Maryland Demand for a Shareholders Meeting: A Comprehensive Overview Introduction: A Maryland Demand for a Shareholders Meeting is a crucial process that allows shareholders to exercise their rights and ensure effective corporate governance within a Maryland corporation. This detailed description will provide an in-depth analysis of what a Maryland Demand for a Shareholders Meeting entails, the reasons for issuing such demands, and the different types that can be utilized. Keywords: Maryland, Demand for a Shareholders Meeting, Shareholders' rights, Corporate governance, Maryland Corporation. 1. Understanding Maryland Demand for a Shareholders Meeting: A Maryland Demand for a Shareholders Meeting refers to the formal request made by shareholders to convene a meeting for important matters affecting the corporation. This demand gives shareholders the opportunity to express concerns, propose resolutions, and participate actively in decision-making processes. 2. Reasons for Issuing a Maryland Demand for a Shareholders Meeting: 2.1 Addressing critical issues: Shareholders can issue a demand to address urgent matters that require immediate attention, such as corporate restructuring, director elections, or mergers and acquisitions. 2.2 Exercising rights: Shareholders have the right to demand meetings as specified in a corporation's bylaws, enabling them to ensure that their interests are protected, and corporate decisions are made transparently. 2.3 Challenging management decisions: Shareholders may use a Demand for a Shareholders Meeting to challenge management decisions or seek redress for perceived injustices or inadequate governance practices. 3. Types of Maryland Demand for a Shareholders Meeting: 3.1 Regular Demand: This type of meeting demand follows the standard procedures outlined in the corporation's bylaws. It is filed when shareholders wish to discuss routine matters or proposals not requiring urgent attention. 3.2 Special Demand: A special demand is used when there is an immediate need to address time-sensitive issues, such as impending financial crises, significant policy changes, or legal disputes. This type of demand enables prompt action before irreparable harm occurs. 3.3 Requisitioned Demand: Requisitioned demands are made by shareholders who collectively hold a minimum percentage of company shares specified in the bylaws. They request a meeting to address specific agenda items, such as executive compensation, strategic decisions, or removal of directors. 4. Process of Issuing a Maryland Demand for a Shareholders Meeting: 4.1 Drafting the demand: Shareholders must articulate their concerns or proposals clearly in writing and present them as a well-structured demand. 4.2 Collecting signatures: For requisitioned demands, shareholders need to gather signatures from the required minimum percentage of shareholders specified by the corporation's bylaws. 4.3 Submitting the demand: The completed demand should be submitted to the corporation's secretary or specified representative. Care must be taken to meet any timeframes or procedural requirements stipulated by the bylaws or relevant state laws. Conclusion: A Maryland Demand for a Shareholders Meeting is a powerful mechanism that empowers shareholders to hold corporations accountable and participate actively in decision-making processes. By understanding the different types and reasons for issuing such demands, shareholders can effectively exercise their rights, ensuring transparent corporate governance and safeguarding their investment. Keywords: Maryland, Demand for a Shareholders Meeting, Shareholders' rights, Corporate governance, Maryland Corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Demanda de Asamblea de Accionistas - Demand for a Shareholders Meeting

