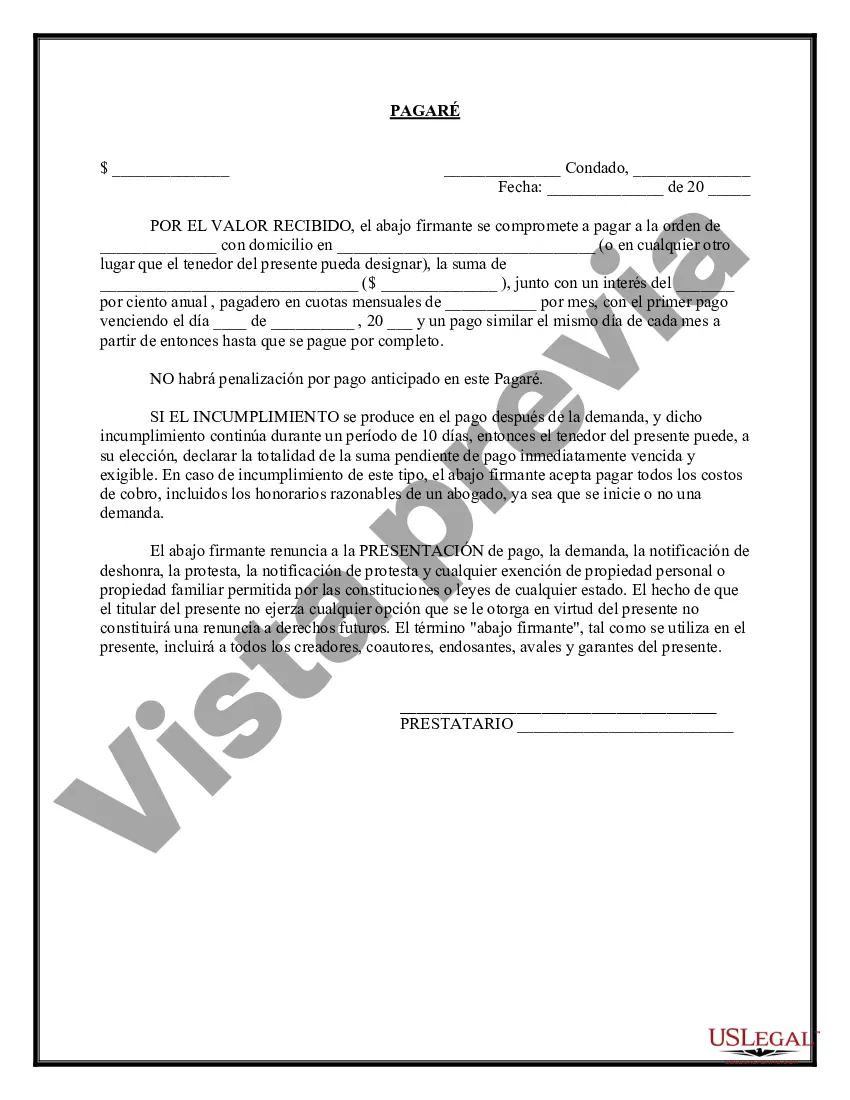

Maine Promissory Note with Installment Payments is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Maine. This promissory note serves as evidence of the loan and sets forth the details of repayment in installments. The Maine Promissory Note with Installment Payments typically includes the following key information: the names and contact details of both the lender and borrower, the loan amount, the interest rate (if applicable), the repayment schedule with specific due dates, the duration of the loan, and any late payment penalties or default provisions. There are various types of Maine Promissory Note with Installment Payments that can be tailored to suit different borrowing needs, including: 1. Secured Promissory Note: This type of note includes additional provisions that secure the loan with collateral. Collateral can be any valuable asset, such as property or vehicles, which the lender can seize if the borrower fails to repay the loan as agreed. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. This type of note is based solely on the borrower's creditworthiness and trustworthiness. As a result, lenders often charge higher interest rates to compensate for the increased risk. 3. Fixed Interest Rate Promissory Note: This note specifies a fixed interest rate that remains unchanged throughout the loan term. Borrowers benefit from predictable payments, while lenders ensure a steady return on investment. 4. Adjustable Interest Rate Promissory Note: Also known as a variable or floating rate note, this type of promissory note allows the interest rate to fluctuate according to market conditions. The rate is usually tied to an index, such as the Prime Rate or London Interbank Offered Rate (LIBOR). 5. Balloon Payment Promissory Note: This note structure permits lower monthly installments for a specific period, followed by a larger final payment (balloon payment) to repay the remaining loan balance. Borrowers who expect a significant inflow of funds in the future often choose this note to manage cash flow effectively. It is essential to consult with legal professionals or use reputable online platforms to customize the Maine Promissory Note with Installment Payments based on specific requirements and comply with all applicable state laws to ensure its enforceability in case of disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out Maine Pagaré Con Pagos A Plazos?

Are you presently in the placement where you will need documents for either business or individual functions almost every day? There are tons of legal document web templates available online, but finding versions you can depend on isn`t effortless. US Legal Forms gives a huge number of develop web templates, just like the Maine Promissory Note with Installment Payments, which are written to satisfy federal and state needs.

Should you be previously familiar with US Legal Forms website and possess a free account, simply log in. After that, you are able to down load the Maine Promissory Note with Installment Payments template.

Should you not come with an bank account and would like to begin using US Legal Forms, follow these steps:

- Find the develop you will need and make sure it is for your correct city/area.

- Use the Preview switch to check the form.

- Read the information to actually have chosen the proper develop.

- In case the develop isn`t what you`re seeking, use the Search area to discover the develop that meets your needs and needs.

- Once you get the correct develop, just click Acquire now.

- Pick the pricing plan you would like, fill in the specified information and facts to make your bank account, and purchase the order using your PayPal or credit card.

- Choose a convenient document format and down load your backup.

Find each of the document web templates you might have bought in the My Forms food selection. You may get a further backup of Maine Promissory Note with Installment Payments whenever, if required. Just click the necessary develop to down load or print out the document template.

Use US Legal Forms, by far the most considerable selection of legal kinds, to save lots of time and prevent errors. The assistance gives expertly made legal document web templates which you can use for an array of functions. Make a free account on US Legal Forms and commence making your lifestyle a little easier.