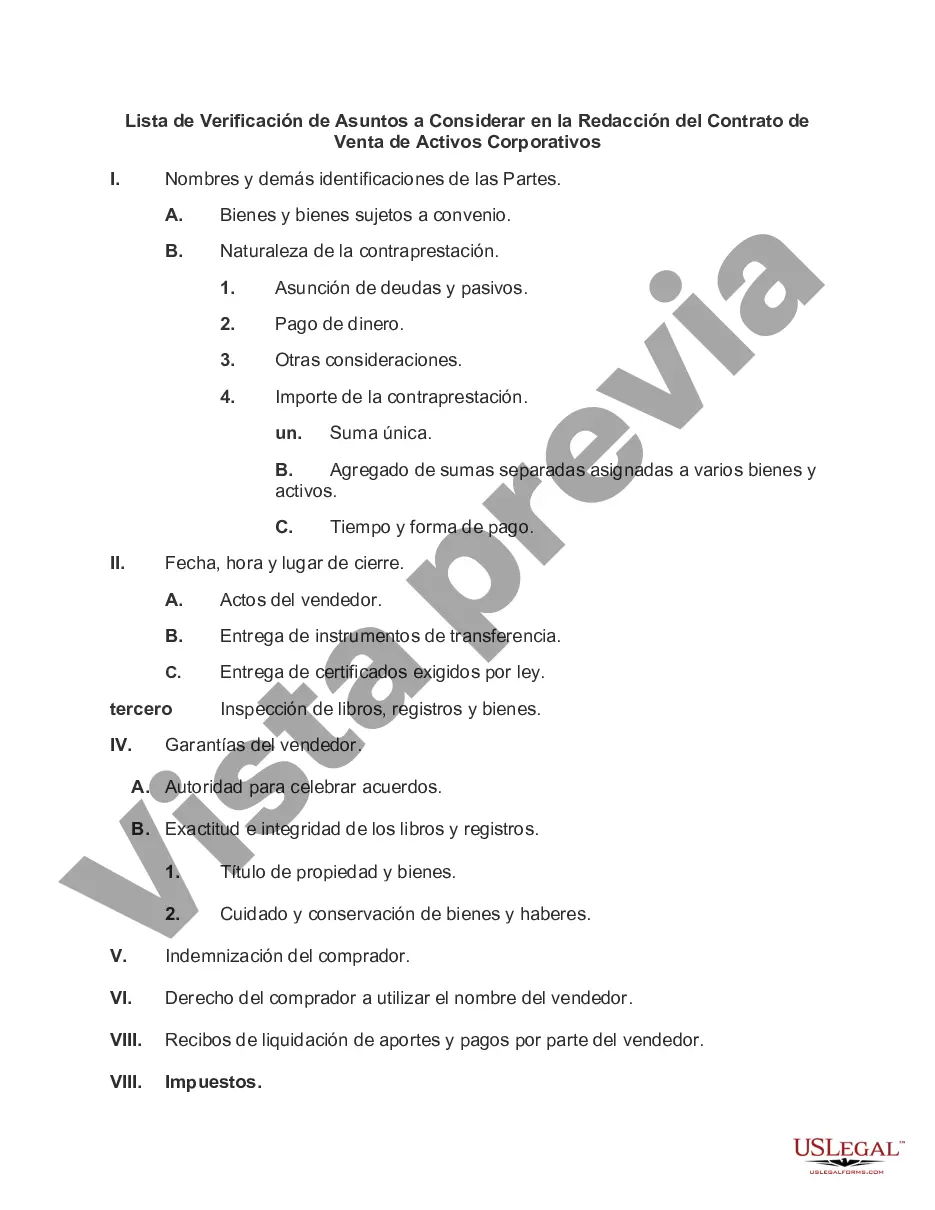

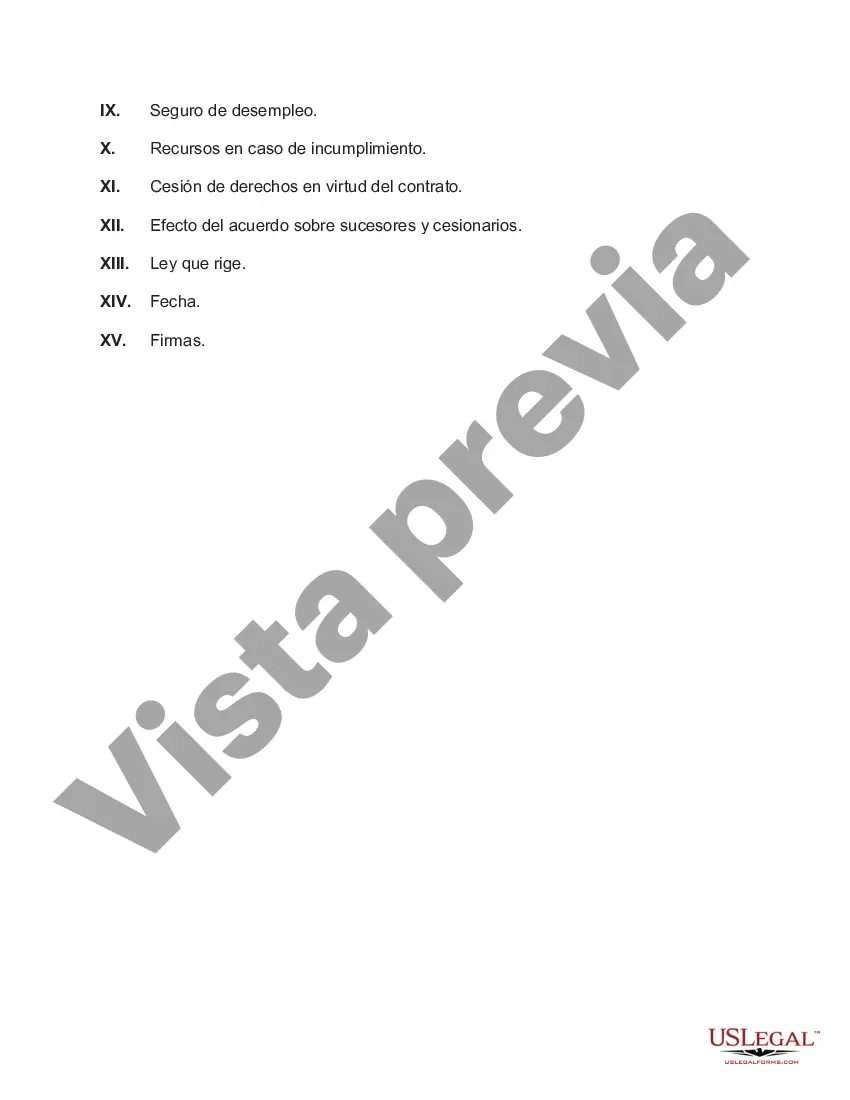

Title: Maryland Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets: A Comprehensive Guide Introduction: When engaging in the sale of corporate assets in Maryland, it is essential to have a well-drafted agreement that addresses all legal considerations. This comprehensive checklist outlines the crucial matters to be considered when drafting an agreement for the sale of corporate assets in Maryland. By adhering to this comprehensive checklist, parties can ensure a smooth transaction while safeguarding their interests. Key Considerations for Drafting the Agreement: 1. Identification of the parties: Clearly state the identities and legal capacities of both the buyer and the seller in the agreement to establish their contractual relationship. 2. Asset description: Provide a detailed description of the assets being sold, including tangible and intangible assets, intellectual property, contracts, leases, licenses, permits, accounts receivable, and inventory. 3. Purchase price and payment terms: Specify the purchase price, including any adjustments, and outline the payment terms, such as the payment schedule, method of payment, and whether any contingent or deferred payments are involved. 4. Representations and warranties: Outline the representations and warranties made by both parties regarding the condition, ownership, title, and legal compliance of the assets, as well as any limitations on such representations. 5. Due diligence: Specify the due diligence process to be conducted by the buyer, including access to relevant documents, financial statements, and other necessary information related to the assets. 6. Assumed liabilities: Clearly identify which liabilities will be assumed by the buyer and those which will remain the responsibility of the seller after the sale. 7. Transfer of contracts and permits: Address the transferability of contracts, permits, licenses, and any other third-party agreements necessary for the buyer to continue operating the acquired assets smoothly. 8. Employment matters: Discuss any potential employment-related issues, including the status of employees, employee benefits, and any necessary post-closing arrangements. 9. Dispute resolution: Determine the preferred method of dispute resolution, whether through negotiation, mediation, arbitration, or litigation, in case any disputes arise during or after the sale. 10. Confidentiality and non-compete provisions: Include clauses that safeguard the confidentiality of any sensitive information disclosed during the sale process and consider whether non-compete provisions are necessary to protect the buyer's interests. 