Title: Maryland Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time Introduction: In Maryland, debtors often find themselves burdened with high interest rates on their credit cards, making it challenging to manage their financial obligations effectively. This article provides a detailed description of a Maryland letter that debtors can use to request a lower interest rate for a specific timeframe from their credit card companies. By incorporating relevant keywords, we aim to support debtors in their pursuit of better financial terms. 1. Structure of a Maryland Letter from Debtor to Credit Card Company: — Salutation: Address the letter to the appropriate department or individual within the credit card company. — Introduction: Begin by clearly stating the purpose of the letter — to request a lower interest rate for a specific period. — Account Details: Provide relevant account information, including the account number, cardholder name, and any other pertinent details. — Justification: Explain the reasons for seeking a lower interest rate, such as financial difficulties, unexpected expenses, or comparisons with existing, more favorable rates. — Offer: Propose the desired lower interest rate for a specific period, ensuring it is reasonable and manageable for both parties. — Supporting Evidence: Attach any supporting documents, such as financial statements, to strengthen your case. — Conclusion: Express gratitude for their consideration and request a prompt response. — Contact Information: Include your full name, contact number, and email address for easy correspondence. 2. Types of Maryland Letters from Debtors to Credit Card Companies Requesting a Lower Interest Rate: — Temporary Financial Hardship: This letter requests a lower interest rate to alleviate financial burdens caused by temporary hardships, such as unexpected medical bills or job loss. — Comparison with Competitor Rates: This type of letter compares the current interest rate on the credit card to lower rates offered by competitors, emphasizing the need for a more competitive rate. — Longstanding Customer Loyalty: Debtors who have been loyal customers for a significant period may draft a letter emphasizing their loyalty and request a lower interest rate as a reward for their continued business. — Balance Transfer Terms: For debtors seeking to consolidate their credit card debt through balance transfers, this letter seeks a lower interest rate for a specific duration to facilitate the transfer process. Conclusion: By utilizing a well-structured Maryland letter, debtors can effectively communicate with their credit card companies, requesting a lower interest rate for a set timeframe. This approach may help them to manage their finances more efficiently, relieve temporary financial difficulties, and explore opportunities for debt consolidation. Remember to customize the letter's content based on individual circumstances and maintain a polite and professional tone throughout the correspondence.

