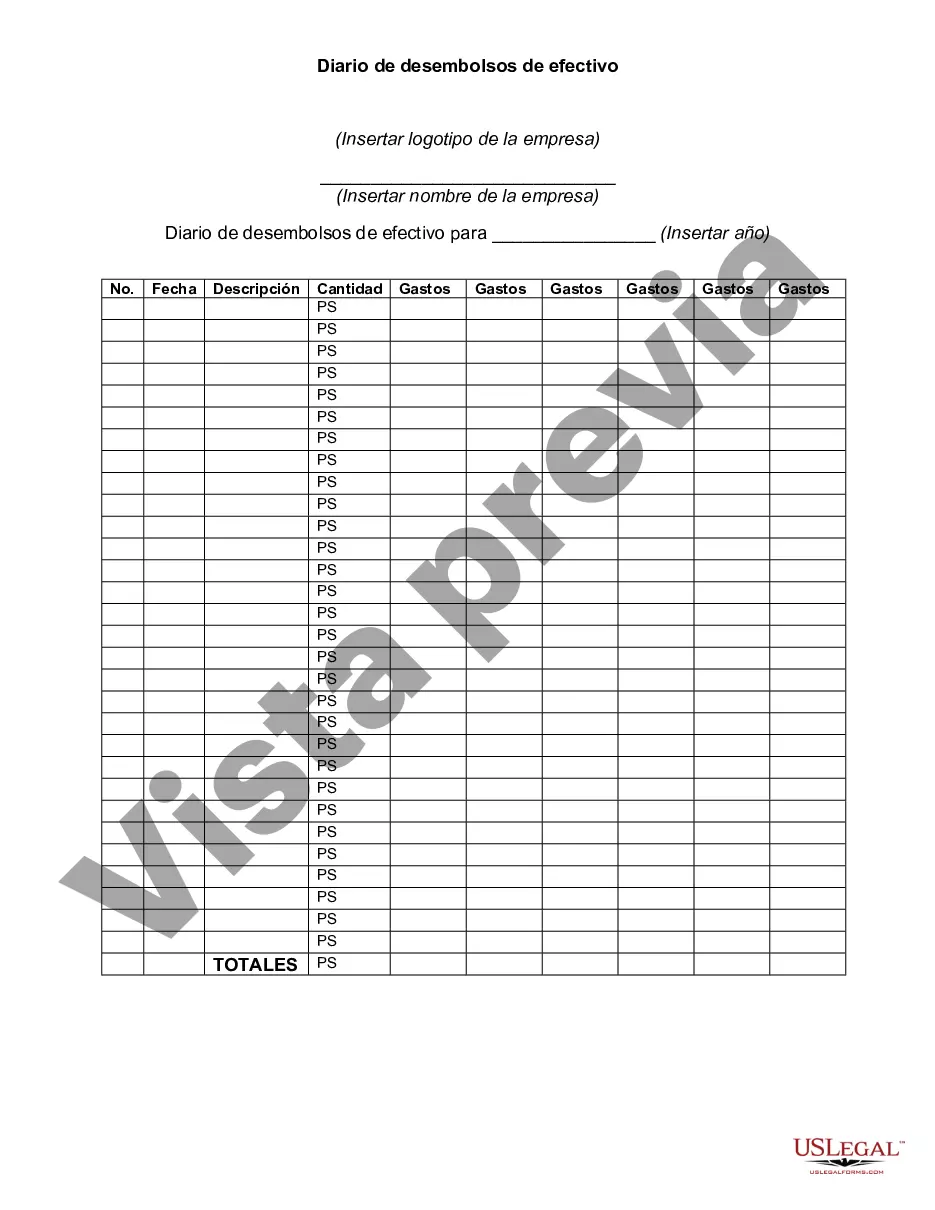

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

The Maryland Check Disbursements Journal is a crucial financial document that records the details of checks issued by organizations operating in the state of Maryland. This journal acts as a centralized record-keeping tool, allowing businesses, government entities, and other institutions to monitor check disbursements accurately. By meticulously maintaining this journal, organizations ensure transparency, facilitate auditing processes, and keep track of their financial transactions involving checks. The Maryland Check Disbursements Journal primarily consists of essential information regarding each check disbursed. This includes the date of issuance, the check number, the name of the payee, the purpose or description of the payment, the amount disbursed, and the account from which the check was debited. These details help in identifying and reconciling financial transactions efficiently. There are different types of Maryland Check Disbursements Journals designed to cater to specific organizations or industries operating in the state: 1. Business Check Disbursements Journal: This type focuses on recording check disbursements for businesses in Maryland. It encompasses a wide range of companies, including small businesses, startups, and large corporations spread across various industries. 2. Government Check Disbursements Journal: Tailored specifically for government entities such as state, county, or city agencies, this journal records checks issued by government organizations in Maryland. It plays a crucial role in maintaining financial transparency and accountability within the government sector. 3. Non-profit Check Disbursements Journal: Non-profit organizations operate differently from profit-driven entities. This type of Maryland Check Disbursements Journal is designed explicitly for non-profits operating in the state, providing them with an efficient means to track and record their check disbursements accurately. By utilizing a comprehensive Maryland Check Disbursements Journal, organizations can streamline their financial operations, ensure accurate record-keeping, and maintain compliance with local regulations. It acts as a vital tool in managing cash flow, identifying potential errors or discrepancies, and providing auditors with detailed financial records during the audit process.The Maryland Check Disbursements Journal is a crucial financial document that records the details of checks issued by organizations operating in the state of Maryland. This journal acts as a centralized record-keeping tool, allowing businesses, government entities, and other institutions to monitor check disbursements accurately. By meticulously maintaining this journal, organizations ensure transparency, facilitate auditing processes, and keep track of their financial transactions involving checks. The Maryland Check Disbursements Journal primarily consists of essential information regarding each check disbursed. This includes the date of issuance, the check number, the name of the payee, the purpose or description of the payment, the amount disbursed, and the account from which the check was debited. These details help in identifying and reconciling financial transactions efficiently. There are different types of Maryland Check Disbursements Journals designed to cater to specific organizations or industries operating in the state: 1. Business Check Disbursements Journal: This type focuses on recording check disbursements for businesses in Maryland. It encompasses a wide range of companies, including small businesses, startups, and large corporations spread across various industries. 2. Government Check Disbursements Journal: Tailored specifically for government entities such as state, county, or city agencies, this journal records checks issued by government organizations in Maryland. It plays a crucial role in maintaining financial transparency and accountability within the government sector. 3. Non-profit Check Disbursements Journal: Non-profit organizations operate differently from profit-driven entities. This type of Maryland Check Disbursements Journal is designed explicitly for non-profits operating in the state, providing them with an efficient means to track and record their check disbursements accurately. By utilizing a comprehensive Maryland Check Disbursements Journal, organizations can streamline their financial operations, ensure accurate record-keeping, and maintain compliance with local regulations. It acts as a vital tool in managing cash flow, identifying potential errors or discrepancies, and providing auditors with detailed financial records during the audit process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.