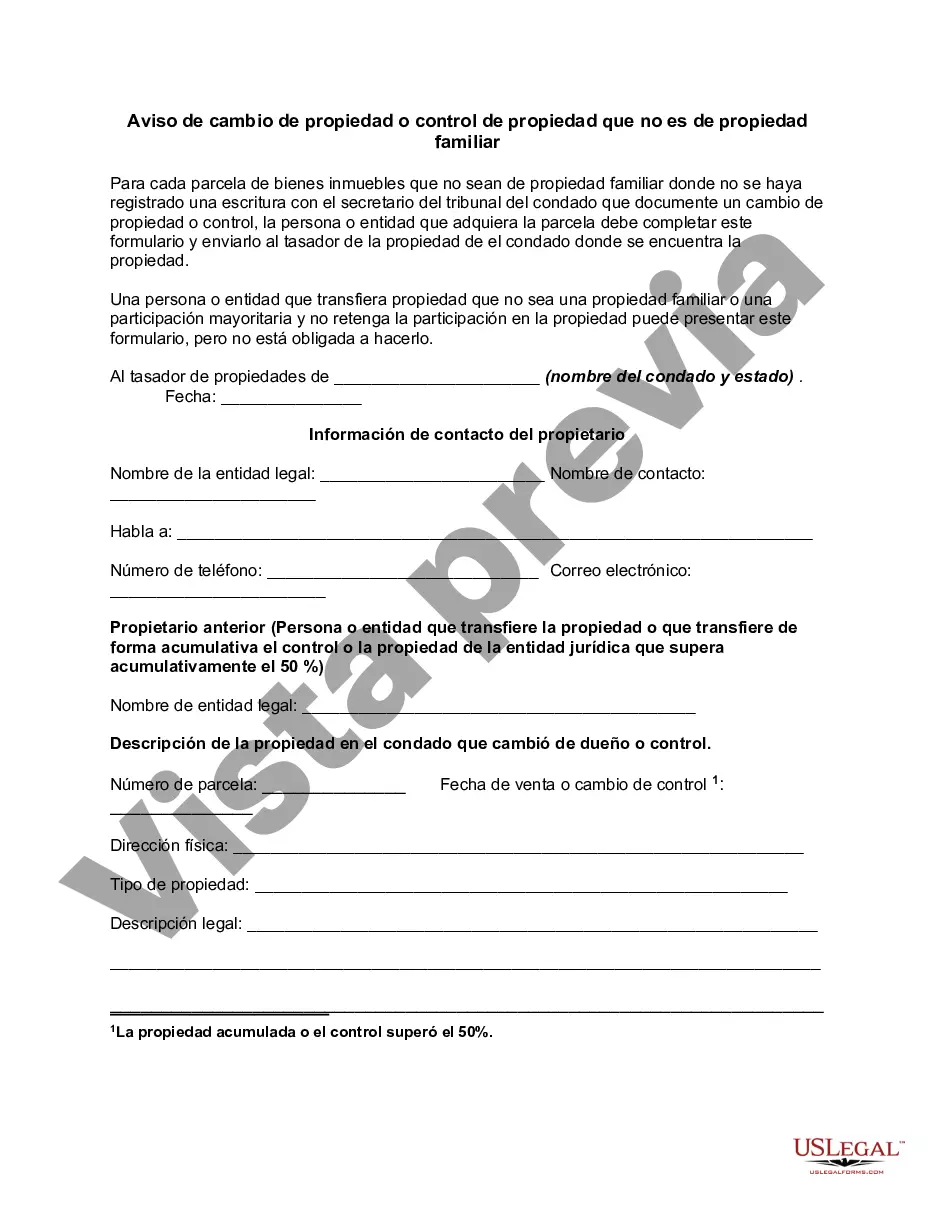

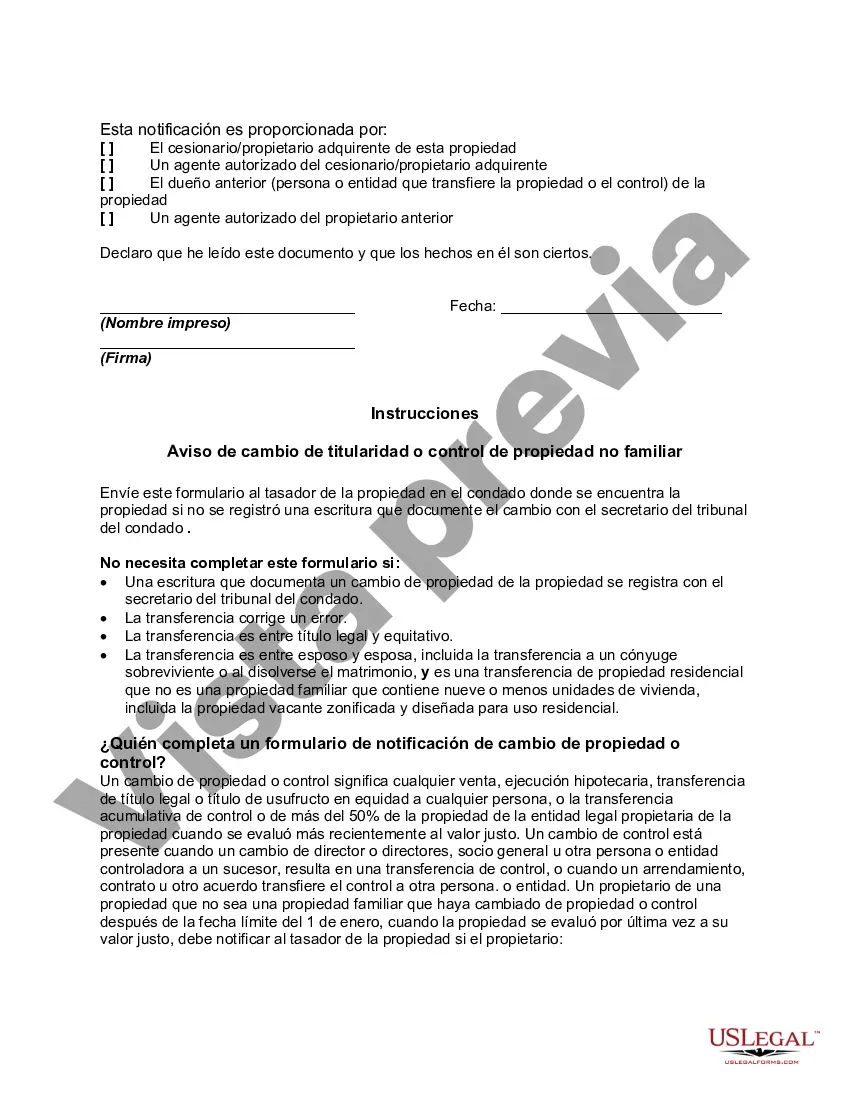

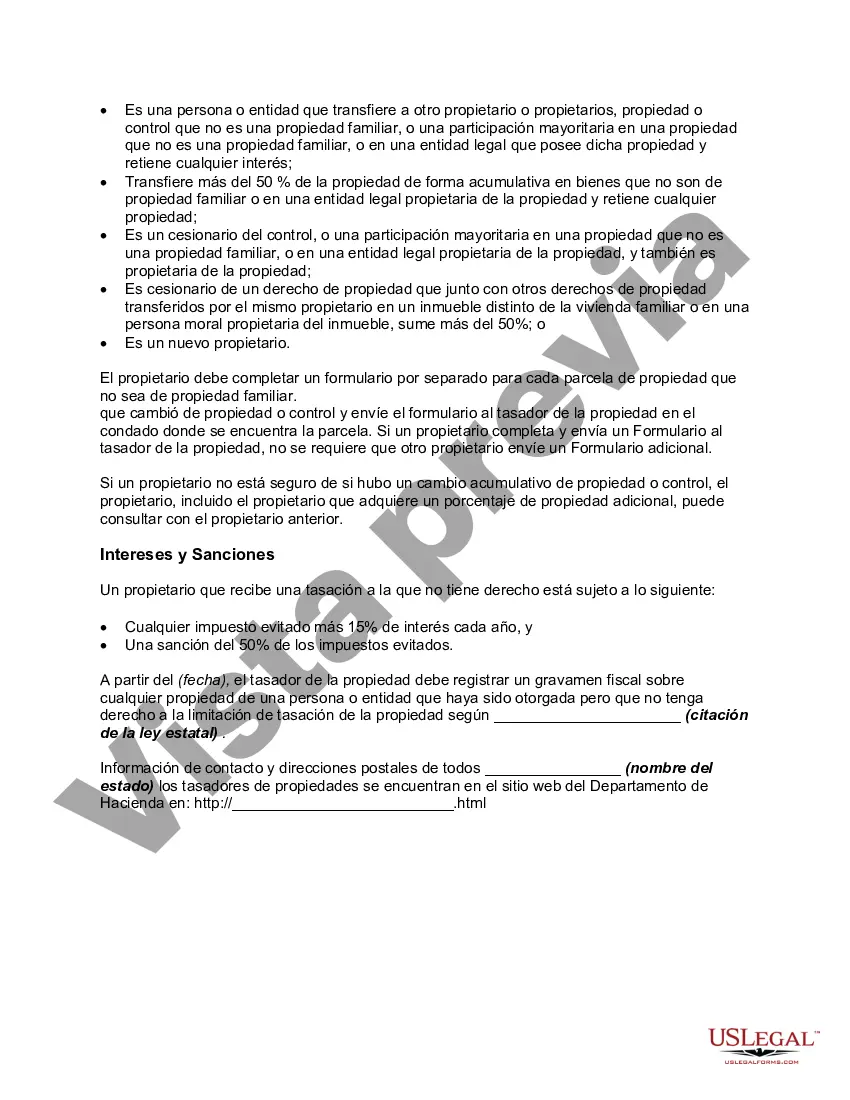

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the Maryland Notice of Change of Ownership or Control Non-Homestead Property Introduction: The Maryland Notice of Change of Ownership or Control Non-Homestead Property is a vital legal document that signifies the transition of ownership or control of non-homestead properties within the state. Property owners, buyers, real estate investors, and other concerned parties must be aware of this notice to comply with the state's regulations effectively. In Maryland, there are different types of notices under this category, which include: 1. Maryland Notice of Change of Ownership Non-Homestead Property: The Maryland Notice of Change of Ownership Non-Homestead Property is filed by the new owner(s) upon acquiring a non-residential property. This notice serves to notify the local government authorities about the change in ownership and the new individuals or entities responsible for the property. It ensures that the correct parties are held accountable for any potential liabilities or obligations associated with the property. 2. Maryland Notice of Change of Control Non-Homestead Property: The Maryland Notice of Change of Control Non-Homestead Property is filed when there is a shift in management or control of a non-residential property. This notice informs authorities that the individual(s) or organization(s) responsible for making decisions about the property's operations have changed. This could include changes in property management companies, trustees, or any other appointed parties. Detailed Description: The Maryland Notice of Change of Ownership or Control Non-Homestead Property is a legal document regulated by the state's laws and regulations, specifically designed to maintain transparency and accountability during the transfer of non-homestead properties. It is important to understand its purpose and requirements to ensure compliance with the law. Key Components of the Notice: 1. Property Identification: The notice should include the complete and accurate identification of the non-homestead property undergoing the change. This includes the property's address, parcel number, and legal description, enabling proper identification by the authorities. 