The Maryland Authority of Partnership to Open Deposit Account and to Procure Loans is a legal provision that grants authorization to partnerships in Maryland to open deposit accounts and procure loans. This authority is essential for partnerships wishing to establish financial accounts and secure loans to support their business operations and growth. In Maryland, there are two types of authorities related to the partnership's ability to open deposit accounts and procure loans: general partnerships and limited partnerships. General Partnership: A general partnership is a business structure where two or more individuals or entities join forces carrying out a business venture. With the Maryland Authority of Partnership to Open Deposit Account and to Procure Loans, general partnerships can legally open bank accounts under their partnership name and apply for loans in the partnership's name. This authority provides partnerships with the necessary legal framework to conduct financial operations efficiently. Limited Partnership: In contrast to a general partnership, a limited partnership involves two types of partners: general partners and limited partners. The general partners have unlimited liability and have authority over the management of the partnership, while limited partners have limited liability and are not involved in the day-to-day operations. Limited partnerships in Maryland can also take advantage of the Authority of Partnership to Open Deposit Account and to Procure Loans, allowing them to establish deposit accounts and apply for loans under the partnership name. The Maryland Authority of Partnership to Open Deposit Account and to Procure Loans offers partnerships the flexibility to manage their finances effectively. By having the legal capacity to open deposit accounts, partnerships can securely hold funds and manage their transactions. Additionally, the ability to procure loans enables partnerships to access capital, which can be crucial for business expansion, acquiring assets, or navigating challenging financial situations. It is important for partnerships to understand and comply with the regulations and requirements associated with the Maryland Authority of Partnership to Open Deposit Account and to Procure Loans. Seeking professional advice from attorneys or financial consultants is recommended to ensure compliance with all necessary legal procedures while utilizing this authority effectively. In conclusion, the Maryland Authority of Partnership to Open Deposit Account and to Procure Loans empowers partnerships, both general and limited, to establish deposit accounts and secure loans. This legal provision facilitates partnerships' financial operations, providing them with the capacity to efficiently manage funds and access capital for business development and growth.

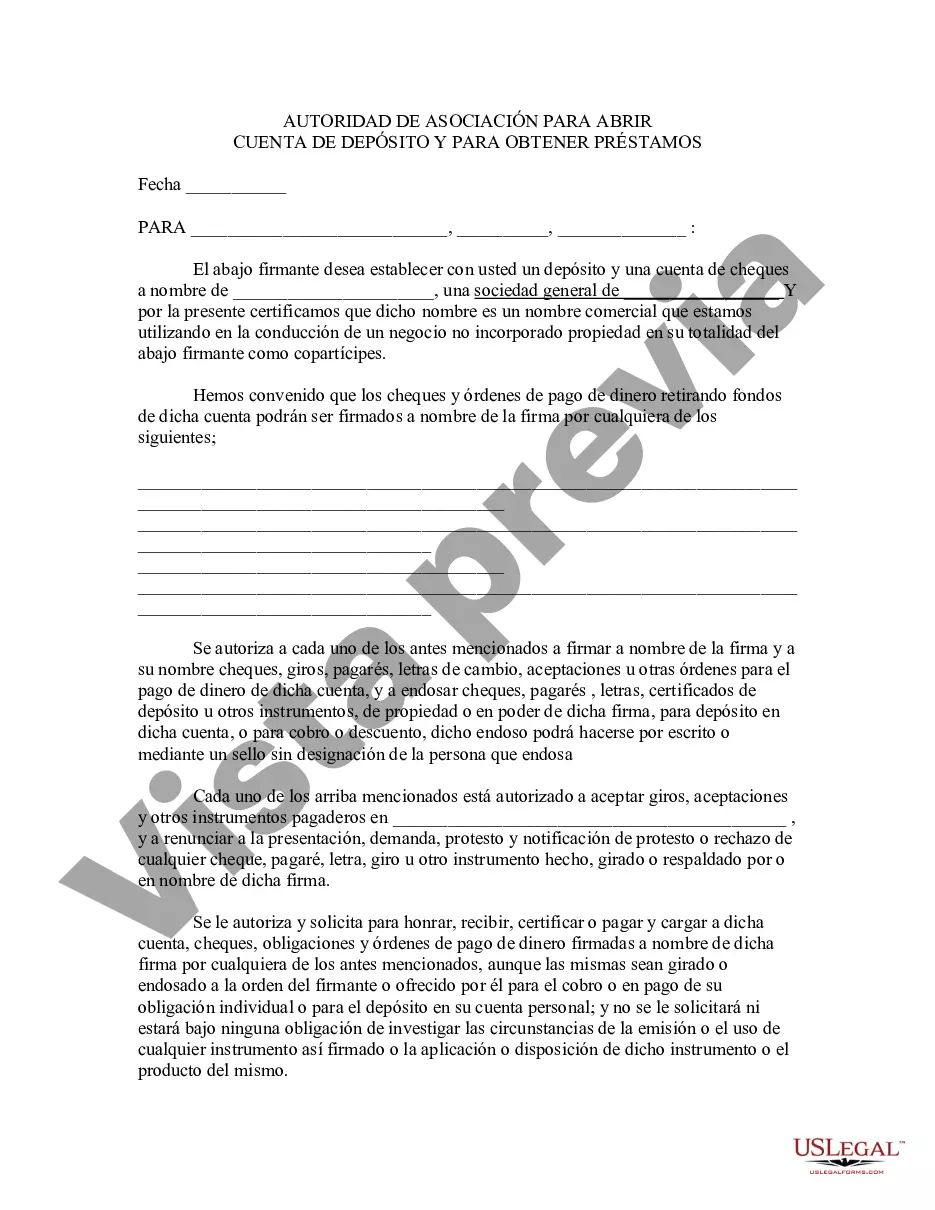

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Autoridad de la Asociación para Abrir Cuentas de Depósito y Procurar Préstamos - Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Maryland Autoridad De La Asociación Para Abrir Cuentas De Depósito Y Procurar Préstamos?

Choosing the right legitimate papers design can be a battle. Of course, there are tons of layouts available on the net, but how would you obtain the legitimate kind you want? Utilize the US Legal Forms internet site. The assistance delivers thousands of layouts, like the Maryland Authority of Partnership to Open Deposit Account and to Procure Loans, that you can use for organization and personal demands. All the varieties are checked out by professionals and fulfill federal and state needs.

Should you be already registered, log in in your account and click on the Down load switch to obtain the Maryland Authority of Partnership to Open Deposit Account and to Procure Loans. Utilize your account to check from the legitimate varieties you have ordered earlier. Go to the My Forms tab of your account and get one more backup of your papers you want.

Should you be a whole new user of US Legal Forms, here are easy instructions that you can comply with:

- First, ensure you have selected the proper kind for your personal town/state. You may look through the form utilizing the Preview switch and browse the form explanation to guarantee this is the right one for you.

- If the kind does not fulfill your preferences, make use of the Seach area to find the proper kind.

- Once you are certain the form is suitable, go through the Purchase now switch to obtain the kind.

- Choose the rates strategy you would like and enter the essential details. Design your account and purchase the transaction using your PayPal account or Visa or Mastercard.

- Select the file format and obtain the legitimate papers design in your product.

- Complete, modify and print and indicator the received Maryland Authority of Partnership to Open Deposit Account and to Procure Loans.

US Legal Forms is definitely the largest local library of legitimate varieties for which you can discover a variety of papers layouts. Utilize the service to obtain expertly-manufactured papers that comply with condition needs.