Description

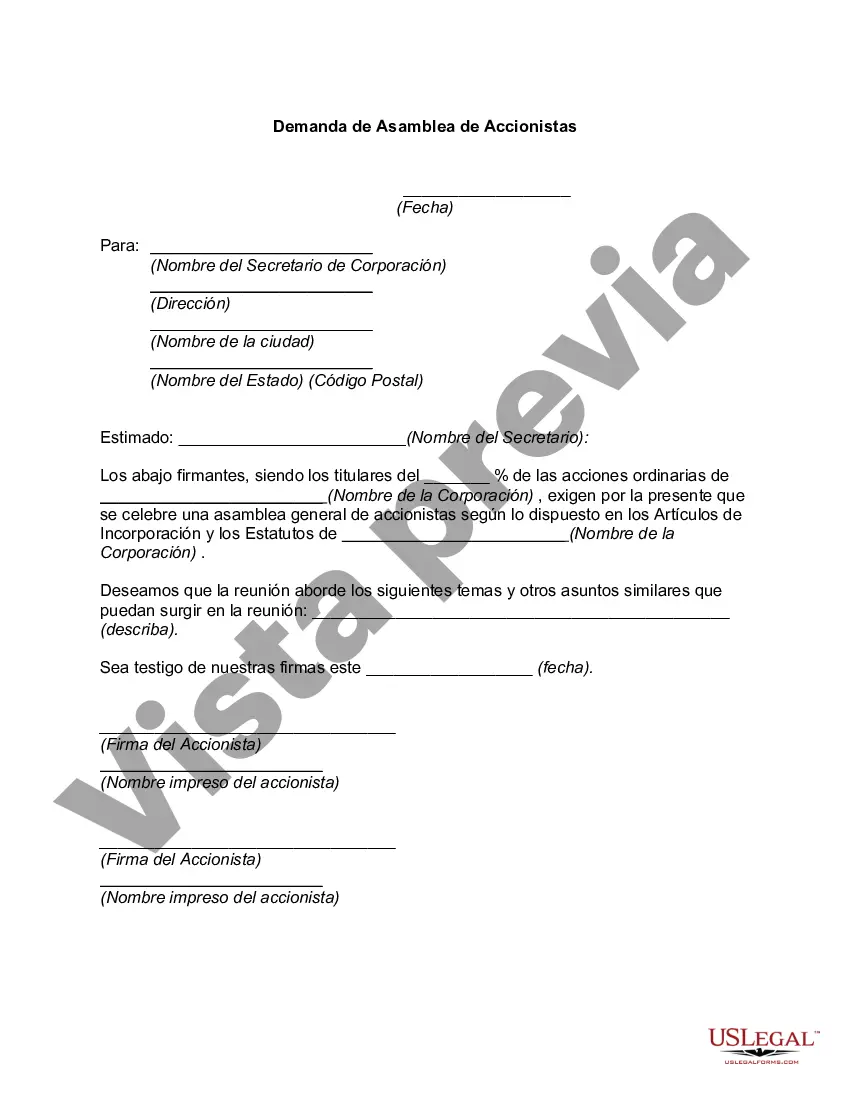

How to fill out Maryland Demanda De Asamblea De Accionistas?

If you want to comprehensive, acquire, or print authorized document layouts, use US Legal Forms, the biggest assortment of authorized kinds, which can be found on-line. Use the site`s easy and convenient look for to get the files you need. A variety of layouts for enterprise and specific reasons are categorized by categories and suggests, or keywords. Use US Legal Forms to get the Maryland Demand for a Shareholders Meeting with a number of clicks.

In case you are presently a US Legal Forms customer, log in to your account and click on the Down load button to have the Maryland Demand for a Shareholders Meeting. Also you can entry kinds you previously acquired from the My Forms tab of your respective account.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for the appropriate town/country.

- Step 2. Use the Review option to check out the form`s articles. Never neglect to read the explanation.

- Step 3. In case you are unsatisfied using the develop, use the Lookup area on top of the display to discover other types of your authorized develop web template.

- Step 4. Upon having identified the form you need, click the Buy now button. Choose the costs strategy you like and put your accreditations to sign up for an account.

- Step 5. Method the financial transaction. You can use your Мisa or Ьastercard or PayPal account to finish the financial transaction.

- Step 6. Select the format of your authorized develop and acquire it on your own system.

- Step 7. Complete, revise and print or indication the Maryland Demand for a Shareholders Meeting.

Every single authorized document web template you buy is yours eternally. You might have acces to every develop you acquired in your acccount. Go through the My Forms segment and select a develop to print or acquire once more.

Contend and acquire, and print the Maryland Demand for a Shareholders Meeting with US Legal Forms. There are millions of professional and status-distinct kinds you can utilize to your enterprise or specific requires.