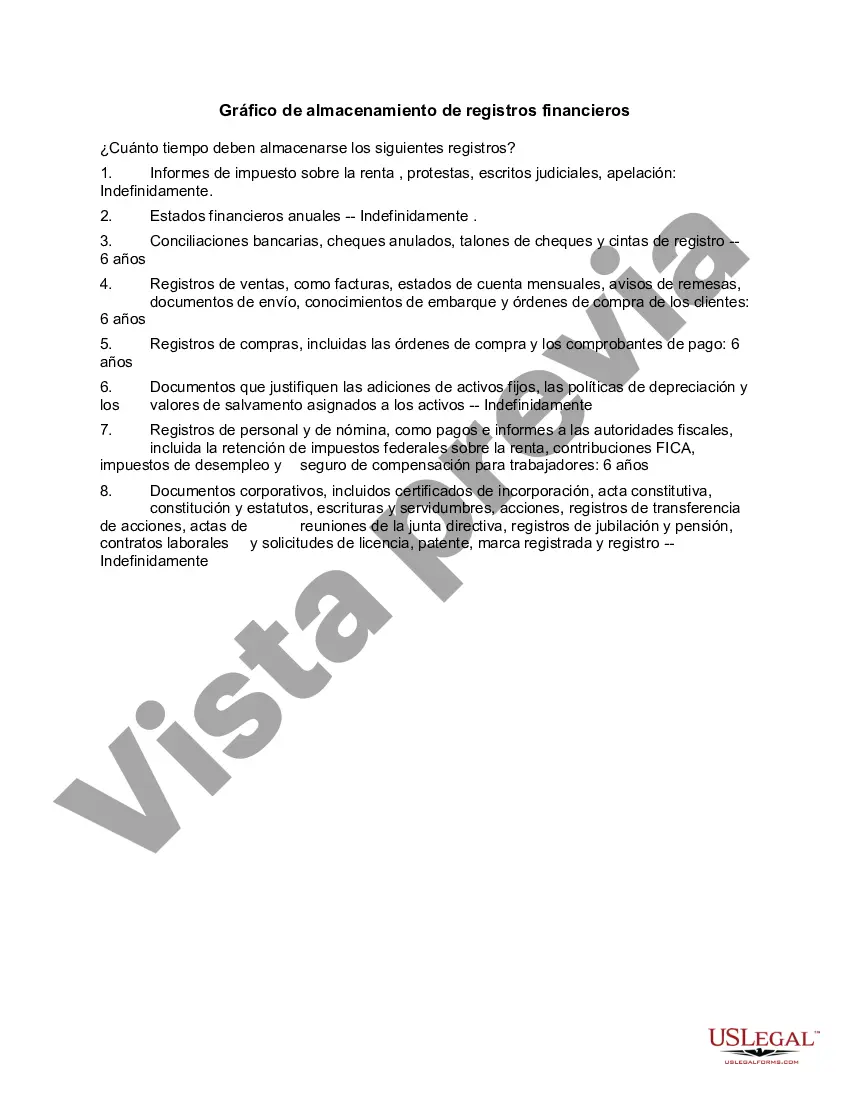

Maryland Financial Record Storage Chart is a comprehensive and organized documentation system used for managing and storing various financial records in the state of Maryland. It is designed to assist individuals, businesses, and organizations in maintaining their financial information securely and efficiently. This chart serves as a framework for categorizing and classifying financial documents based on specific criteria and guidelines. The Maryland Financial Record Storage Chart encompasses different types of financial records, each serving a unique purpose. These types include: 1. Tax Records: This category includes income tax returns, property tax records, sales tax records, and other tax-related documents required by the state of Maryland. 2. Financial Statements: Financial statements such as balance sheets, profit and loss statements, cash flow statements, and budgets are vital in assessing an individual's or organization's financial position and performance. 3. Banking Records: This section includes bank statements, canceled checks, deposit slips, loan agreements, and any other documents related to banking transactions. 4. Investment Records: Investment records encompass documents related to stocks, bonds, mutual funds, and any other investment vehicles held by individuals or organizations. 5. Insurance Policies: This category consists of insurance policies, premium payments, claims, and other relevant documentation for various types of insurance coverage, including health, life, home, and auto insurance. 6. Contracts and Agreements: Records of contracts, lease agreements, purchase agreements, and any legally binding documents fall under this category, ensuring easy access and reference when needed. 7. Payroll and Employee Records: This section comprises employee tax forms (W-2, W-4), payroll records, timesheets, benefit documents, and any other records related to employee compensation. 8. Receipts and Invoices: Receipts and invoices for purchases made, either for personal or business purposes, are essential for tracking expenses, tax deductions, and reimbursement. 9. Legal and Licensing Documents: This category includes licenses, permits, registrations, legal notices, and any other legally required documents. 10. Retirement and Pension Records: Documents related to retirement savings, pension plans, and Social Security records should be retained for future reference and potential benefit claims. The Maryland Financial Record Storage Chart provides an organized framework for managing these types of financial records, ensuring easy retrieval, compliance with legal requirements, and efficient financial management. It promotes transparency, accuracy, and security, helping individuals and organizations stay organized and prepared for any financial challenges or audits.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Gráfico de almacenamiento de registros financieros - Financial Record Storage Chart

Description

How to fill out Maryland Gráfico De Almacenamiento De Registros Financieros?

Are you in the placement where you need paperwork for both organization or personal uses virtually every day time? There are a lot of legitimate papers themes available online, but discovering versions you can depend on isn`t effortless. US Legal Forms offers a large number of form themes, just like the Maryland Financial Record Storage Chart, that happen to be written in order to meet federal and state requirements.

If you are presently knowledgeable about US Legal Forms web site and also have a merchant account, just log in. Afterward, you may download the Maryland Financial Record Storage Chart web template.

Should you not offer an account and need to begin to use US Legal Forms, abide by these steps:

- Obtain the form you need and make sure it is for the appropriate area/region.

- Utilize the Review switch to review the form.

- Look at the description to ensure that you have chosen the proper form.

- If the form isn`t what you`re looking for, use the Lookup field to find the form that fits your needs and requirements.

- Once you obtain the appropriate form, simply click Purchase now.

- Choose the prices strategy you want, fill in the specified details to generate your money, and buy the order utilizing your PayPal or Visa or Mastercard.

- Pick a practical data file file format and download your copy.

Locate each of the papers themes you have purchased in the My Forms food list. You can aquire a extra copy of Maryland Financial Record Storage Chart any time, if necessary. Just click on the necessary form to download or print out the papers web template.

Use US Legal Forms, by far the most extensive assortment of legitimate types, to save some time and stay away from blunders. The assistance offers appropriately created legitimate papers themes that you can use for a variety of uses. Create a merchant account on US Legal Forms and start producing your daily life a little easier.