Maryland Checklist for Corporate Minutes: A Comprehensive Guide Corporate minutes are an essential part of maintaining accurate records for businesses in Maryland. Whether it is a small startup or a large corporation, adhering to the checklist for corporate minutes ensures compliance with state laws and regulations. This detailed description will explore the significance of corporate minutes in Maryland and provide an overview of the checklist and its different types. Corporate minutes refer to the written record of meetings conducted by a corporation's board of directors, shareholders, or management team. These minutes serve as official documentation of decisions made during meetings, actions taken, and discussions held. They play a crucial role in maintaining transparency, accountability, and legal protection for businesses. The Maryland Checklist for Corporate Minutes contains several key components that need to be addressed during meetings, including: 1. Meeting Details: The checklist prompts the inclusion of essential information such as the date, time, and location of the meeting. This ensures accurate recording and facilitates future reference. 2. Attendance: Recording the names of attendees, including directors, officers, shareholders, or legal representatives, is crucial. This step establishes who had voting rights, allowing for accurate documentation of decisions made. 3. Approval of Prior Meeting Minutes: Maryland law requires the approval of minutes from previous meetings before moving forward. The checklist ensures that the minutes are reviewed, approved, and signed by the appropriate individuals. 4. Reports and Financial Statements: Prominent financial aspects, such as reports provided by shareholders, officers, or committees, need to be recorded. This involves mentioning the financial statements presented, their content, and any resolutions stemming from financial discussions. 5. Resolutions and Decisions: The checklist prompts the inclusion of a section dedicated to recording resolutions and decisions made during the meeting. This includes voting outcomes, any unanimous consents, and actions authorized by the attendees. 6. Sensitive Matters: In cases involving sensitive matters such as mergers, acquisitions, major contracts, or litigation, additional documentation may be necessary. This checklist ensures these matters are noted, along with any discussions or decisions made regarding them. 7. Adjournment: Properly documenting the adjournment details, including time and manner of adjournment, is essential to indicate when the meeting officially ended. In Maryland, there are no specific variations in the types of corporate minutes checklists based on the type of business entity. However, the checklist may vary depending on the meeting type, such as a board of directors meeting, annual shareholder meeting, or special meetings. In conclusion, the Maryland Checklist for Corporate Minutes is a crucial tool for businesses in the state. It ensures compliance with legal requirements, transparency, and accountability. By following this comprehensive checklist, businesses can maintain accurate records of meetings, decisions, and actions taken, safeguarding their legal standing and protecting the interests of shareholders, directors, and officers.

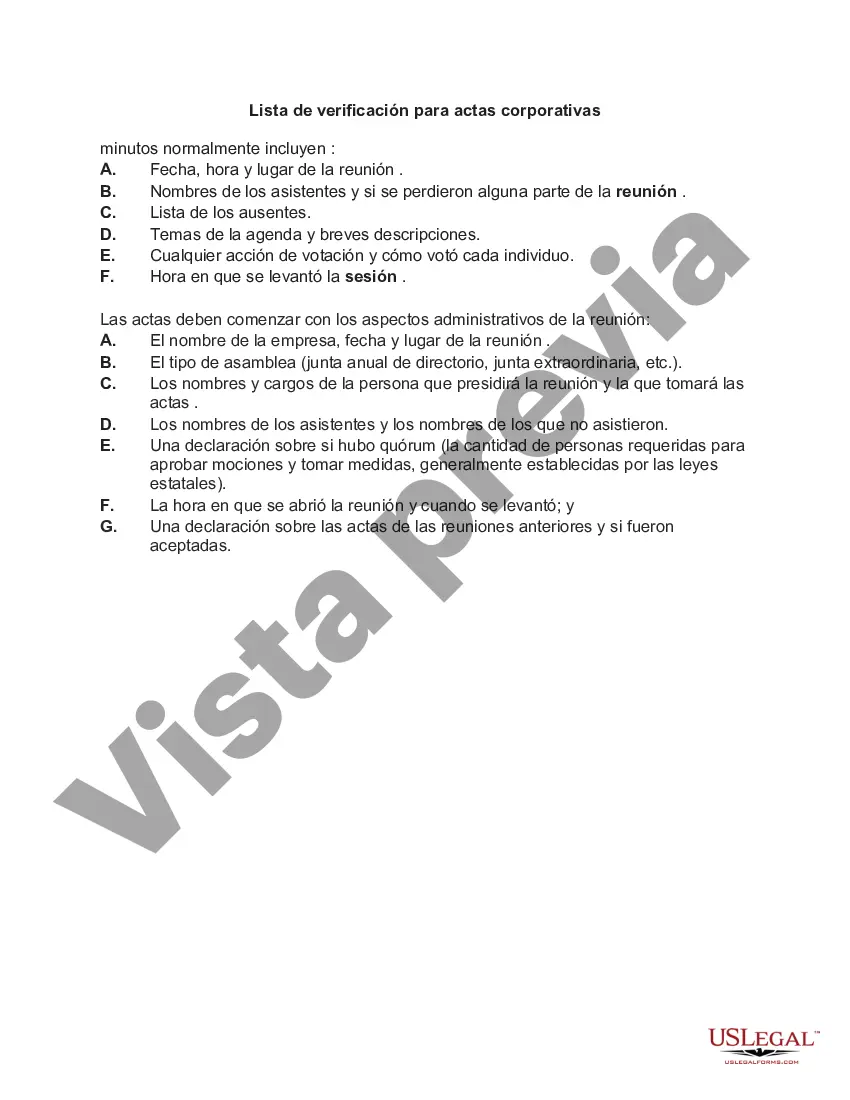

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Lista de verificación para actas corporativas - Checklist for Corporate Minutes

Description

How to fill out Maryland Lista De Verificación Para Actas Corporativas?

If you wish to comprehensive, acquire, or produce legal papers layouts, use US Legal Forms, the biggest selection of legal varieties, which can be found on the web. Utilize the site`s simple and easy hassle-free search to obtain the files you will need. Numerous layouts for business and specific functions are sorted by classes and states, or search phrases. Use US Legal Forms to obtain the Maryland Checklist for Corporate Minutes with a number of click throughs.

If you are presently a US Legal Forms client, log in in your accounts and then click the Obtain button to find the Maryland Checklist for Corporate Minutes. Also you can access varieties you in the past saved within the My Forms tab of your respective accounts.

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have selected the form for that proper area/country.

- Step 2. Use the Preview method to check out the form`s information. Don`t neglect to learn the outline.

- Step 3. If you are not satisfied together with the kind, use the Lookup discipline towards the top of the screen to get other types of your legal kind template.

- Step 4. Upon having discovered the form you will need, click the Purchase now button. Choose the pricing prepare you prefer and include your qualifications to sign up to have an accounts.

- Step 5. Method the financial transaction. You can use your bank card or PayPal accounts to accomplish the financial transaction.

- Step 6. Pick the structure of your legal kind and acquire it on the product.

- Step 7. Total, change and produce or signal the Maryland Checklist for Corporate Minutes.

Every single legal papers template you get is your own property permanently. You have acces to every kind you saved within your acccount. Click the My Forms segment and select a kind to produce or acquire once more.

Be competitive and acquire, and produce the Maryland Checklist for Corporate Minutes with US Legal Forms. There are millions of skilled and status-specific varieties you can utilize to your business or specific demands.