Maryland Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time: Explained A Maryland Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a type of trust established in Maryland that allows individuals to set aside assets for the benefit of a future beneficiary while receiving income from those assets after a specified time. This trust, also known as an income-only trust or a beneficiary trust, offers individuals the ability to control their assets and ensure financial security for themselves while designating a future beneficiary to receive the ultimate benefit. The trust or (also known as the granter or settler) creates the trust and transfers their assets into it, effectively removing them from their estate. The defining feature of this Maryland Irrevocable Trust is that during the specified time, typically set by the trust or, the income generated by the trust's assets is payable back to the trust or. This arrangement allows the trust or to maintain financial stability and receive income from the trust, while still preserving the assets for the future beneficiary. Within the category of Maryland Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, there can be variations and subtypes based on specific circumstances and preferences. Some common variations include: 1. Charitable Remainder Trust: This type of trust allows the trust or to receive income from the trust for a specified time, after which any remaining assets are donated to a charitable organization. 2. Generation-Skipping Trust: This trust is designed to pass the assets to future generations while bypassing the immediate beneficiaries (typically the trust or's children). The income can be payable to the trust or for a specific time period before passing to subsequent generations. 3. Qualified Personnel Residence Trust (PRT): A PRT allows the trust or to transfer their primary residence or vacation home to the trust, receiving income from its use for a specified term before ultimately passing it on to the beneficiary. This type of trust provides estate tax benefits. 4. Granter Retained Annuity Trust (GREAT): A GREAT allows the trust or to transfer assets into the trust and retain a fixed annuity payment for a specified period. At the end of the term, any remaining assets pass to the beneficiary, offering potential estate tax benefits. In all variants of the Maryland Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, the trust or must carefully consider the terms, duration, and income distribution to meet their specific needs and objectives. Consulting with a trust attorney or financial advisor is crucial to ensure compliance with Maryland laws and to maximize the benefits of such a trust structure. Overall, a Maryland Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time provides a flexible and efficient tool for individuals to safeguard their assets, maintain financial stability, and secure the financial well-being of future generations.

