Maryland Determining Self-Employed Contractor Status

Description

How to fill out Determining Self-Employed Contractor Status?

Locating the appropriate legal document template can be rather challenging. Clearly, there are numerous templates accessible on the internet, but how will you obtain the specific legal format you seek.

Utilize the US Legal Forms platform. This service offers a vast selection of templates, such as the Maryland Determining Self-Employed Contractor Status, which you can utilize for both business and personal purposes.

All of the samples are reviewed by professionals and comply with local and federal regulations.

Once you are confident that the form is suitable, click on the Purchase now button to obtain the form. Choose the payment plan you desire and input the required information. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired Maryland Determining Self-Employed Contractor Status. US Legal Forms is indeed the largest repository of legal documents where you can find various document templates. Take advantage of the service to download properly crafted files that meet state requirements.

- If you are already registered, Log In to your account and click on the Download button to acquire the Maryland Determining Self-Employed Contractor Status.

- Utilize your account to search for the legal forms you may have previously obtained.

- Go to the My documents section of your account and retrieve an additional copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

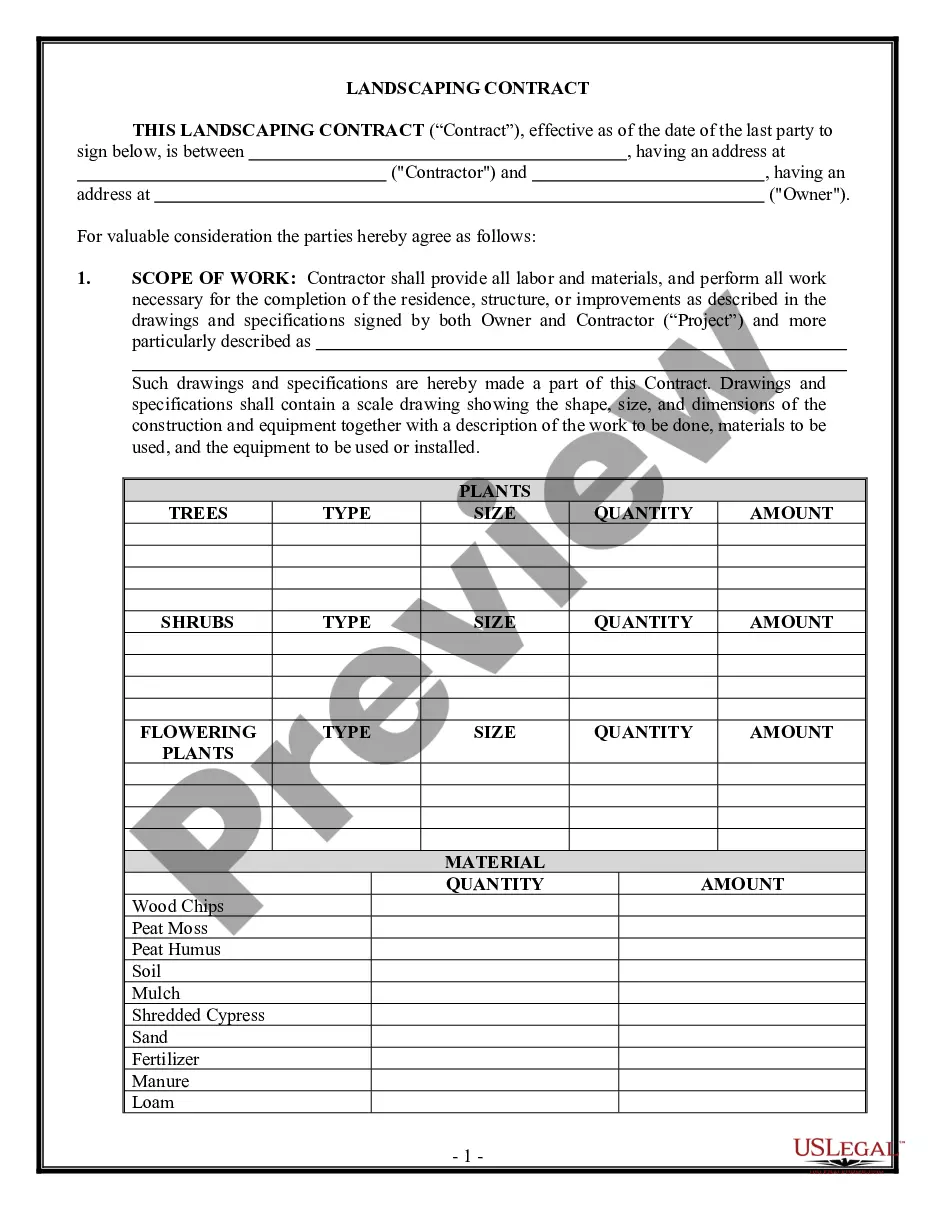

- First, ensure you have selected the correct type for your city/state. You can browse the form using the Preview button and check the form description to ensure it suits your needs.

- If the form does not meet your expectations, use the Search area to find the appropriate form.

Form popularity

FAQ

If you operate two or more retail stores under the same general management or ownership in Maryland, you must have a chain store license. However, the term "store" does not include an automobile service station where the principal business is the sale or distribution of motor fuel.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

To be declared an independent contractor the individual (1) must be free from control and direction over his work both in fact and pursuant to the contract between the employer and contractor; (2) must be customarily engaged in independent business or contracting; and (3) the work must be outside the usual course of

In Maryland, a contractor license is required if you wish to work on home improvement projects or do electrical, plumbing, or HVACR work.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How to demonstrate that you are an independent worker on your resumeMention that time when you had to work on a project on your own.Talk about projects that required extra accountability.Describe times when you had to manage several projects all at once.More items...

How much does it cost to get a business license in Maryland? There is a $100 fee for new businesses and those changing their name, so be sure to bring this amount with you when filing any necessary forms.

The basic test for determining whether a worker is an independent contractor or an employee is whether the principal has the right to control the manner and means by which the work is performed.

The state of Maryland does not require general contractors to obtain a license to do business. It is not necessary to have a license if you are doing electrical, plumbing, or HVACR work or are working on home improvement projects. A license is issued by the Department of Labor, Licensing and Regulation (DLLR).