2. Parties Involved: The notice must specify the names, addresses, and contact information of both the previous and current owners or controllers. This ensures that they can be reached for any important communication or inquiries regarding the property. 3. Effective Date: The notice should clearly state the effective date of the change in ownership or control. This date will be crucial for determining the timing and accuracy of property tax assessments and calculations. 4. Supporting Documentation: Depending on the circumstances of the change, certain supporting documents may be required to accompany the notice. These might include contracts of sale, partnership agreements, trust documents, or any other relevant legal instrument demonstrating the change in ownership or control. Conclusion: The Maryland Notice of Change of Ownership or Control Non-Homestead Property plays a crucial role in maintaining transparency and ensuring accountability during any transfer of non-homestead properties within the state. By fulfilling the requirements of this notice accurately and timely, property owners and controllers can comply with Maryland's legal framework, avoid potential disputes, and facilitate smooth transitions in property ownership or control.Title: Understanding the Maryland Notice of Change of Ownership or Control Non-Homestead Property Introduction: The Maryland Notice of Change of Ownership or Control Non-Homestead Property is a vital legal document that signifies the transition of ownership or control of non-homestead properties within the state. Property owners, buyers, real estate investors, and other concerned parties must be aware of this notice to comply with the state's regulations effectively. In Maryland, there are different types of notices under this category, which include: 1. Maryland Notice of Change of Ownership Non-Homestead Property: The Maryland Notice of Change of Ownership Non-Homestead Property is filed by the new owner(s) upon acquiring a non-residential property. This notice serves to notify the local government authorities about the change in ownership and the new individuals or entities responsible for the property. It ensures that the correct parties are held accountable for any potential liabilities or obligations associated with the property. 