Maine Corporate Right of First Refusal is a legal provision that allows corporations in the state of Maine to have the first opportunity to purchase a specific stock or asset before it can be sold to any external party. This provision is typically mentioned and governed by Corporate Resolutions, which are official acts or decisions taken by the corporation's board of directors. The key purpose of the Corporate Right of First Refusal is to provide existing shareholders with the ability to maintain their proportional ownership in the corporation and to protect their investment. It ensures that shareholders have the first chance to acquire any new shares or assets being offered for sale by another shareholder or a third party. There can be various types of Maine Corporate Right of First Refusal — Corporate Resolutions, such as: 1. Direct Share Offering: This type of resolution allows existing shareholders to purchase additional shares of stock directly from the corporation, instead of offering them to external investors. It ensures that shareholders have the privilege to increase their ownership stake before dilution occurs. 2. Transfer of Shares: When a shareholder decides to sell their shares to an external party, the Maine Corporate Right of First Refusal can be invoked. It enables other existing shareholders to match the terms and conditions of the proposed sale and acquire the shares before the external party can complete the transaction. 3. Sale of Corporate Assets: Corporate Resolutions governing the Corporate Right of First Refusal can also apply to the sale of corporate assets. If a shareholder wants to sell a significant asset of the corporation, such as real estate or intellectual property, the other shareholders have the opportunity to match the terms of the proposed sale and acquire the asset instead. By implementing the Maine Corporate Right of First Refusal through Corporate Resolutions, corporations can ensure that existing shareholders have the priority and the ability to protect their investment by maintaining their proportional ownership in the company. It provides a fair and equitable process for all shareholders, allowing them to participate in any potential benefits associated with additional shares or the sale of corporate assets.

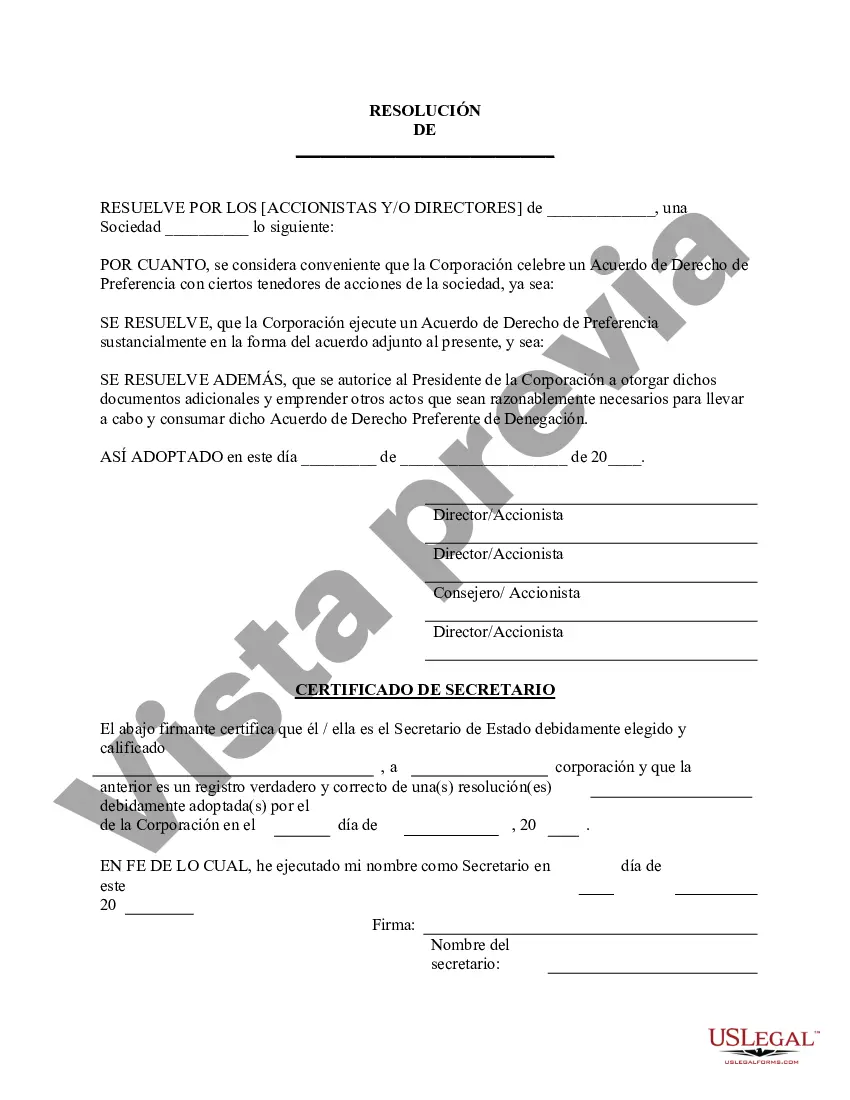

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Derecho Corporativo de Preferencia - Resoluciones Corporativas - Corporate Right of First Refusal - Corporate Resolutions

Description

How to fill out Maine Derecho Corporativo De Preferencia - Resoluciones Corporativas?

Choosing the right legitimate file template can be a have a problem. Naturally, there are a variety of themes available on the net, but how can you find the legitimate form you need? Take advantage of the US Legal Forms site. The assistance offers a huge number of themes, like the Maine Corporate Right of First Refusal - Corporate Resolutions, that you can use for enterprise and private requires. All of the varieties are examined by experts and meet state and federal demands.

Should you be currently registered, log in for your account and click the Download button to obtain the Maine Corporate Right of First Refusal - Corporate Resolutions. Make use of account to look through the legitimate varieties you might have bought previously. Check out the My Forms tab of your account and get yet another copy of your file you need.

Should you be a whole new customer of US Legal Forms, listed here are straightforward recommendations that you should comply with:

- Initially, be sure you have chosen the proper form to your metropolis/state. It is possible to examine the shape utilizing the Review button and study the shape description to make certain it is the best for you.

- When the form does not meet your preferences, use the Seach area to obtain the appropriate form.

- Once you are certain that the shape would work, click the Buy now button to obtain the form.

- Opt for the costs program you desire and type in the necessary information and facts. Create your account and pay for the transaction making use of your PayPal account or credit card.

- Choose the data file file format and down load the legitimate file template for your gadget.

- Total, modify and print out and indication the acquired Maine Corporate Right of First Refusal - Corporate Resolutions.

US Legal Forms is definitely the greatest catalogue of legitimate varieties where you can see various file themes. Take advantage of the service to down load skillfully-made files that comply with state demands.