11. Closing conditions: Outline the conditions precedent to closing the transaction, such as necessary regulatory approvals, third-party consents, or other actions required to finalize the sale. Conclusion: A well-drafted agreement for the sale of corporate assets in Maryland is essential to protect the interests of both the buyer and the seller. Adhering to this checklist will help ensure that all crucial matters are considered, providing a solid foundation for a successful transaction. Remember, consulting with legal professionals well-versed in Maryland corporate law is advisable to address any specific requirements or regulations regarding the sale of corporate assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Maryland Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

If you have to total, download, or produce lawful document web templates, use US Legal Forms, the largest selection of lawful forms, that can be found on the Internet. Take advantage of the site`s basic and hassle-free look for to find the paperwork you require. Various web templates for company and personal purposes are categorized by types and says, or key phrases. Use US Legal Forms to find the Maryland Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets in just a few mouse clicks.

If you are already a US Legal Forms customer, log in for your profile and click on the Obtain switch to have the Maryland Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets. You may also access forms you in the past delivered electronically in the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form to the correct town/nation.

- Step 2. Utilize the Review option to examine the form`s content. Do not neglect to learn the description.

- Step 3. If you are unhappy with all the kind, take advantage of the Search industry towards the top of the display screen to discover other types of the lawful kind design.

- Step 4. Once you have located the form you require, click on the Acquire now switch. Opt for the prices plan you like and put your accreditations to sign up on an profile.

- Step 5. Process the transaction. You can utilize your charge card or PayPal profile to accomplish the transaction.

- Step 6. Choose the format of the lawful kind and download it on your own product.

- Step 7. Full, edit and produce or sign the Maryland Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets.

Each lawful document design you purchase is your own property for a long time. You may have acces to every single kind you delivered electronically in your acccount. Click on the My Forms portion and choose a kind to produce or download once again.

Compete and download, and produce the Maryland Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets with US Legal Forms. There are millions of skilled and express-distinct forms you can use to your company or personal demands.