2. Maryland Notice of Change of Control Non-Homestead Property: The Maryland Notice of Change of Control Non-Homestead Property is filed when there is a shift in management or control of a non-residential property. This notice informs authorities that the individual(s) or organization(s) responsible for making decisions about the property's operations have changed. This could include changes in property management companies, trustees, or any other appointed parties. Detailed Description: The Maryland Notice of Change of Ownership or Control Non-Homestead Property is a legal document regulated by the state's laws and regulations, specifically designed to maintain transparency and accountability during the transfer of non-homestead properties. It is important to understand its purpose and requirements to ensure compliance with the law. Key Components of the Notice: 1. Property Identification: The notice should include the complete and accurate identification of the non-homestead property undergoing the change. This includes the property's address, parcel number, and legal description, enabling proper identification by the authorities. 2. Parties Involved: The notice must specify the names, addresses, and contact information of both the previous and current owners or controllers. This ensures that they can be reached for any important communication or inquiries regarding the property. 3. Effective Date: The notice should clearly state the effective date of the change in ownership or control. This date will be crucial for determining the timing and accuracy of property tax assessments and calculations. 4. Supporting Documentation: Depending on the circumstances of the change, certain supporting documents may be required to accompany the notice. These might include contracts of sale, partnership agreements, trust documents, or any other relevant legal instrument demonstrating the change in ownership or control. Conclusion: The Maryland Notice of Change of Ownership or Control Non-Homestead Property plays a crucial role in maintaining transparency and ensuring accountability during any transfer of non-homestead properties within the state. By fulfilling the requirements of this notice accurately and timely, property owners and controllers can comply with Maryland's legal framework, avoid potential disputes, and facilitate smooth transitions in property ownership or control.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.