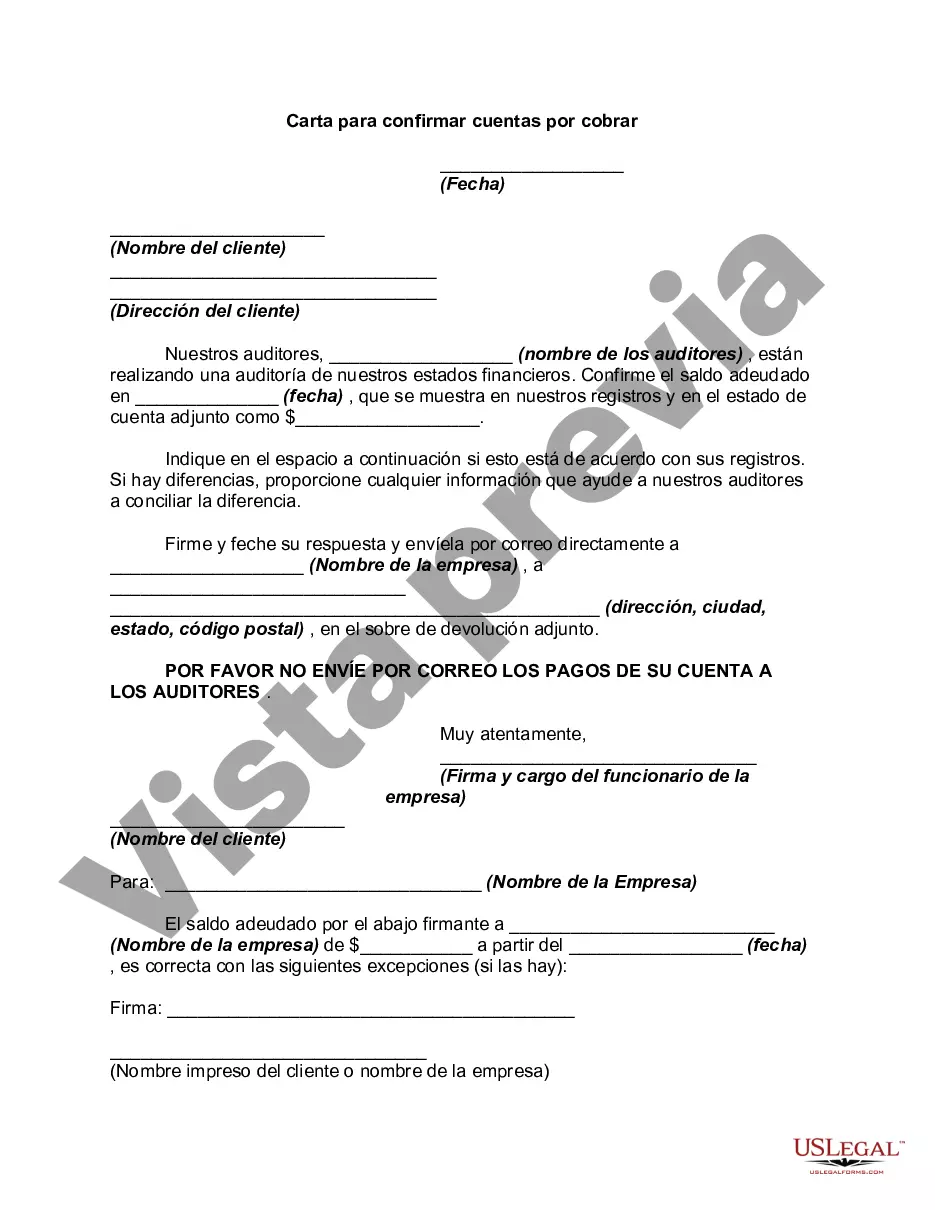

Maryland Letter to Confirm Accounts Receivable is a formal document used by businesses to verify the existence and accuracy of accounts receivable balances with their clients located in the state of Maryland. This letter plays a crucial role in maintaining transparency and confirming the reliability of financial records. The purpose of the Maryland Letter to Confirm Accounts Receivable is to request the client's confirmation of the outstanding balances owed by them and to ensure that both parties agree on the accuracy of these amounts. It serves as a written confirmation from the client regarding the validity and completeness of the accounts receivable records maintained by the business. By sending this letter, a business strives to eliminate any potential discrepancies or misunderstandings in financial transactions, ultimately enhancing trust and fostering a healthy business relationship with clients. This letter is commonly used during auditing processes to provide independent evidence of the accuracy of accounts receivable balances. Different types of Maryland Letters to Confirm Accounts Receivable may include: 1. Initial Confirmation Letter: This is the first communication sent to the client, requesting confirmation of the specified accounts receivable balances. It includes detailed information about the client's outstanding invoices, their due dates, and the total amount due. 2. Follow-up Confirmation Letter: If the client fails to respond to the initial confirmation request within a specified time, a follow-up letter is sent. This letter serves as a gentle reminder to the client, encouraging them to review and confirm the outstanding balances without any further delay. 3. Amended Confirmation Letter: In certain cases, after the initial confirmation, either party identifies discrepancies or errors in the accounts receivable balances. An amended confirmation letter is then sent to update and reconcile the accounts accordingly. This letter ensures that accurate and up-to-date information is reflected in the financial records. 4. Final Confirmation Letter: Once all discrepancies have been resolved and both parties agree on the accuracy of the accounts receivable balances, a final confirmation letter is sent to indicate the successful completion of the verification process. This letter may also include a request for prompt payment or any necessary actions to be taken to clear the outstanding balances. In conclusion, the Maryland Letter to Confirm Accounts Receivable serves as a vital tool to verify the accuracy and completeness of accounts receivable balances with clients in Maryland. It plays a crucial role in maintaining financial transparency, resolving discrepancies, and fostering strong business relationships. Businesses use different types of confirmation letters depending on the stage and purpose of the verification process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Carta para confirmar cuentas por cobrar - Letter to Confirm Accounts Receivable

Description

How to fill out Maryland Carta Para Confirmar Cuentas Por Cobrar?

Choosing the right authorized file template can be quite a have difficulties. Naturally, there are a variety of templates accessible on the Internet, but how would you discover the authorized develop you require? Utilize the US Legal Forms website. The support provides a large number of templates, including the Maryland Letter to Confirm Accounts Receivable, which can be used for enterprise and personal requirements. Each of the varieties are checked out by experts and meet federal and state needs.

If you are previously listed, log in to your bank account and then click the Acquire option to get the Maryland Letter to Confirm Accounts Receivable. Use your bank account to appear with the authorized varieties you possess acquired earlier. Proceed to the My Forms tab of your own bank account and get an additional version in the file you require.

If you are a fresh user of US Legal Forms, listed here are straightforward recommendations so that you can follow:

- Initially, make sure you have selected the right develop for your personal town/area. It is possible to examine the shape while using Review option and look at the shape explanation to make sure this is the right one for you.

- In the event the develop fails to meet your requirements, take advantage of the Seach area to discover the proper develop.

- Once you are sure that the shape is proper, select the Get now option to get the develop.

- Pick the costs program you want and enter in the essential information. Build your bank account and pay for the transaction making use of your PayPal bank account or Visa or Mastercard.

- Choose the data file file format and acquire the authorized file template to your product.

- Complete, change and produce and sign the received Maryland Letter to Confirm Accounts Receivable.

US Legal Forms will be the most significant library of authorized varieties where you can see numerous file templates. Utilize the service to acquire appropriately-created paperwork that follow condition needs.