Maryland Reorganization of Partnership by Modification of Partnership Agreement is a legal process that allows for changes and modifications to be made to an existing partnership agreement in the state of Maryland. This process enables partnerships to reorganize their structure, operations, or ownership through amendments to their partnership agreement. It is essential for partnerships in Maryland to understand the requirements and procedures involved in this reorganization process. The Maryland Reorganization of Partnership by Modification of Partnership Agreement can take various forms, depending on the specific changes a partnership wants to implement. Some different types of reorganization that can occur are: 1. Change in Ownership: Partnerships may decide to modify their partnership agreement to accommodate changes in ownership. This could involve adding or removing partners, altering profit-sharing ratios, or restructuring the equity ownership within the partnership. 2. Change in Business Structure: Partnerships may choose to reorganize by modifying their partnership agreement to change their business structure. For instance, they may decide to transition to a limited liability partnership (LLP) or convert to a limited liability company (LLC) to gain certain legal protections or tax advantages. 3. Expansion or Restructuring of Operations: Partnerships may opt for reorganization to expand or restructure their operations. This could involve acquiring new business assets, adding new lines of business, or modifying the scope of services provided. 4. Dissolution or Merger: In some cases, partnerships may decide to dissolve the existing partnership and create a new entity or merge with another partnership. This type of reorganization can be relatively complex and requires careful consideration of legal, financial, and tax implications. To initiate a Maryland Reorganization of Partnership by Modification of Partnership Agreement, partnerships are required to follow certain steps. First, the partners must mutually agree on the modifications to be made and document them in an amended partnership agreement. The amended agreement must adhere to Maryland partnership laws and regulations. Once the amended partnership agreement is created, it must be executed and signed by all partners. Partnerships should also consider consulting with legal professionals who specialize in partnership law to ensure compliance with all applicable legal requirements. It is important to note that any amendments to the partnership agreement must be filed with the Maryland State Department of Assessments and Taxation to ensure legal validity. Overall, the Maryland Reorganization of Partnership by Modification of Partnership Agreement allows partnerships operating in Maryland to adapt to changing business needs, restructure ownership or operations, and take advantage of opportunities for growth. By following the necessary procedures and seeking legal guidance, partnerships can ensure a smooth and legally compliant reorganization process.

