Maryland Credit Information Request is a formal process that allows individuals or businesses to obtain their credit information from credit bureaus in Maryland. It serves as a means to access comprehensive credit reports, providing insights into an individual's creditworthiness and financial history. Maryland's law mandates that credit bureaus must fulfill these requests within a certain timeframe, ensuring consumers have a fair and transparent view of their credit profile. The credit information obtained through Maryland Credit Information Request includes various key details relevant to one's creditworthiness. This encompasses information about credit accounts, such as credit cards, loans, mortgages, and their respective balances. It also includes payment history, credit utilization, credit inquiries from lenders, public records (including bankruptcies or liens), and any collection accounts. Additionally, personal information like name, address, and Social Security number may also be included. There are different types of Maryland Credit Information Requests that individuals can choose from, depending on their requirements. These include: 1. Personal Credit Information: This type of request is specifically designed for individual consumers who wish to review their personal credit reports. It allows them to thoroughly evaluate their credit standing, identify any errors or discrepancies, and make informed decisions regarding loans, mortgages, or credit card applications. 2. Business Credit Information: This type of request pertains to businesses or companies seeking insights into their credit history. It helps enterprises evaluate their creditworthiness, determine their ability to secure financing, negotiate favorable terms with suppliers or lenders, and make informed financial decisions. 3. Joint Credit Information: Maryland Credit Information Request also allows for joint requests. This caters to situations where two or more individuals share credit accounts or loans, such as spouses or business partners. The joint credit information request enables an inclusive view of the credit profile of all parties involved. It is important to note that Maryland Credit Information Request may have specific eligibility criteria, documentation requirements, and fees associated, which are determined by credit bureaus or agencies. It is advisable to thoroughly review the process guidelines and gather all necessary documents before submitting a request to ensure a smooth and successful credit information retrieval process.

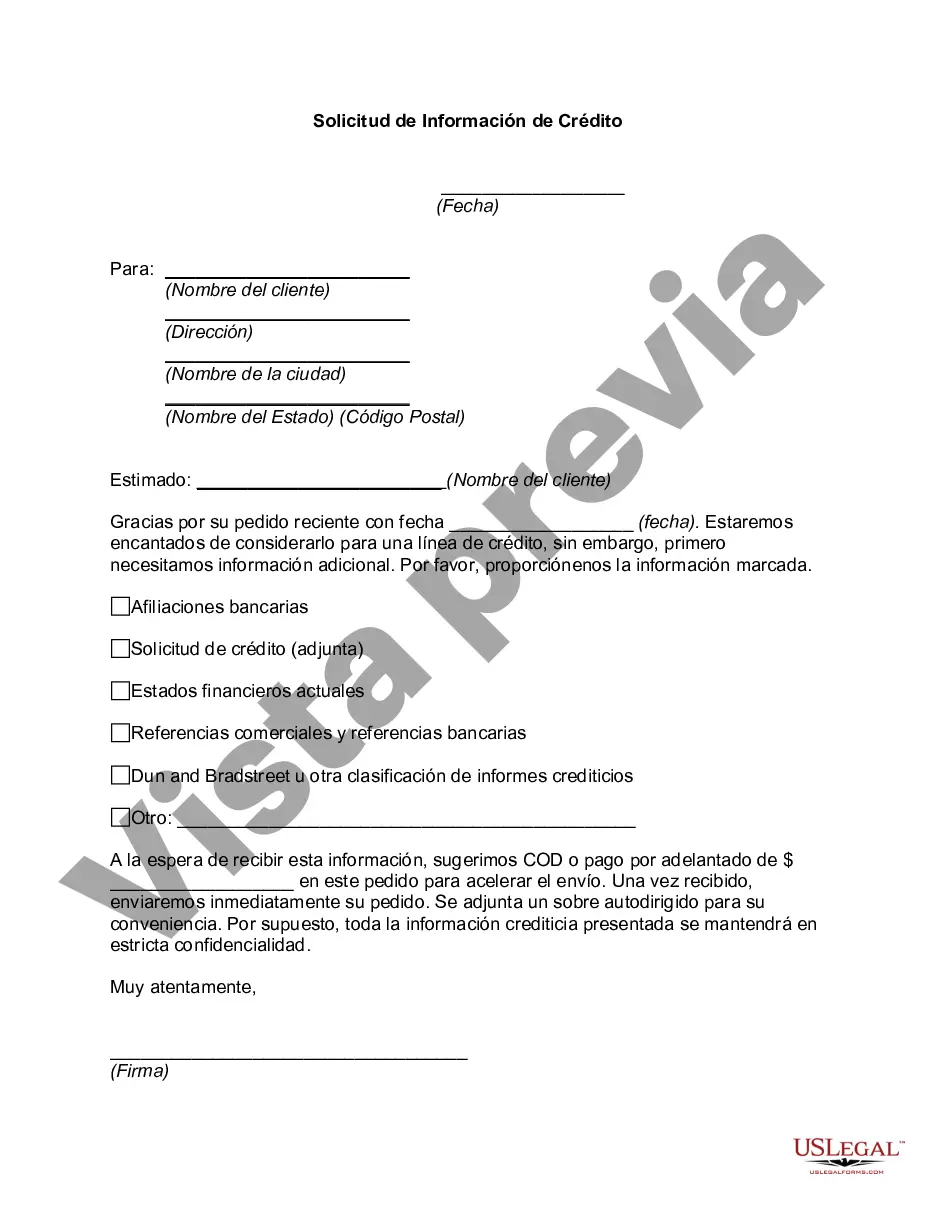

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Maryland Solicitud De Información De Crédito?

US Legal Forms - one of the biggest libraries of legitimate forms in the USA - gives a wide array of legitimate record templates you may acquire or printing. Using the internet site, you can find a large number of forms for enterprise and personal purposes, sorted by groups, says, or search phrases.You can find the newest versions of forms just like the Maryland Credit Information Request within minutes.

If you have a membership, log in and acquire Maryland Credit Information Request from the US Legal Forms catalogue. The Acquire switch will appear on each and every kind you perspective. You get access to all in the past downloaded forms from the My Forms tab of your own bank account.

If you want to use US Legal Forms the first time, listed here are straightforward instructions to obtain started off:

- Ensure you have chosen the best kind to your metropolis/county. Click on the Review switch to review the form`s content. Browse the kind explanation to actually have chosen the proper kind.

- In the event the kind doesn`t fit your requirements, make use of the Lookup area near the top of the display screen to discover the one who does.

- In case you are content with the form, affirm your selection by simply clicking the Get now switch. Then, select the pricing plan you want and give your references to register for an bank account.

- Approach the deal. Utilize your credit card or PayPal bank account to finish the deal.

- Select the formatting and acquire the form on your own product.

- Make changes. Load, edit and printing and signal the downloaded Maryland Credit Information Request.

Each and every format you included with your account does not have an expiration time and is also your own property for a long time. So, if you wish to acquire or printing yet another backup, just visit the My Forms area and click in the kind you require.

Gain access to the Maryland Credit Information Request with US Legal Forms, probably the most considerable catalogue of legitimate record templates. Use a large number of specialist and state-specific templates that meet up with your small business or personal requirements and requirements.