Maryland Profit-Sharing Plan and Trust Agreement: A Comprehensive Overview The Maryland Profit-Sharing Plan and Trust Agreement is a legal document that outlines the provisions and framework for a profit-sharing plan established by an employer to provide additional compensation and retirement benefits to its employees. This plan seeks to incentivize employee performance by granting them a share in the profits generated by the company. Key Features and Provisions: 1. Purpose and Objectives: The Maryland Profit-Sharing Plan and Trust Agreement aim to reward employees for their contributions to the organization's success, encourage employee retention, and provide additional retirement benefits. 2. Eligibility: The agreement specifies eligibility criteria for employees to participate in the profit-sharing plan. These criteria usually include a minimum age requirement, length of service, and employment status. 3. Contribution Structure: The agreement outlines the method of funding the profit-sharing plan and determines the employer's contributions. This includes specifying whether the contributions are discretionary or fixed, as well as the timing and frequency of such contributions. 4. Vesting Schedule: The vesting schedule determines the duration of service required for an employee to retain full ownership of the employer's contributions to their profit-sharing account. It may include graded vesting, where ownership gradually increases over time, or cliff vesting, where full ownership is granted after a certain number of years. 5. Investment Options: The Maryland Profit-Sharing Plan and Trust Agreement provide guidelines for investment options available to participants. These options may include mutual funds, stocks, bonds, or other investment vehicles chosen by the employer or plan administrator. 6. Participant Withdrawals: The agreement also includes provisions for participant withdrawals, such as hardship withdrawals or loans against the participant's account balance. These provisions may be subject to certain restrictions and taxation rules. Types of Maryland Profit-Sharing Plan and Trust Agreements: 1. Traditional Profit-Sharing Plan: This type of plan allows employers to share a portion of the company's profits with the employees, usually in the form of cash contributions or additional contributions to their retirement savings accounts. 2. 401(k) Profit-Sharing Plan: This type of plan combines the features of a traditional profit-sharing plan with a 401(k) retirement savings plan. It allows employees to contribute a portion of their income on a pre-tax or post-tax basis and potentially receive an employer matching contribution. 3. Safe Harbor Profit-Sharing Plan: This plan ensures that the employer's profit-sharing contributions are not subject to annual discrimination testing, making it suitable for businesses that may otherwise face limitations due to higher-income employees. 4. New Comparability Profit-Sharing Plan: This plan allows employers to allocate different contribution levels based on employee classifications, such as compensation levels or job positions. It empowers employers to design contributions that favor specific groups of employees more than others while maintaining compliance with applicable regulations. In conclusion, the Maryland Profit-Sharing Plan and Trust Agreement provides a valuable mechanism for employers to reward employees, enhance retirement benefits, and drive performance and loyalty. Different types of profit-sharing plans allow employers to tailor their contributions and provisions based on their specific business goals and circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Plan de participación en las ganancias y contrato de fideicomiso - Profit-Sharing Plan and Trust Agreement

Description

How to fill out Maryland Plan De Participación En Las Ganancias Y Contrato De Fideicomiso?

You can commit several hours on the Internet attempting to find the legal papers template that fits the federal and state specifications you need. US Legal Forms offers thousands of legal types that are examined by pros. You can actually obtain or produce the Maryland Profit-Sharing Plan and Trust Agreement from your support.

If you have a US Legal Forms bank account, you can log in and click on the Acquire switch. Next, you can comprehensive, edit, produce, or indicator the Maryland Profit-Sharing Plan and Trust Agreement. Each legal papers template you purchase is the one you have for a long time. To have an additional version associated with a bought kind, check out the My Forms tab and click on the related switch.

