Maryland Credit Approval Form is a document used by financial institutions and lenders in the state of Maryland to evaluate and approve credit applications. This form is crucial in the credit approval process as it enables lenders to assess the creditworthiness of borrowers and determine their eligibility for obtaining credit. Keywords: Maryland, credit approval form, financial institutions, lenders, credit applications, creditworthiness, eligibility, obtaining credit. There are several types of Maryland Credit Approval Forms, each serving a specific purpose within the lending industry: 1. Personal Credit Approval Form: This type of form is designed for individuals seeking personal loans or credit. It collects personal information, such as name, address, social security number, and employment details. Additionally, it gathers financial data, including income, assets, liabilities, and credit history. 2. Business Credit Approval Form: This form is used by lenders when evaluating credit applications from businesses. It gathers information about the company's financial position, such as revenue, expenses, assets, liabilities, and credit history. It may also require details about the business structure and ownership. 3. Mortgage Credit Approval Form: Mortgage lenders use this form to assess creditworthiness specifically for mortgage loans. It collects detailed financial information, employment history, current debts, assets, and liabilities to determine the borrower's ability to repay the loan. 4. Auto Loan Credit Approval Form: This form is utilized by lenders when evaluating credit applications for auto loans. It gathers information about the borrower's employment, income, credit history, and other financial details to determine the risk associated with lending funds for the purchase of a vehicle. 5. Student Loan Credit Approval Form: This form is used by lenders offering student loans to evaluate the creditworthiness of applicants. It collects information about the student's academic program, school enrollment, and financial circumstances to assess eligibility and determine loan terms. It is important to note that while these different types of Maryland Credit Approval Forms may have varying sections and requirements, they all serve the common purpose of assessing creditworthiness and eligibility for various types of credit facilities within the state of Maryland.

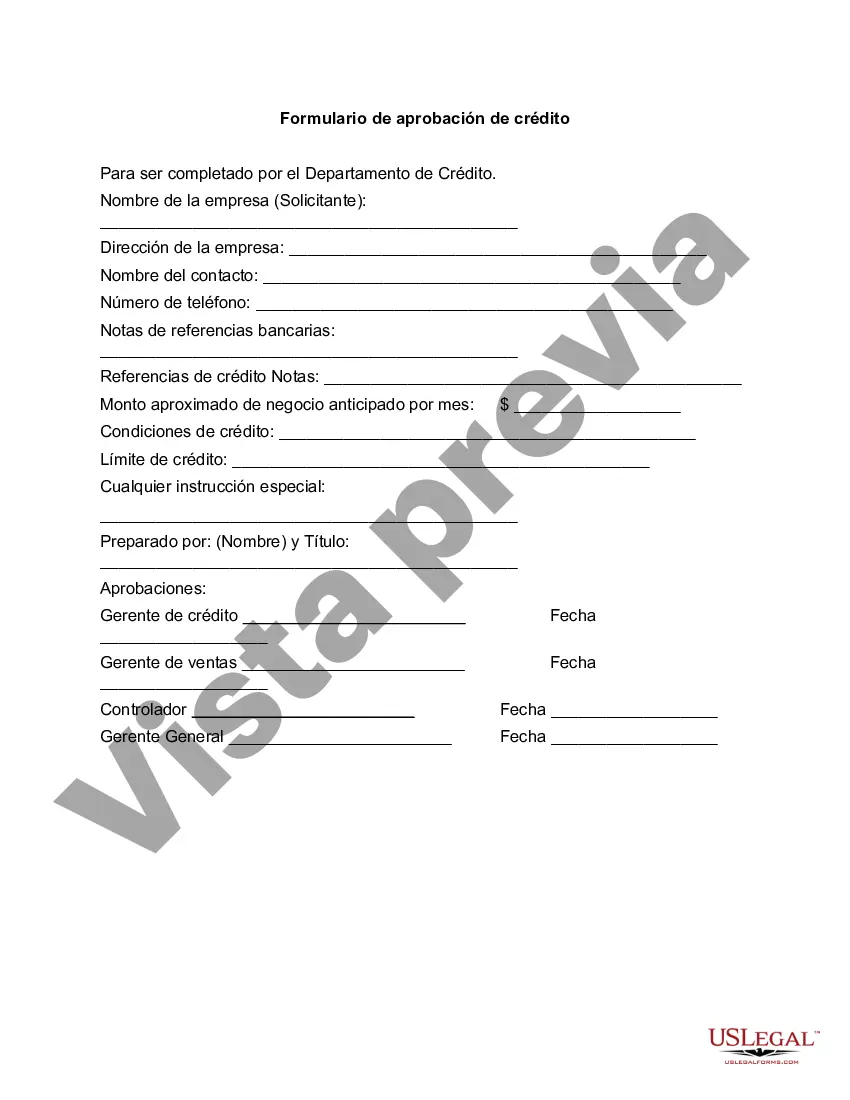

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Maryland Formulario De Aprobación De Crédito?

If you wish to total, download, or print out legal file templates, use US Legal Forms, the biggest assortment of legal kinds, which can be found on the Internet. Make use of the site`s easy and hassle-free lookup to obtain the paperwork you require. A variety of templates for enterprise and specific functions are categorized by categories and claims, or keywords. Use US Legal Forms to obtain the Maryland Credit Approval Form within a handful of mouse clicks.

In case you are currently a US Legal Forms buyer, log in to the profile and click on the Obtain option to get the Maryland Credit Approval Form. You may also entry kinds you in the past downloaded from the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the appropriate area/land.

- Step 2. Utilize the Review solution to look over the form`s content material. Don`t forget about to read through the information.

- Step 3. In case you are unsatisfied together with the form, use the Lookup industry on top of the screen to discover other types from the legal form format.

- Step 4. When you have located the form you require, select the Get now option. Opt for the pricing prepare you choose and include your credentials to register for the profile.

- Step 5. Process the financial transaction. You can use your credit card or PayPal profile to perform the financial transaction.

- Step 6. Pick the file format from the legal form and download it in your device.

- Step 7. Total, edit and print out or indicator the Maryland Credit Approval Form.

Each and every legal file format you get is your own eternally. You have acces to each form you downloaded inside your acccount. Select the My Forms portion and pick a form to print out or download once more.

Compete and download, and print out the Maryland Credit Approval Form with US Legal Forms. There are thousands of specialist and express-specific kinds you can utilize to your enterprise or specific demands.