Maryland Assignment Creditor's Claim Against Estate refers to a legal process in the state of Maryland where a creditor seeks to recover unpaid debts from the estate of a deceased individual. This process becomes relevant when there are outstanding debts owed by the deceased person at the time of their death. Keywords: Maryland, Assignment, Creditor's Claim Against Estate, legal process, unpaid debts, deceased individual, outstanding debts. In Maryland, when a person passes away, their estate includes all their assets, properties, and debts. If the deceased person owed money to a creditor, the creditor has the right to file a claim against the estate to recover the outstanding debt. However, to ensure a fair distribution of assets and protection for beneficiaries, the Maryland law provides a specific procedure for creditors to follow. There are primarily two types of Maryland Assignment Creditor's Claim Against Estate: 1. Maryland Assignment Creditor's Claim Against Real Property: This type of claim arises when the creditor believes that the deceased person's estate includes real property (real estate) that could be used to settle the outstanding debt. The creditor must file a claim with the appropriate Maryland court and provide evidence supporting their claim. The court will then evaluate the validity of the claim and determine if the creditor has a rightful interest in the real property. 2. Maryland Assignment Creditor's Claim Against Personal Property: This type of claim occurs when the creditor believes that the deceased person's estate contains personal property, such as bank accounts, vehicles, or valuable possessions, that could be used to satisfy the debt. Similar to claims against real property, the creditor must file a claim in the Maryland court and provide evidence substantiating their claim. The court will review the claim and ascertain if the creditor is entitled to recover the debt from the personal property. To initiate the Maryland Assignment Creditor's Claim Against Estate, the creditor must file a Petition for Assignment with the Orphans' Court or the Circuit Court where the deceased person resided. The petition should contain specific information, including the name and address of the decedent, the creditor's name and contact information, details of the debt owed, supporting documents, and any other relevant evidence. Once the claim is filed, the court will review the petition, notify the personal representative (executor) of the estate of the claim, and evaluate its validity. If the court determines that the claim is legitimate, it may grant an assignment of a portion of the estate's assets to satisfy the debt. If the assigned assets are insufficient to cover the debt fully, the creditor may have to share the remaining proceeds with other creditors who have filed claims. It is important to note that Maryland law imposes strict deadlines for filing a creditor's claim against an estate. Failure to meet these deadlines may result in a loss of the creditor's right to recover the debt. It is advisable for creditors to seek legal counsel to ensure compliance with all necessary requirements and to maximize their chances of successfully recovering the outstanding debts through the Maryland Assignment Creditor's Claim Against Estate process. In conclusion, Maryland Assignment Creditor's Claim Against Estate is a legal process that allows creditors to pursue unpaid debts from a deceased person's estate. By following the specific procedures outlined by Maryland law, creditors can present their claims and potentially recover what is owed to them from the estate's assets, either through a claim against real property or personal property. Understanding the intricacies of this process is crucial for creditors to protect their rights and seek debt settlement in a fair and timely manner.

