Maryland Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report

Description

How to fill out Proposal To Consider And Approve Offer To Exchange Outstanding Shares And Amend Certificate Of Designations, Preferences And Rights With Fairness Opinion Report?

Are you presently within a place that you require documents for both organization or specific reasons nearly every working day? There are plenty of legitimate papers templates available online, but locating ones you can rely is not straightforward. US Legal Forms delivers a huge number of form templates, much like the Maryland Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report, which are created to satisfy state and federal specifications.

When you are already familiar with US Legal Forms site and get a merchant account, merely log in. Following that, you are able to down load the Maryland Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report web template.

Should you not come with an bank account and need to start using US Legal Forms, abide by these steps:

- Discover the form you want and make sure it is to the correct city/county.

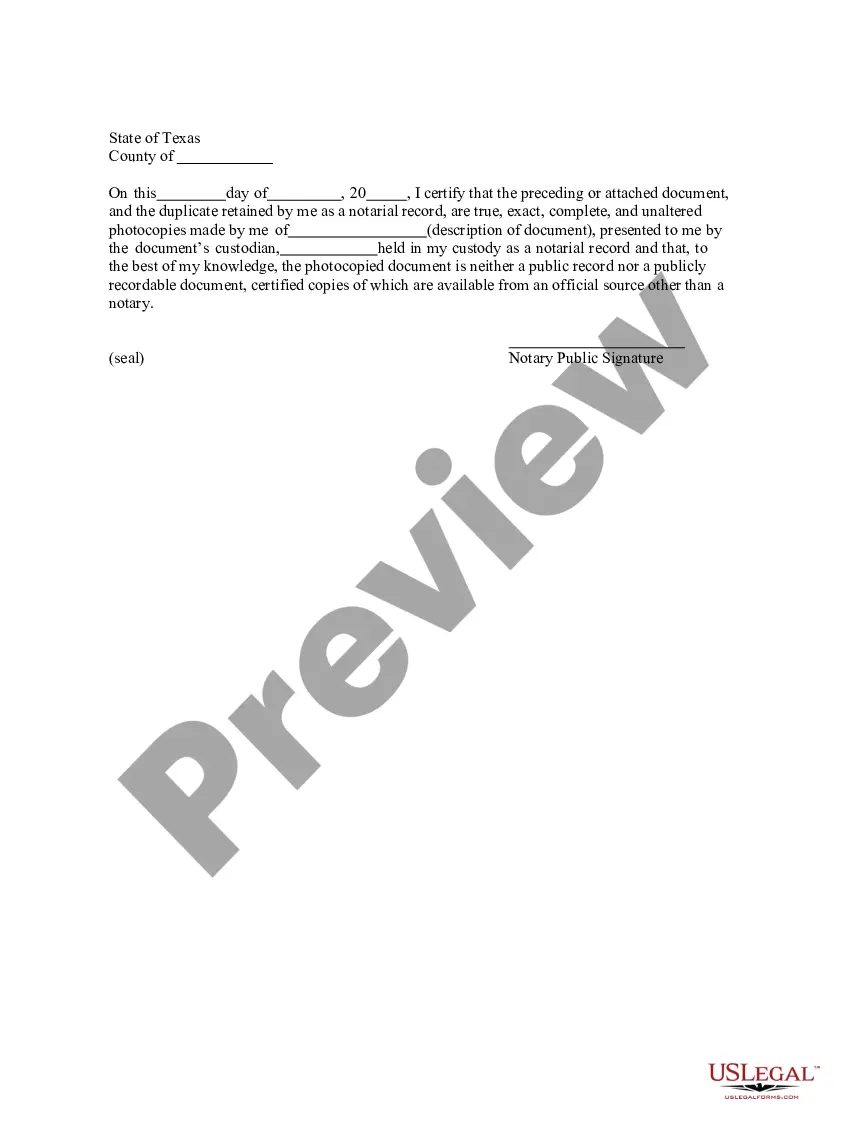

- Take advantage of the Preview option to examine the form.

- Browse the description to actually have chosen the right form.

- In the event the form is not what you`re trying to find, make use of the Search field to discover the form that fits your needs and specifications.

- Once you get the correct form, click Get now.

- Choose the costs strategy you would like, submit the specified details to produce your money, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Pick a practical data file file format and down load your version.

Find all of the papers templates you may have purchased in the My Forms menus. You may get a further version of Maryland Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report at any time, if necessary. Just click on the essential form to down load or print out the papers web template.

Use US Legal Forms, one of the most substantial collection of legitimate kinds, to conserve time as well as stay away from mistakes. The service delivers appropriately produced legitimate papers templates which you can use for an array of reasons. Make a merchant account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

A fairness opinion is a financial advisor's perspective as to whether the price to be paid or received in a transaction is fair to the client's shareholders.

A fairness opinion is a financial advisor's perspective as to whether the price to be paid or received in a transaction is fair to the client's shareholders.

In Canada, other than mandatory valuations provided in connection with conflicted transactions governed by Multilateral Instrument 61-101 (MI 61-101), fairness opinions are not legally mandated. Their role is to assist the board in fulfilling the directors' fiduciary duties (i.e., their duty of care).

Fairness Opinion Requirement Section 1203 requires an affirmative opinion as to the fairness of the consideration offered to the shareholders of the subject corporation in any transaction involving an interested party.

Fairness opinions are written by qualified analysts or advisors, usually from an investment bank, and are provided to these key decision-makers for a fee.

Q: What's the difference between a fairness opinion vs. valuation? A: Both are important in a large transaction. Valuation though informs an actual transaction price, while the fairness opinion concludes how reasonable that price is.

Fairness opinions are based on objective, independent analyses performed by experienced financial experts that include not only a valuation (including full financial due diligence on the underlying business), but a review of the transaction's financial structure, the type and timing of the deal, and the financial and ...

A fairness opinion is a report that evaluates the facts of a merger, acquisition, carve out, spin-off, buyback or another type of purchase and provides an opinion as to whether or not the proposed stock price is fair to the selling or target company.