Maine Consents to Release of Financial Information is a legal document that allows an individual or entity to obtain and share someone's financial information with a third party. This consent is commonly used in various financial transactions, such as loan applications, mortgage approvals, or background checks, where access to financial data is necessary. The main purpose of the Maine Consents to Release of Financial Information is to ensure that the individual granting consent is aware of and allows the release of their sensitive financial details. This consent form serves as a protection against any unauthorized use or disclosure of private financial information. It also helps to establish a legal framework for financial institutions and other entities to lawfully collect and exchange financial data. The content of the Maine Consent to Release of Financial Information may vary depending on the specific requirements of the requesting party. However, there are some common elements typically included in this document. These elements often include the following: 1. Personal Information: The consent form usually requires the individual's full name, address, contact details, and any other identifying information necessary to verify their identity. 2. Purpose: The form will specify the purpose for which the financial information is being requested. This could be for a loan application, employment background check, or any other specific reason. 3. Release of Information: The document will clearly state which financial information is being released, such as bank statements, credit history, tax returns, or other relevant records. The individual granting consent must explicitly authorize the sharing of each category of information. 4. Recipient Information: The consent form will mention the name and contact details of the party to whom the information will be released. This ensures that the individual knows exactly who will have access to their financial data. 5. Duration: The consent form may specify the duration for which the consent is valid. This could be a one-time release or a period of time during which the recipient can access the information as needed. It is essential to note that while this description provides a general overview, specific requirements for the Maine Consent to Release of Financial Information may vary across different institutions and situations. Some institutions may have their own customized forms that adhere to state laws and regulations. Therefore, individuals should always read and understand the specific form they are signing to ensure they are consenting accurately and intelligently. As the prompt does not mention different types of Maine Consent to Release of Financial Information, it can be assumed that there is a standard form used in the state. However, it is important to consult with legal professionals or relevant institutions to verify if there are any variations or specialized forms applicable in specific scenarios.

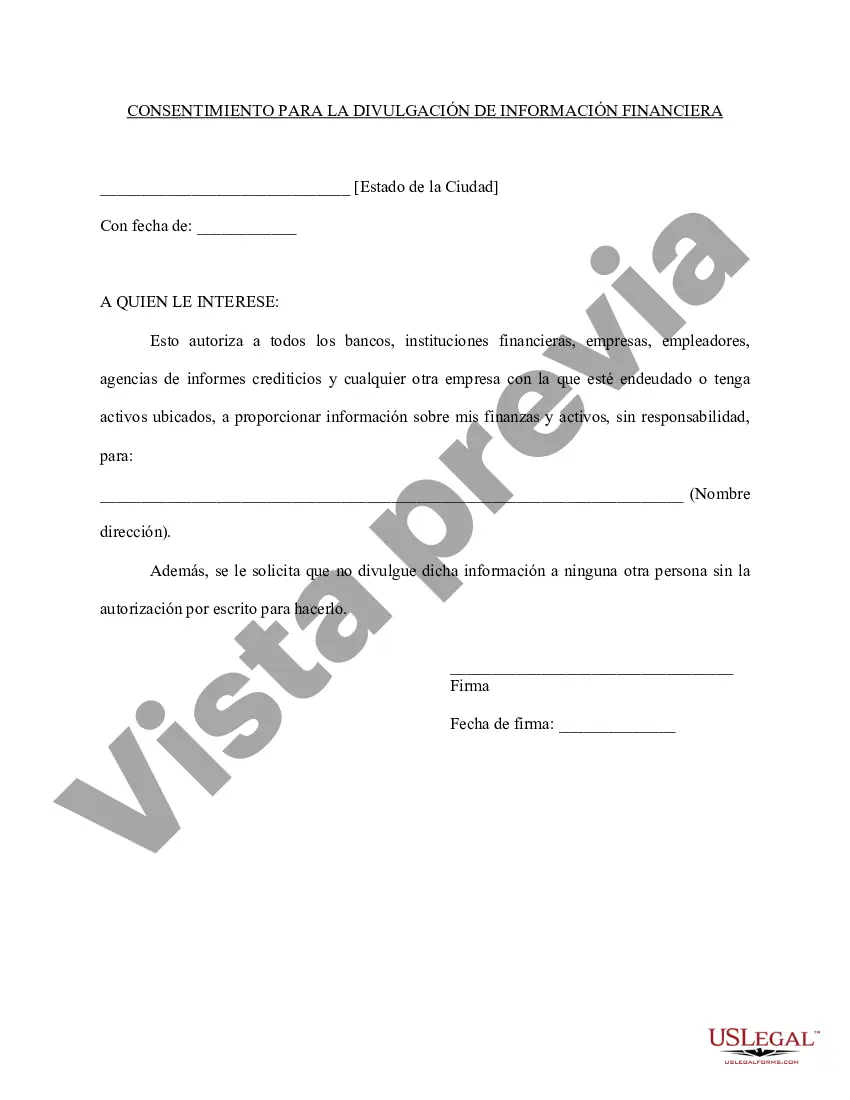

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Consentimiento para la divulgación de información financiera - Consent to Release of Financial Information

Description

How to fill out Maine Consentimiento Para La Divulgación De Información Financiera?

US Legal Forms - one of many greatest libraries of legitimate forms in America - gives a wide array of legitimate papers templates you may down load or print out. Utilizing the site, you may get 1000s of forms for business and individual functions, sorted by classes, says, or search phrases.You will find the newest types of forms like the Maine Consent to Release of Financial Information within minutes.

If you already have a monthly subscription, log in and down load Maine Consent to Release of Financial Information in the US Legal Forms library. The Acquire switch will show up on every single kind you look at. You gain access to all in the past saved forms inside the My Forms tab of the accounts.

If you wish to use US Legal Forms for the first time, listed here are basic instructions to get you started off:

- Ensure you have selected the proper kind to your metropolis/state. Go through the Preview switch to review the form`s content material. Browse the kind explanation to ensure that you have selected the appropriate kind.

- If the kind doesn`t satisfy your needs, use the Research area towards the top of the screen to find the the one that does.

- If you are content with the shape, confirm your decision by clicking on the Buy now switch. Then, opt for the costs strategy you want and provide your accreditations to sign up for an accounts.

- Process the purchase. Make use of charge card or PayPal accounts to finish the purchase.

- Select the structure and down load the shape on your gadget.

- Make modifications. Fill out, revise and print out and signal the saved Maine Consent to Release of Financial Information.

Every design you added to your money does not have an expiry day and it is yours eternally. So, if you want to down load or print out one more version, just visit the My Forms segment and then click around the kind you want.

Obtain access to the Maine Consent to Release of Financial Information with US Legal Forms, the most comprehensive library of legitimate papers templates. Use 1000s of skilled and express-distinct templates that satisfy your company or individual requires and needs.