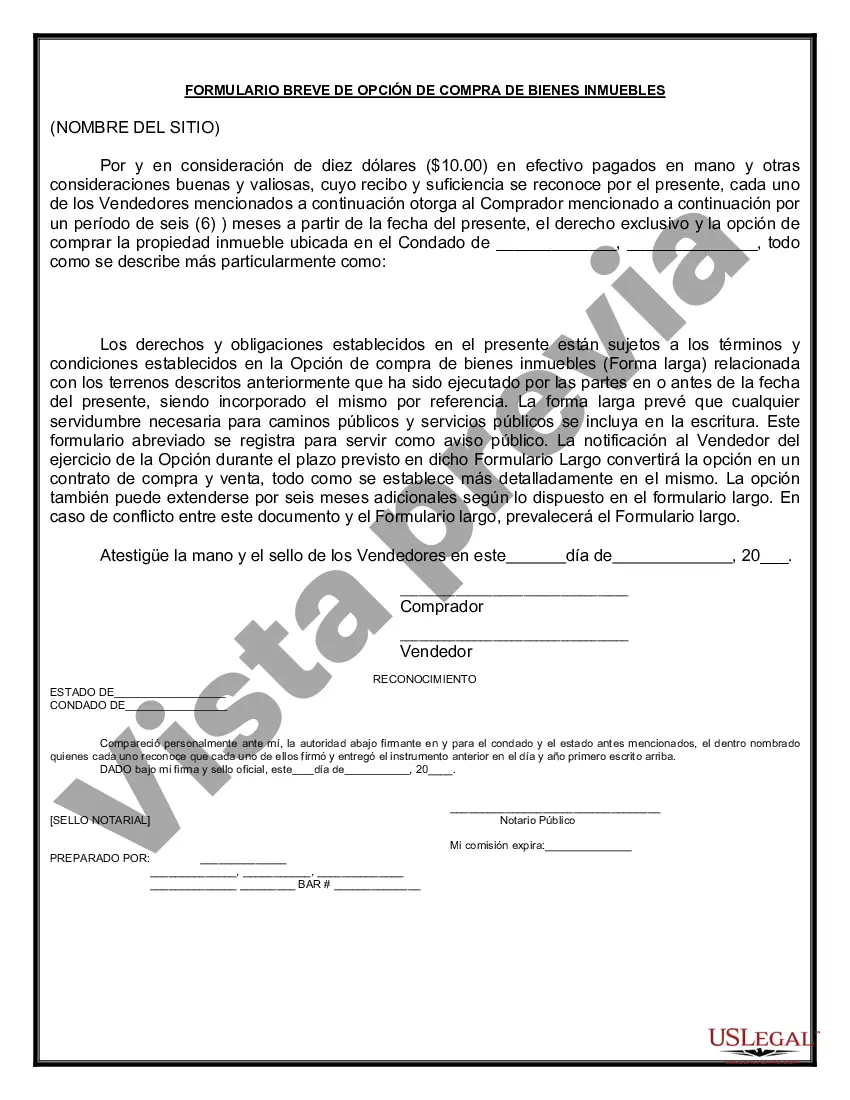

Maryland Option to Purchase Real Estate — Short Form is a legally binding agreement that allows a tenant or potential buyer to secure the option of purchasing a property at a later date. This document is commonly used in real estate transactions and provides numerous benefits to both parties involved. The Maryland Option to Purchase Real Estate — Short Form grants the tenant or potential buyer exclusive rights to buy a property within a specified period, usually ranging from a few months to a year. During this time, the tenant has the option, but not the obligation, to proceed with the purchase. This agreement offers flexibility and allows the buyer to thoroughly assess the property before committing to its purchase. In Maryland, there are several types of Option to Purchase Real Estate — Short Form agreements, including: 1. Residential Option to Purchase: This type of agreement applies to residential properties, such as houses or apartments. It provides tenants with the opportunity to buy the property they are currently residing in, providing stability and the possibility of homeownership. 2. Commercial Option to Purchase: Designed for commercial properties, this agreement allows businesses or potential investors to secure the option of purchasing a commercial building or space. It is particularly useful for businesses wanting to test the viability of their operations before fully committing to buying a property. 3. Land Option to Purchase: This type of option is specifically for vacant land or undeveloped properties. It gives buyers the right to purchase the land at a specified price within a specified timeframe. This option is commonly used by developers or investors looking to acquire land for future development projects. The Maryland Option to Purchase Real Estate — Short Form consists of several essential elements, including: 1. Property Description: The agreement must include a detailed description of the property, including its address, legal description, and boundaries, to ensure clarity and accuracy. 2. Option Price: The agreed-upon purchase price or a formula for determining the price must be stated clearly in the agreement. 3. Option Period: The period within which the buyer can exercise their option to purchase should be clearly defined. This timeframe allows the buyer to conduct inspections, obtain financing, and make an informed decision. 4. Option Consideration: The amount paid by the buyer for securing the option should be specified in the agreement. This consideration is generally non-refundable and may be credited toward the purchase price if the option is exercised. 5. Conditions and Terms: Any special conditions, such as contingencies or specific requirements, should be clearly stated in the agreement. These conditions may include financing obligations, property inspections, or any necessary approvals. 6. Seller's Obligations: The responsibilities of the seller, which may include maintaining the property, providing access for inspections, and disclosing material defects, need to be outlined in the agreement. The Maryland Option to Purchase Real Estate — Short Form is a valuable tool in the real estate industry. It allows tenants or potential buyers to secure their interest in a property while providing flexibility and the opportunity to assess the property's suitability before committing to its purchase. Whether it is a residential, commercial, or land option, this agreement ensures a fair and transparent process, benefiting both buyers and sellers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Opción de Compra de Bienes Raíces - Forma Corta - Option to Purchase Real Estate - Short Form

Description

How to fill out Maryland Opción De Compra De Bienes Raíces - Forma Corta?

Choosing the best authorized record template can be a battle. Of course, there are a variety of templates accessible on the Internet, but how do you discover the authorized type you want? Utilize the US Legal Forms site. The services offers thousands of templates, including the Maryland Option to Purchase Real Estate - Short Form, which you can use for company and private requirements. All the varieties are checked out by specialists and meet up with state and federal requirements.

If you are currently signed up, log in to the account and click on the Acquire option to get the Maryland Option to Purchase Real Estate - Short Form. Utilize your account to check through the authorized varieties you possess ordered formerly. Check out the My Forms tab of your respective account and get one more backup from the record you want.

If you are a whole new user of US Legal Forms, listed here are simple guidelines that you can comply with:

- Initially, be sure you have selected the appropriate type for your personal metropolis/region. You are able to check out the shape utilizing the Review option and read the shape outline to ensure it will be the right one for you.

- In case the type will not meet up with your requirements, take advantage of the Seach discipline to discover the proper type.

- Once you are positive that the shape is proper, select the Acquire now option to get the type.

- Choose the pricing strategy you desire and type in the required information and facts. Build your account and pay money for an order utilizing your PayPal account or bank card.

- Select the document formatting and download the authorized record template to the gadget.

- Comprehensive, revise and print and indication the received Maryland Option to Purchase Real Estate - Short Form.

US Legal Forms will be the greatest catalogue of authorized varieties where you can see various record templates. Utilize the company to download professionally-made papers that comply with status requirements.