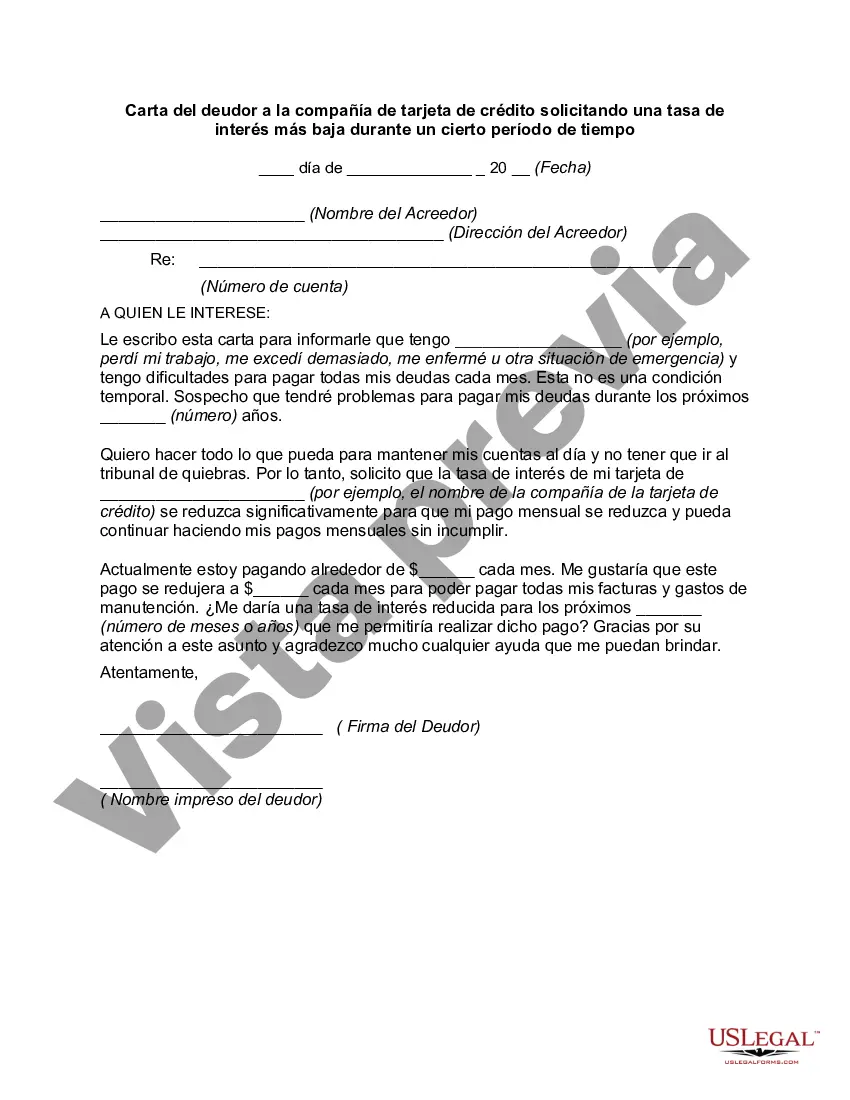

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Maryland Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

Finding the right legitimate papers template might be a struggle. Of course, there are a variety of layouts available on the net, but how would you find the legitimate kind you will need? Take advantage of the US Legal Forms web site. The support provides thousands of layouts, including the Maryland Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, that you can use for company and private needs. Each of the kinds are inspected by professionals and satisfy state and federal needs.

In case you are presently signed up, log in in your profile and click on the Download option to have the Maryland Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Use your profile to look through the legitimate kinds you possess bought formerly. Check out the My Forms tab of your respective profile and get an additional duplicate in the papers you will need.

In case you are a brand new customer of US Legal Forms, listed here are basic guidelines that you should comply with:

- Very first, ensure you have chosen the right kind for your personal area/region. You may look through the form utilizing the Preview option and browse the form outline to make sure this is the right one for you.

- In the event the kind is not going to satisfy your requirements, utilize the Seach industry to get the appropriate kind.

- When you are positive that the form is acceptable, click on the Buy now option to have the kind.

- Opt for the costs strategy you would like and enter the required info. Create your profile and purchase the transaction making use of your PayPal profile or Visa or Mastercard.

- Pick the file structure and download the legitimate papers template in your system.

- Total, revise and produce and sign the acquired Maryland Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

US Legal Forms is definitely the biggest local library of legitimate kinds where you can see numerous papers layouts. Take advantage of the company to download skillfully-created files that comply with status needs.

Form popularity

FAQ

If you're unhappy with your credit card's interest rate, securing a lower one may be as simple as asking your credit card issuer. They may decline your request, but it doesn't hurt to ask. If you've established a history of on-time payments and other responsible behavior with the issuer, your odds may be good.

How Long Can a Debt Collector Pursue an Old Debt? Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

Call your card provider: Contact your credit card issuer and explain why you would like an interest rate reduction. You could start by pointing out your history with the company and mention your good credit or on-time payment history.

You can negotiate a lower interest rate on your credit card by calling your credit card issuerparticularly the issuer of the account you've had the longestand requesting a reduction.

In Maryland, the statute of limitations on debt collection is three years. This means creditors have up to three years to file a lawsuit against you for the debt you supposedly owe.

It's often possible to negotiate terms, interest rates, and payments on credit card debt. You can also try to negotiate a settlement of the amount you owe. The steps you take and the options available will depend on your situation and the credit card company you're dealing with.

State in the letter you are requesting an interest rate reduction for the following reasons and be specific. Include competitor offers with lower rates, your creditor's own new introductory rates, and state your timely payment history and length of time you've had the account.

Yes. There are time limits governing when a creditor can sue you for a debt. These laws are called the statute of limitations. In Maryland, the statute of limitations requires that a lawsuit be filed within three years for written contracts, and 3 years for open accounts, such as credit cards.

Here are 11 ways to pay off high interest credit cards.Try Paying With Cash.Consider a Credit Card Balance Transfer.Pay More Than the Minimum Amount Due.Lower Your Expenses.Increase Your Income.Sell Your Old Stuff.Ask for Lower Interest Rates.Pay Off High Interest Credit Cards First.More items...?03-Dec-2019