can utilize your bank card or PayPal accounts to finish the financial transaction.

- Step 6. Pick the structure of your legitimate type and download it on your own gadget.

- Step 7. Full, edit and printing or sign the Maryland Invoice Template for Branch Manager.

Every single legitimate document design you purchase is your own eternally. You might have acces to each and every type you acquired within your acccount. Select the My Forms section and select a type to printing or download again.

Contend and download, and printing the Maryland Invoice Template for Branch Manager with US Legal Forms. There are thousands of skilled and status-distinct varieties you can utilize for your business or individual requires.