Maryland General Assignment: A Comprehensive Overview Maryland General Assignment refers to a legal concept related to debt and property transfer in the state of Maryland, United States. It involves the transfer of one's assets, rights, and interests to a designated person or entity to settle a debt or obligation. In Maryland, there are two main types of General Assignment that are recognized and commonly used: General Assignment for the Benefit of Creditors (GBC) and General Assignment with Preferences or Preferences Act Assignment. 1. General Assignment for the Benefit of Creditors (GBC): This type of General Assignment is an alternative to bankruptcy for individuals or entities who are facing financial distress and want to settle their debts amicably. In a GBC, the debtor voluntarily transfers their assets to a neutral third-party, known as an Assignee or Trustee, who will distribute the assets to satisfy the creditors. The Assignee is responsible for identifying and collecting the debtor's assets, determining the validity of creditor claims, and distributing the proceeds according to an agreed-upon priority scheme. 2. General Assignment with Preferences or Preferences Act Assignment: This type of General Assignment is governed by Maryland's Preferences Act, which provides protection to a debtor's property from attachment by creditors. It allows individuals or businesses to transfer their property to a third party, known as an Assignee, for the purpose of protecting it from potential creditor claims. The Assignee holds the property until the specified time period has passed, during which creditors can file their claims. Once this period elapses, the property is returned to the debtor, without being subject to attachment by creditors who did not successfully file their claims. Maryland General Assignment can be a useful debt resolution tool for both individuals and businesses, as it offers an alternative to the potentially costly and time-consuming process of bankruptcy. It provides debtors the opportunity to settle their liabilities and protect their assets, while allowing creditors to receive their fair share of the debtor's estate. There are several key benefits associated with Maryland General Assignment, including: — Preservation of assets: Debtors can safeguard their assets from being seized or liquidated by creditors, allowing them to retain control over their property during the debt resolution process. — Simplified administration: Assignees or Trustees handle the complex tasks of evaluating creditor claims, identifying assets, and distributing proceeds, thereby providing a streamlined and efficient process for all parties involved. — Flexibility and customization: General Assignment allows debtors to negotiate a customized agreement with creditors, establishing repayment terms that are mutually beneficial and fair, aimed at satisfying the debts most efficiently. In conclusion, Maryland General Assignment encompasses two primary forms, General Assignment for the Benefit of Creditors (GBC) and General Assignment with Preferences. These legal mechanisms provide individuals and businesses with viable options for organizing and resolving their debts, ensuring fair treatment for both debtors and creditors.

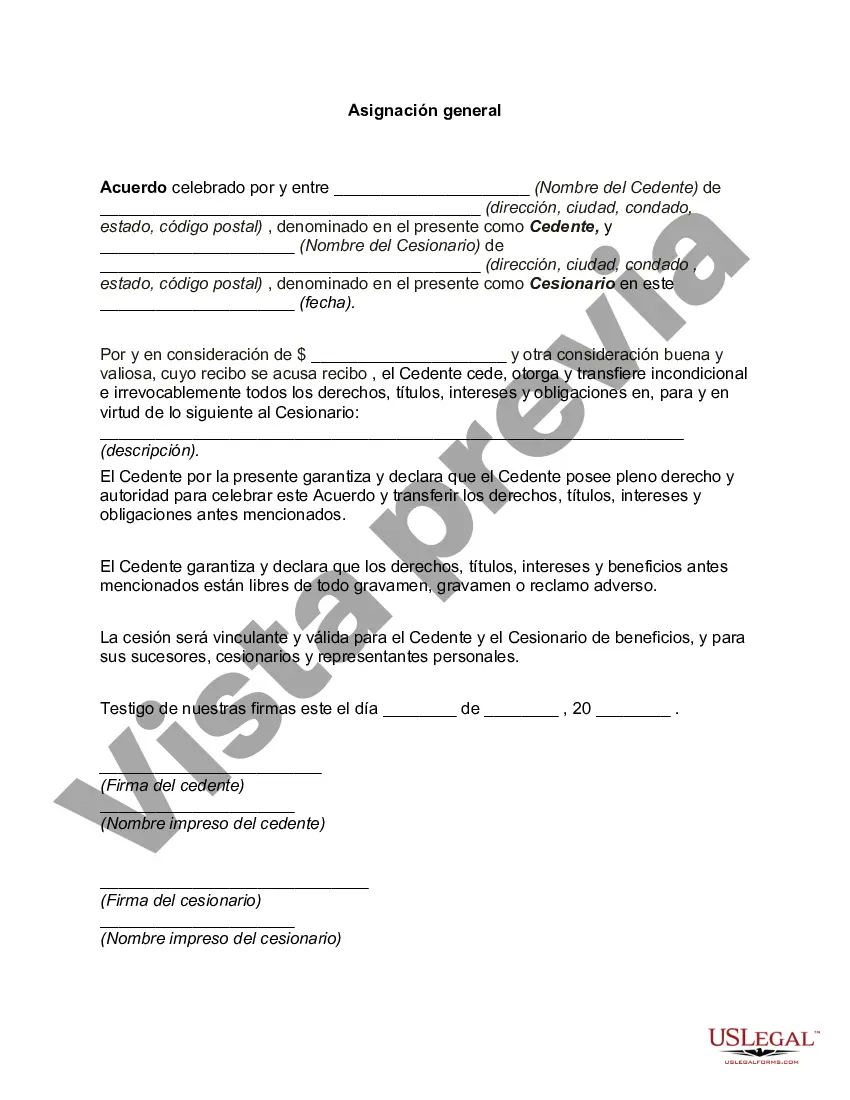

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Asignación general - General Assignment

Description

How to fill out Maryland Asignación General?

Have you been inside a place the place you need documents for either organization or personal reasons almost every time? There are plenty of authorized record themes available on the net, but locating types you can depend on is not simple. US Legal Forms gives 1000s of type themes, like the Maryland General Assignment, which are published to fulfill state and federal requirements.

Should you be already informed about US Legal Forms website and possess a merchant account, simply log in. Afterward, you may acquire the Maryland General Assignment web template.

If you do not come with an bank account and need to begin using US Legal Forms, follow these steps:

- Discover the type you need and ensure it is to the proper city/region.

- Make use of the Preview option to examine the form.

- Look at the information to ensure that you have selected the right type.

- In the event the type is not what you are searching for, take advantage of the Research field to discover the type that fits your needs and requirements.

- Whenever you discover the proper type, click on Get now.

- Choose the rates prepare you need, submit the necessary info to generate your bank account, and pay for an order making use of your PayPal or Visa or Mastercard.

- Choose a practical file structure and acquire your copy.

Find every one of the record themes you have purchased in the My Forms food selection. You can aquire a extra copy of Maryland General Assignment at any time, if required. Just click the needed type to acquire or print out the record web template.

Use US Legal Forms, by far the most extensive collection of authorized varieties, to conserve some time and prevent mistakes. The support gives expertly made authorized record themes which you can use for a variety of reasons. Generate a merchant account on US Legal Forms and commence generating your daily life a little easier.