If you work with the US Legal Forms website initially, adhere to the basic recommendations beneath:

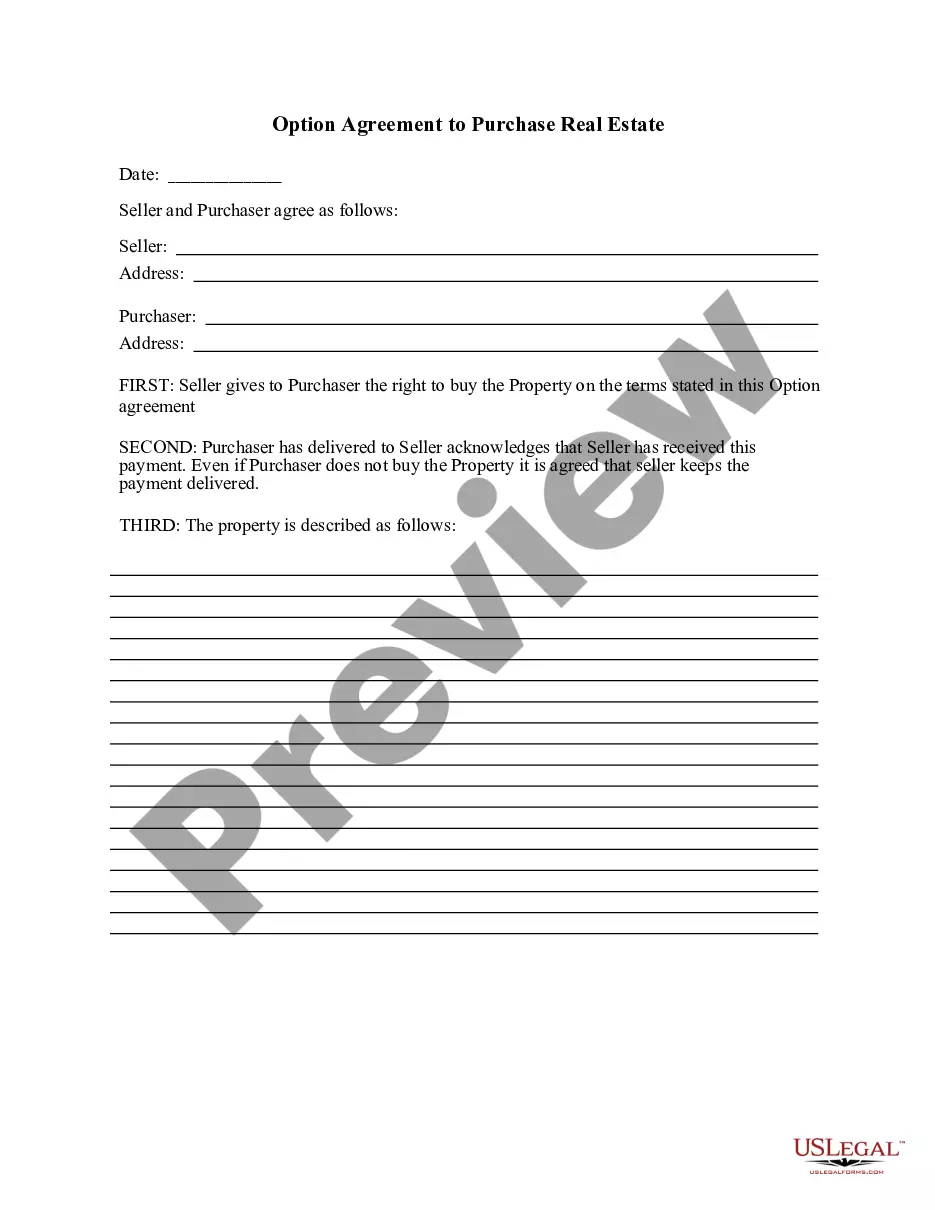

- Initially, be sure that you have chosen the right papers template to the state/town of your liking. See the kind description to make sure you have picked out the appropriate kind. If available, take advantage of the Review switch to look with the papers template as well.

- In order to discover an additional variation in the kind, take advantage of the Look for area to discover the template that suits you and specifications.

- Upon having identified the template you would like, click Acquire now to move forward.

- Find the costs prepare you would like, type in your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can utilize your Visa or Mastercard or PayPal bank account to purchase the legal kind.

- Find the format in the papers and obtain it in your gadget.

- Make alterations in your papers if needed. You can comprehensive, edit and indicator and produce Maryland Profit-Sharing Plan and Trust Agreement.

Acquire and produce thousands of papers layouts using the US Legal Forms site, that provides the greatest variety of legal types. Use professional and state-certain layouts to take on your small business or personal demands.