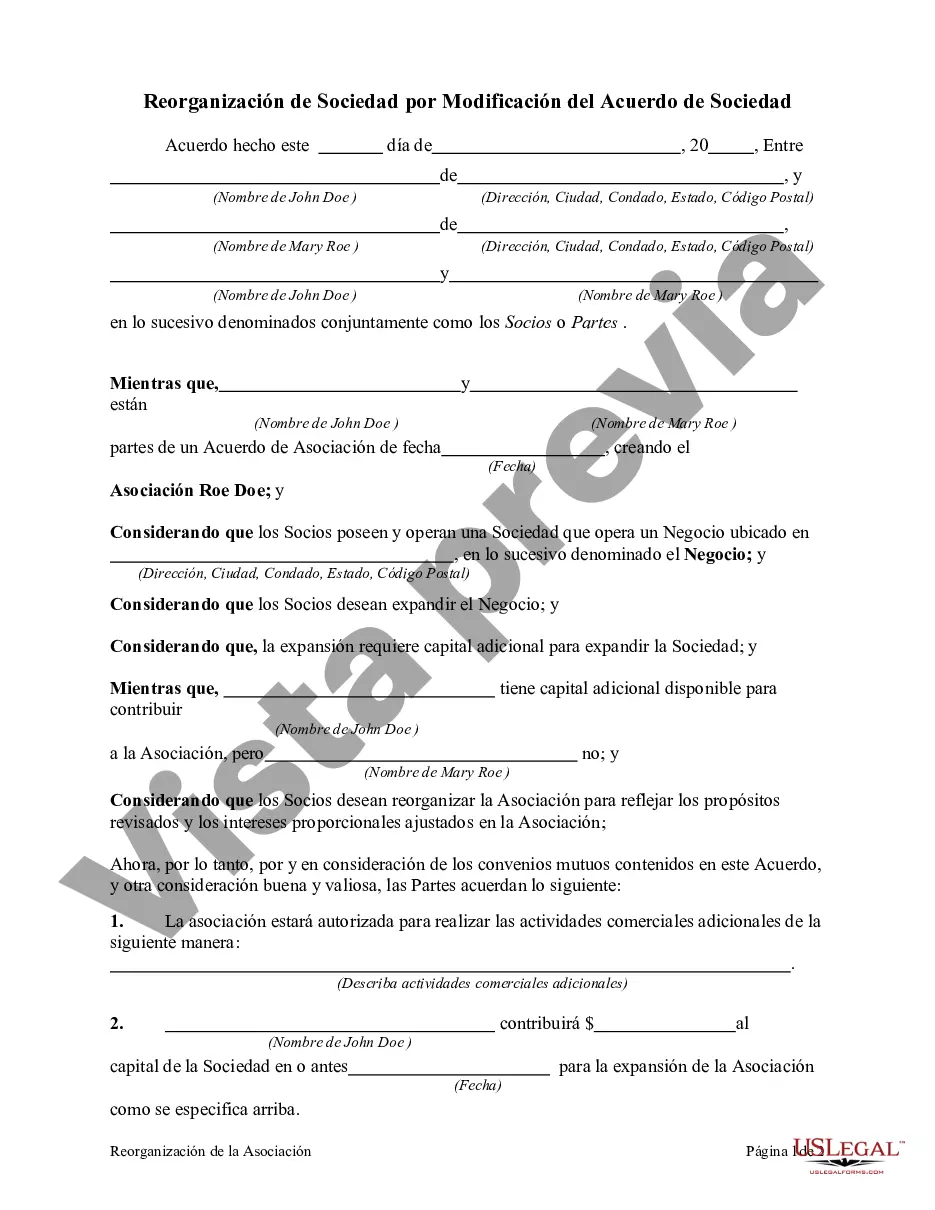

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Reorganización de Sociedad por Modificación del Acuerdo de Sociedad - Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Maryland Reorganización De Sociedad Por Modificación Del Acuerdo De Sociedad?

US Legal Forms - one of many most significant libraries of legitimate kinds in the USA - provides a wide array of legitimate file layouts it is possible to download or printing. While using site, you will get a huge number of kinds for organization and specific reasons, categorized by types, states, or search phrases.You will discover the most recent variations of kinds much like the Maryland Reorganization of Partnership by Modification of Partnership Agreement within minutes.

If you currently have a subscription, log in and download Maryland Reorganization of Partnership by Modification of Partnership Agreement through the US Legal Forms local library. The Download key can look on each and every develop you see. You gain access to all earlier acquired kinds from the My Forms tab of your respective account.

If you would like use US Legal Forms initially, listed below are simple directions to help you began:

- Ensure you have chosen the right develop to your town/area. Click the Preview key to check the form`s content. Look at the develop outline to actually have chosen the correct develop.

- In case the develop doesn`t fit your demands, make use of the Look for industry at the top of the display screen to get the the one that does.

- Should you be pleased with the shape, verify your option by clicking on the Buy now key. Then, select the pricing strategy you prefer and offer your credentials to sign up on an account.

- Procedure the transaction. Use your charge card or PayPal account to accomplish the transaction.

- Choose the file format and download the shape on your device.

- Make alterations. Complete, edit and printing and indication the acquired Maryland Reorganization of Partnership by Modification of Partnership Agreement.

Each and every design you added to your money does not have an expiration date and it is yours eternally. So, in order to download or printing an additional backup, just proceed to the My Forms section and then click about the develop you want.

Gain access to the Maryland Reorganization of Partnership by Modification of Partnership Agreement with US Legal Forms, by far the most comprehensive local library of legitimate file layouts. Use a huge number of expert and condition-certain layouts that satisfy your business or specific requires and demands.