The Maryland Charitable Contribution Payroll Deduction Form is a document designed to facilitate voluntary donations made by state employees to eligible charitable organizations through payroll deductions. This form allows employees to conveniently and regularly contribute a designated amount from their paychecks towards a cause or nonprofit organization of their choice. By completing the Maryland Charitable Contribution Payroll Deduction Form, state employees demonstrate their commitment to giving back to the community and supporting charitable initiatives. This form serves as a tool to streamline the contribution process, ensuring that funds are allocated appropriately and in compliance with state regulations. Some relevant keywords for the Maryland Charitable Contribution Payroll Deduction Form include: 1. Payroll deduction: This refers to the process of deducting a predetermined amount from an employee's paycheck to contribute towards a charitable organization. 2. Voluntary donations: The Maryland Charitable Contribution Payroll Deduction Form is used for facilitating voluntary contributions, meaning employees have the discretion to participate or opt-out. 3. State employees: The form specifically targets employees working for the state government in Maryland who want to contribute to charitable causes through their payroll. 4. Charitable organizations: This term encompasses a wide range of nonprofits and charitable entities that are eligible to receive contributions via the Maryland Charitable Contribution Payroll Deduction Form. 5. Contribution allocation: The form ensures that the funds contributed by employees are allocated to the charitable organizations they choose, ensuring transparency and accountability. There may not be different types of Maryland Charitable Contribution Payroll Deduction Forms per se, as the form generally serves the same purpose regardless of the specific organizations chosen by employees for their donations. However, variations in the form could exist based on any updates or changes made to the process by Maryland's state government. In conclusion, the Maryland Charitable Contribution Payroll Deduction Form provides state employees with an easy and systematic avenue to contribute regularly to charitable organizations of their choice through automatic paycheck deductions. This form plays a vital role in fostering a culture of giving within the state and supporting various charitable causes benefiting the community.

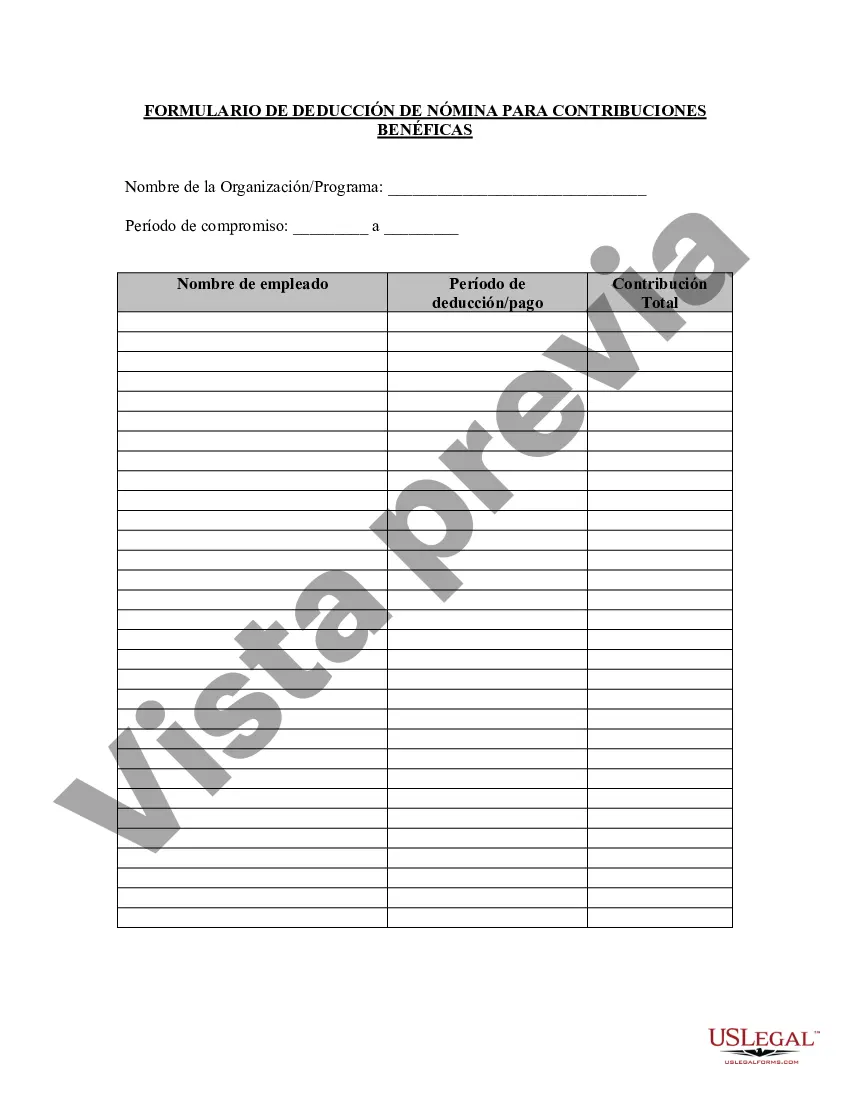

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Maryland Formulario De Deducción De Nómina De Contribución Benéfica?

It is possible to devote hours on the Internet attempting to find the legal record format that meets the state and federal demands you require. US Legal Forms supplies a huge number of legal types that happen to be analyzed by professionals. You can easily download or printing the Maryland Charitable Contribution Payroll Deduction Form from the services.

If you already have a US Legal Forms accounts, it is possible to log in and click on the Obtain option. Next, it is possible to comprehensive, modify, printing, or signal the Maryland Charitable Contribution Payroll Deduction Form. Each and every legal record format you get is your own property for a long time. To acquire yet another duplicate associated with a obtained develop, go to the My Forms tab and click on the related option.

If you are using the US Legal Forms web site the first time, keep to the easy guidelines beneath:

- Initially, ensure that you have selected the best record format for that state/city of your liking. Browse the develop explanation to make sure you have chosen the correct develop. If available, make use of the Preview option to appear from the record format at the same time.

- In order to get yet another version in the develop, make use of the Search discipline to discover the format that meets your needs and demands.

- Once you have found the format you want, just click Acquire now to move forward.

- Choose the costs program you want, enter your references, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You can utilize your Visa or Mastercard or PayPal accounts to cover the legal develop.

- Choose the format in the record and download it to the system.

- Make alterations to the record if necessary. It is possible to comprehensive, modify and signal and printing Maryland Charitable Contribution Payroll Deduction Form.

Obtain and printing a huge number of record web templates using the US Legal Forms web site, that provides the biggest collection of legal types. Use specialist and state-specific web templates to deal with your small business or specific demands.