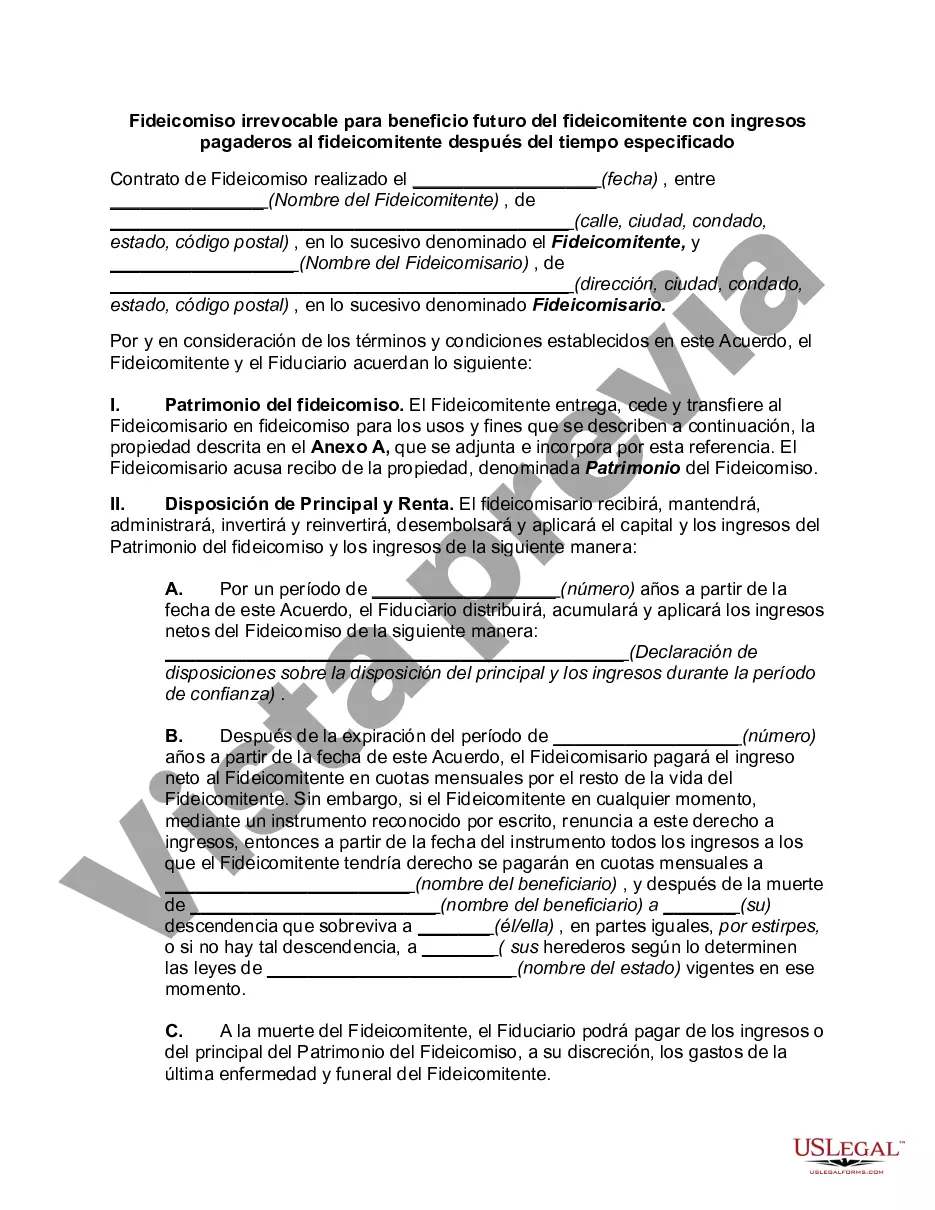

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Maryland Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

If you want to comprehensive, down load, or printing legitimate document themes, use US Legal Forms, the greatest selection of legitimate forms, which can be found on the web. Utilize the site`s easy and handy look for to find the files you will need. Various themes for enterprise and personal reasons are sorted by classes and claims, or search phrases. Use US Legal Forms to find the Maryland Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time within a number of clicks.

If you are presently a US Legal Forms client, log in to the account and click on the Acquire switch to have the Maryland Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time. You can even gain access to forms you earlier downloaded inside the My Forms tab of your account.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for that right metropolis/nation.

- Step 2. Take advantage of the Review solution to look over the form`s articles. Do not neglect to see the information.

- Step 3. If you are unsatisfied with all the type, make use of the Look for discipline near the top of the screen to find other types in the legitimate type template.

- Step 4. Once you have discovered the shape you will need, select the Get now switch. Pick the prices strategy you choose and put your accreditations to sign up for the account.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal account to accomplish the transaction.

- Step 6. Select the formatting in the legitimate type and down load it on the product.

- Step 7. Comprehensive, modify and printing or indicator the Maryland Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

Every legitimate document template you get is the one you have eternally. You may have acces to each type you downloaded inside your acccount. Click on the My Forms section and choose a type to printing or down load once again.

Be competitive and down load, and printing the Maryland Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time with US Legal Forms. There are millions of skilled and condition-particular forms you can use for your personal enterprise or personal demands.

Form popularity

FAQ

An irrevocable trust provides an alternative to simply giving an asset to a beneficiary in order to reduce your taxable estate. With a trust, you can set the timing of distributions (i.e. when the beneficiary attains 30 years of age) as well as the reasons for distributions (i.e. for education only).

Can a beneficiary withdraw money from an irrevocable trust? The trustee of an irrevocable Trust cannot withdraw money except to benefit the Trust. These terms include paying maintenance costs and disbursement income to beneficiaries. However, it is not possible to withdraw money for personal or business use.

Retained Interest Trusts This is a trust where a grantor makes an irrevocable transfer of assets but reserves the right to receive income or enjoyment of those assets for a period of time. When the trust then subsequently terminates, the assets are passed on to others.

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

A credit shelter trust, also known as a bypass trust or a family trust, is a trust fund that allows the trustor to grant the recipients an amount of assets or funds up to the estate-tax exemption.