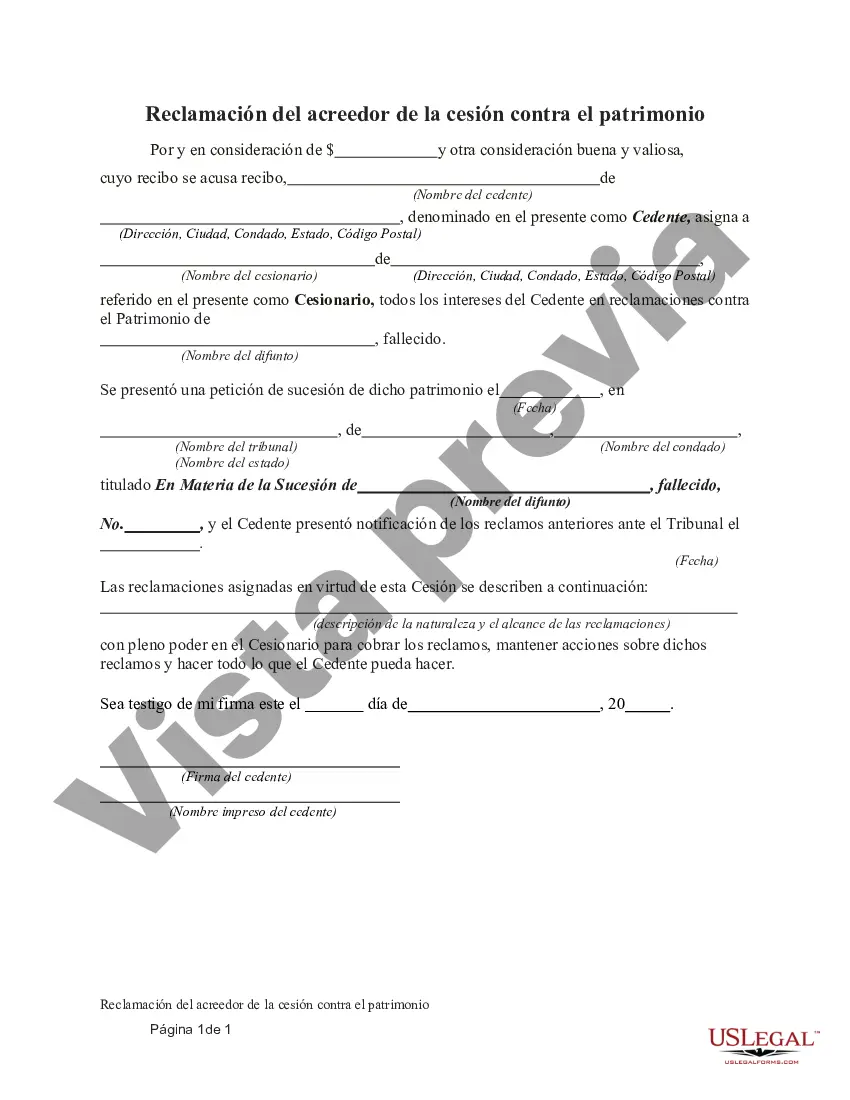

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Reclamación del acreedor de la cesión contra el patrimonio - Assignment Creditor's Claim Against Estate

Description

How to fill out Maryland Reclamación Del Acreedor De La Cesión Contra El Patrimonio?

US Legal Forms - among the biggest libraries of legal varieties in the States - offers an array of legal record web templates you may download or printing. Utilizing the website, you can get 1000s of varieties for organization and individual uses, sorted by classes, claims, or keywords.You will find the most up-to-date versions of varieties like the Maryland Assignment Creditor's Claim Against Estate within minutes.

If you have a subscription, log in and download Maryland Assignment Creditor's Claim Against Estate from the US Legal Forms library. The Download button will appear on every form you perspective. You get access to all earlier saved varieties inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms the very first time, allow me to share simple guidelines to get you started out:

- Make sure you have chosen the best form for your personal metropolis/area. Click on the Review button to analyze the form`s content. See the form description to actually have selected the correct form.

- In the event the form does not fit your needs, utilize the Search industry near the top of the display to discover the one that does.

- Should you be content with the shape, validate your decision by simply clicking the Get now button. Then, choose the rates program you prefer and supply your credentials to sign up for the accounts.

- Procedure the purchase. Utilize your credit card or PayPal accounts to perform the purchase.

- Find the file format and download the shape on the system.

- Make adjustments. Complete, revise and printing and indication the saved Maryland Assignment Creditor's Claim Against Estate.

Every single format you added to your money lacks an expiry date and is yours forever. So, if you want to download or printing another version, just visit the My Forms portion and then click about the form you want.

Obtain access to the Maryland Assignment Creditor's Claim Against Estate with US Legal Forms, the most comprehensive library of legal record web templates. Use 1000s of expert and state-certain web templates that meet your company or individual demands and needs.