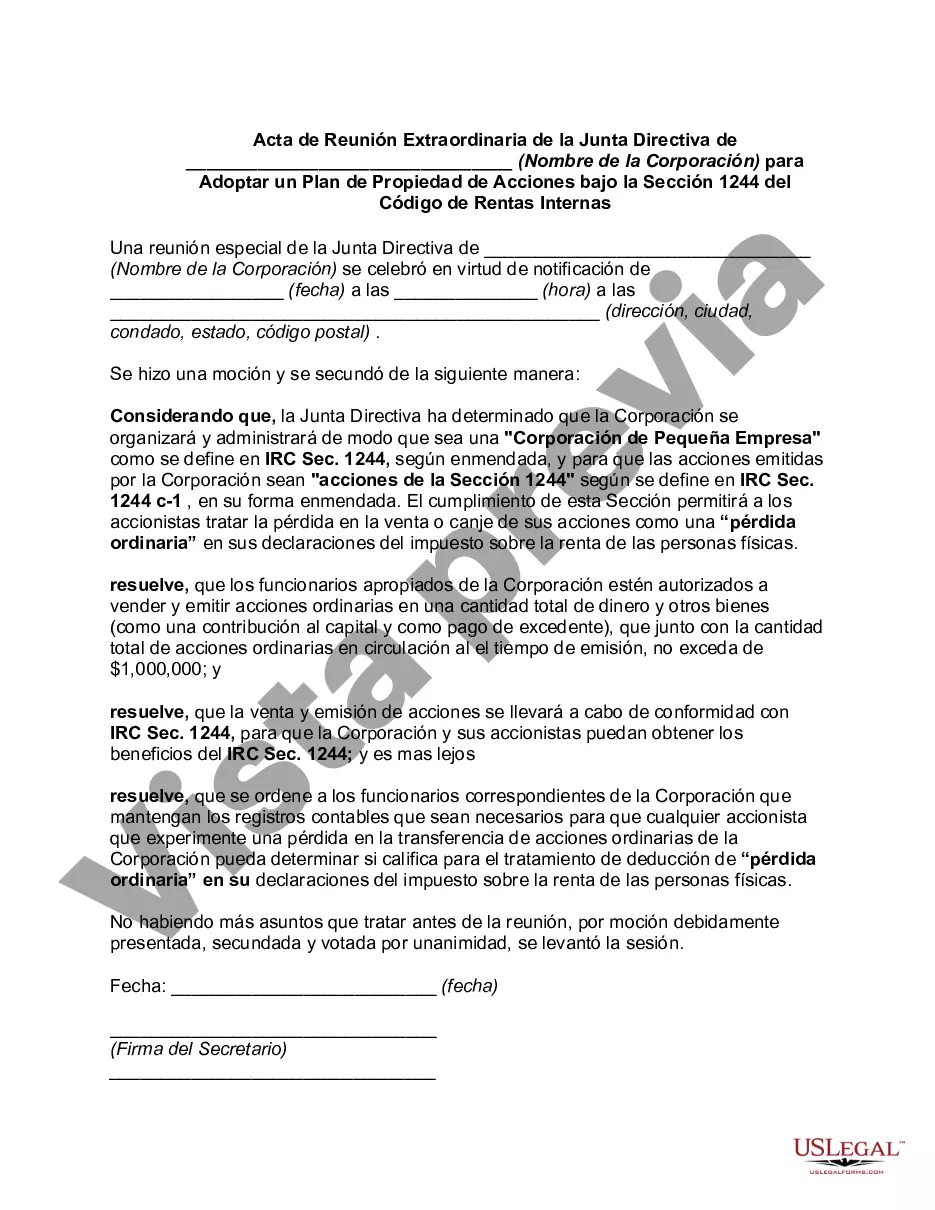

Maryland Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code In accordance with the Maryland Corporation Law, a special meeting of the Board of Directors of (Name of Corporation) was held on [Date]. The purpose of this meeting was to discuss and formally adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. The Board of Directors convened at [Time] and were present at the meeting: [List of Directors' Names]. Also, present were [List any other individuals present such as the corporate secretary or legal counsel]. The meeting was called to order by the Chairperson, [Name of Chairperson], who verified a quorum was present. The Chairperson outlined the agenda and opened the floor for discussion regarding the adoption of the Stock Ownership Plan. During the course of the meeting, the Board of Directors thoroughly reviewed the provisions and implications of the Stock Ownership Plan as outlined in the proposed document. Pertinent topics, such as tax benefits under Section 1244 of the Internal Revenue Code, were discussed extensively. After careful consideration and evaluation of the proposed Stock Ownership Plan, the Board of Directors unanimously agreed to adopt the plan. The plan is intended to promote employee ownership and incentivize key employees by offering them stock ownership in the corporation. The Stock Ownership Plan includes provisions specifying eligibility criteria, the allocation of shares, vesting periods, restrictions on transferability, and valuation methods for the shares. The plan comprises essential details to ensure compliance with Section 1244 of the Internal Revenue Code and maximize the potential tax benefits for the corporation and its shareholders. Upon adoption of the Stock Ownership Plan, a motion was made by [Director's Name] and seconded by [Director's Name]. A roll call vote was conducted, and all members of the Board of Directors present voted in favor of the adoption, establishing a unanimous decision. It was resolved that the Secretary of the corporation shall ensure that the adopted Stock Ownership Plan is properly recorded and filed in the corporate records. Additionally, the Secretary was directed to provide copies of the minutes of this meeting, along with a certified copy of the adopted Stock Ownership Plan, to all directors and relevant corporate officers. This concludes the Minutes of the Special Meeting wherein the Board of Directors of (Name of Corporation) formally adopted the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. Alternative types of Maryland Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code may include: 1. Maryland Minutes of Special Meeting of the Board of Directors to Amend an Existing Stock Ownership Plan under Section 1244 of the Internal Revenue Code 2. Maryland Minutes of Special Meeting of the Board of Directors to Revoke a Stock Ownership Plan under Section 1244 of the Internal Revenue Code 3. Maryland Minutes of Special Meeting of the Board of Directors to Transfer Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Maryland Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

If you have to total, obtain, or printing legal papers templates, use US Legal Forms, the largest assortment of legal varieties, that can be found on the Internet. Make use of the site`s basic and handy research to find the papers you will need. A variety of templates for company and specific purposes are sorted by categories and says, or keywords. Use US Legal Forms to find the Maryland Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code in just a handful of mouse clicks.

When you are currently a US Legal Forms client, log in for your bank account and click the Acquire button to obtain the Maryland Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code. You can even access varieties you in the past acquired in the My Forms tab of your own bank account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the right metropolis/nation.

- Step 2. Utilize the Preview choice to examine the form`s articles. Never neglect to see the information.

- Step 3. When you are unhappy with the kind, take advantage of the Search area on top of the display screen to discover other types of your legal kind design.

- Step 4. Upon having located the form you will need, click the Buy now button. Choose the pricing prepare you favor and include your accreditations to register on an bank account.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Find the structure of your legal kind and obtain it on the system.

- Step 7. Complete, change and printing or sign the Maryland Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

Every single legal papers design you buy is the one you have forever. You might have acces to every kind you acquired within your acccount. Click the My Forms segment and choose a kind to printing or obtain again.

Be competitive and obtain, and printing the Maryland Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code with US Legal Forms. There are many specialist and condition-particular varieties you can use for the company or specific requires.